Home price appreciation between June and July was weaker than its long-term average despite the fact that the latter month's annual gain remained historically strong, according to CoreLogic.

On a consecutive-month basis, prices depreciated by 0.3%, contrasting pre-pandemic norms between 2010 and 2019, when the average typically appreciated 0.5%. Compared to a year earlier, home prices in July were up 15.8%. Annual home price appreciation more typically runs in the single digits.

The third consecutive month of slower home price growth is largely the result of greater pressure to deliver affordability in the midst of rising

"Even though annual price growth remains in double digits, the month-over-month decline suggests further deceleration on the horizon," Selma Hepp, interim lead in CoreLogic's office of the chief economist, said in a press release.

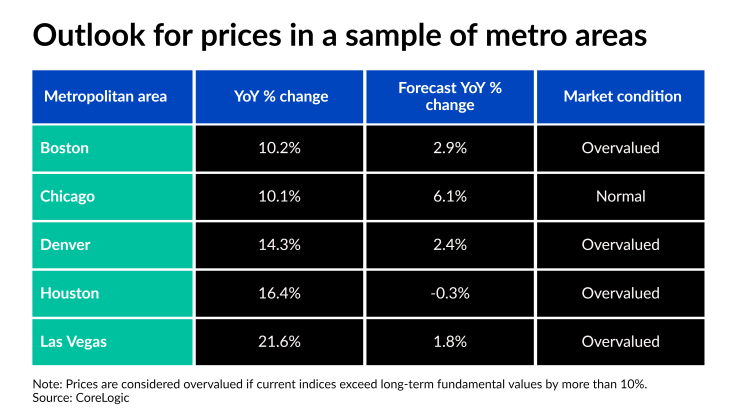

In line with national trends, a growing number of metropolitan areas are now considered overvalued and are forecasted to transition to lower HPA rates or an environment in which some depreciation occurs by next summer.

However, so far, forecasts generally predict the extent of the deterioration won't be severe enough to completely upend the value of mortgage collateral or reverse the extraordinary run-up in prices over the past couple of years.

"We aren't likely to see a 'reset' where home prices suddenly collapse by 50% or more to get to an affordable level for all investors," David Auerbach, managing director of Armada ETF Advisors, an exchange-traded fund that invests in publicly-traded real estate investment trusts.

While current affordability rivals that seen in the housing boom that preceded a residential real estate crash during the Great Recession, Armada ETF's forecast predicts a much milder downturn in the coming year.

"The structural underpinnings of our housing and mortgage markets are quite strong and demand from individual buyers and institutional investors is real," said Al Otero, a portfolio manager, in an email.

High rates of appreciation could persist in some markets, Auerbach noted, citing examples in the CoreLogic data like Tampa, Florida, which experienced the highest annual price appreciation (29.7%) seen among top-20 metros, followed by Miami (27.1%).

"Select markets (Tampa, Orlando, Jacksonville, Nashville, Charlotte, Raleigh, Austin) are seeing the most migration…from other places such as California, Chicago, and New York," Auerbach said in an email, noting that this is "leading to a bidding frenzy to buy those properties."

While there are exceptions at the local level, generally home-price reports through June, ranging from the

While that cooling and the jump in rates that precipitated it have jolted the mortgage and housing markets, investors forecast that after stakeholders readjust their operational capacity and expenditures for current conditions, prices will stabilize.

"We may see some time of correction, but don't see it being a magnification effect where it truly collapses in value," Auerbach said.