-

The Federal Housing Finance Agency's proposal could undermine the companies’ mission to support the housing market and penalize consumers in underserved communities, industry and consumer groups say.

September 8 -

The agency’s plan to extend the "qualified mortgage" stamp of approval to more loans could help lenders that rely on alternative data and cushion the blow of other QM changes for Fannie Mae and Freddie Mac.

September 2 -

The pandemic drives home the point that without those funds being siphoned off, the recent fee hikes would not be necessary.

September 2 Community Home Lenders Association

Community Home Lenders Association -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

Arch's second CRT transaction this year to obtain indemnity reinsurance for mortgage-insurance premiums comes at a time it is also experiencing rising 60-plus-day delinquencies on its outstanding securitized pools.

August 31 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

August 25 -

There were questions about the GSEs' use of structured credit risk transfers in the single-family market given an earlier pandemic-related market disruption.

August 21 -

Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

August 20 -

The number of loans going into coronavirus-related forbearance decreased for the ninth consecutive week, according to the Mortgage Bankers Association.

August 17 -

But the 30-year fixed remains below 3%, which should continue to support increased demand.

August 13 -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

In a letter to the Consumer Financial Protection Bureau, the Mortgage Bankers Association recommended adding six more months to the latest GSE patch proposal.

August 12 -

The collateral pool consists of 59 loans for mostly older garden-style and mid-rise apartment buildings that have undergone recent upgrades and renovation.

August 10 -

The agency said property owners can enter into new or modified forbearance plans if they have a hardship due to the coronavirus, but the landlords must agree not to kick out renters solely for nonpayment of rent.

August 6 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

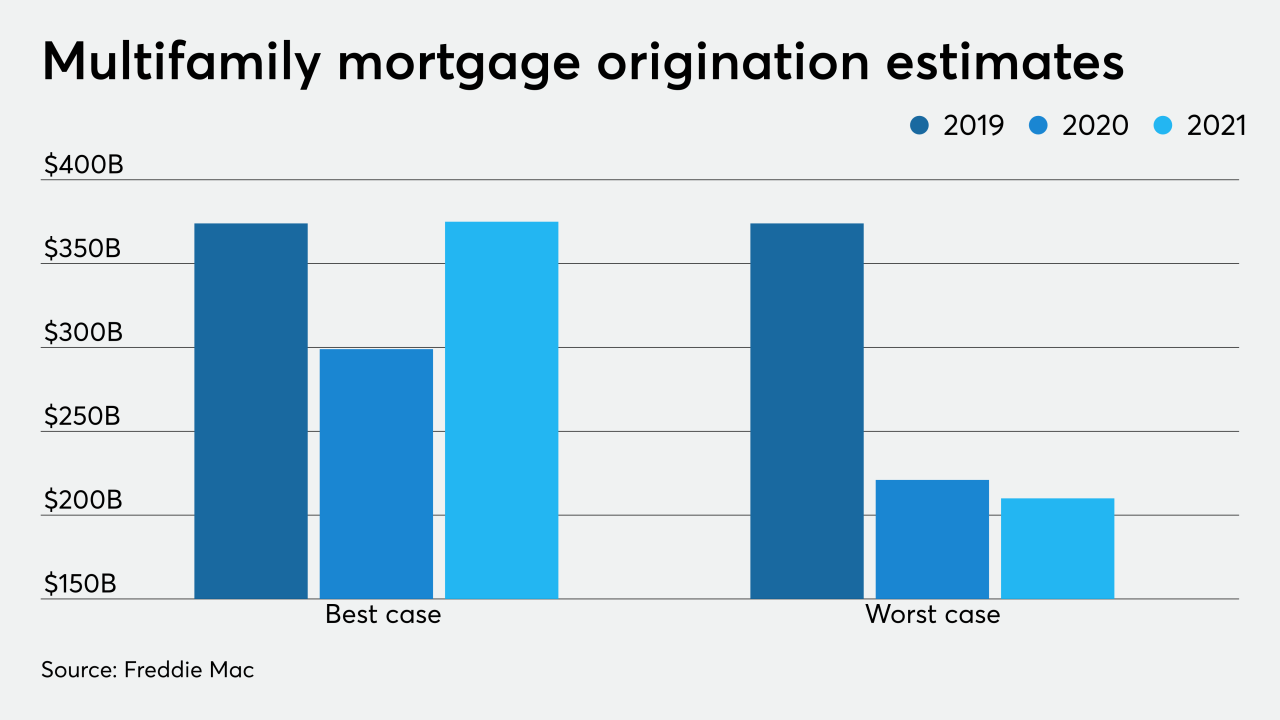

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

Mortgage rates fell 2 basis points this week, remaining near their historic lows as they have for the past month with the markets roiled by uncertainty, according to Freddie Mac.

July 30