-

But the 30-year fixed remains below 3%, which should continue to support increased demand.

August 13 -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

In a letter to the Consumer Financial Protection Bureau, the Mortgage Bankers Association recommended adding six more months to the latest GSE patch proposal.

August 12 -

The collateral pool consists of 59 loans for mostly older garden-style and mid-rise apartment buildings that have undergone recent upgrades and renovation.

August 10 -

The agency said property owners can enter into new or modified forbearance plans if they have a hardship due to the coronavirus, but the landlords must agree not to kick out renters solely for nonpayment of rent.

August 6 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

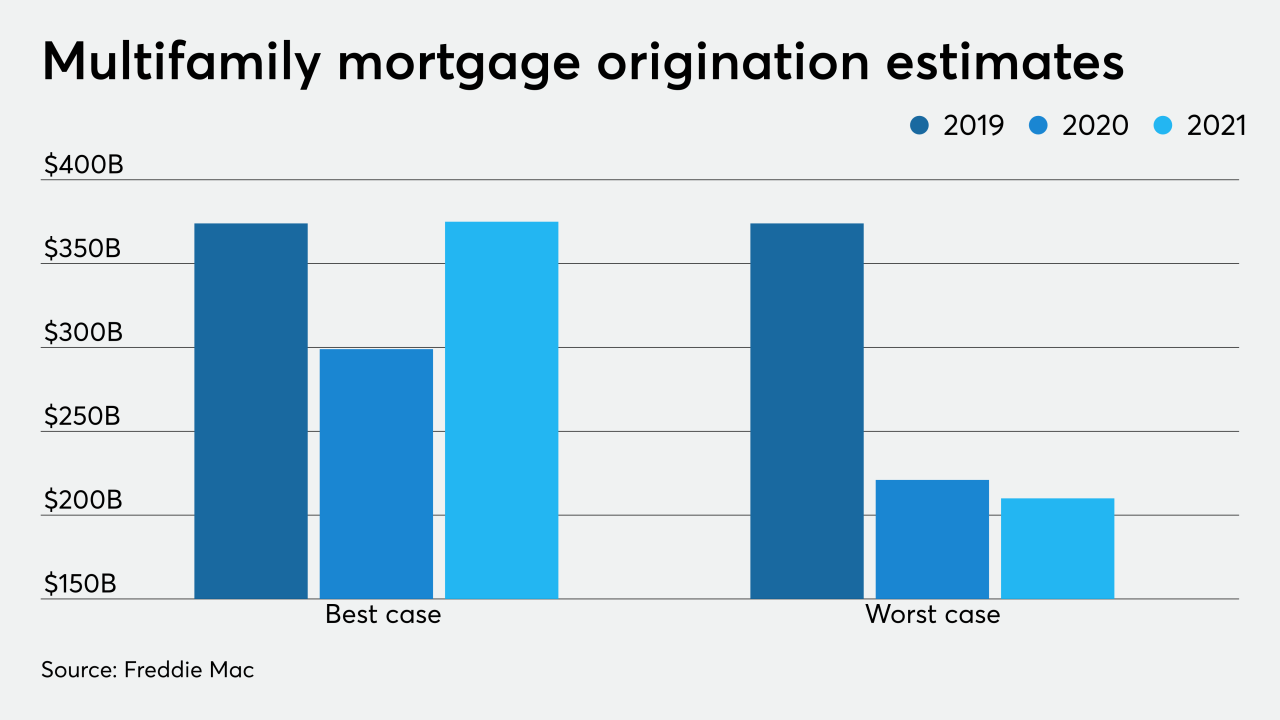

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

Mortgage rates fell 2 basis points this week, remaining near their historic lows as they have for the past month with the markets roiled by uncertainty, according to Freddie Mac.

July 30 -

The number of loans going into coronavirus-related forbearance dropped for the sixth consecutive week, as the growth rate fell 6 basis points between July 13 and July 19, according to the Mortgage Bankers Association.

July 27 -

Mortgage rates rose for the first time in six weeks, going back the above the 3% mark, as spreads to the 10-year Treasury yield widened again, according to Freddie Mac.

July 23 -

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

July 22 -

The number of loans going into coronavirus-related forbearance dropped for the fifth straight week, as the growth rate plummeted 38 basis points between July 6 and July 12, according to the Mortgage Bankers Association.

July 20 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

A recent ruling declaring the Consumer Financial Protection Bureau’s structure unconstitutional signaled that a similar outcome awaits the Federal Housing Finance Agency. But the FHFA will argue in a new case that it does not deserve the same fate.

July 14 -

The council created by the Dodd-Frank Act to identify systemic risks launched a review of the market as part of an activities-based approach that shifts focus away from targeting individual firms.

July 14 -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13 -

B. Riley FBR raised its ratings for both Fannie Mae and Freddie Mac to sell from neutral on the possibility the net worth sweep is declared illegal.

July 13 -

The high court ruled June 29 that the structure of the Consumer Financial Protection Bureau violated the separation of powers.

July 9