-

GDLP 2025-3 has a so-called vertical risk retention structure, where 95% of the collateral balance is allocated to the noteholders, while retained interest noteholders will hold the rest.

November 18 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Spread premiums on esoteric ABS attract new types of investors, including those managing insurers' assets.

November 18 -

If class A notes fail a credit enhancement rest, a cumulative default ratio amortization event occurs, or the pool balance is 10% or less, then GSKY 2025-3 will move to a sequential pay structure.

November 17 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Since introducing the Upstart Macro Index to address increasing delinquency rates in previous years, the changes to its underwriting and credit models have improved future vintages' performances.

November 14 -

Loan sizes are only $477.50 on average, while borrowers attached to the contracts have weighted average FICO scores of 727.

November 13 -

The proceeds from the deal will recoup costs for repairs on energy infrastructure damaged after Hurricane Helene in 2024.

November 13 -

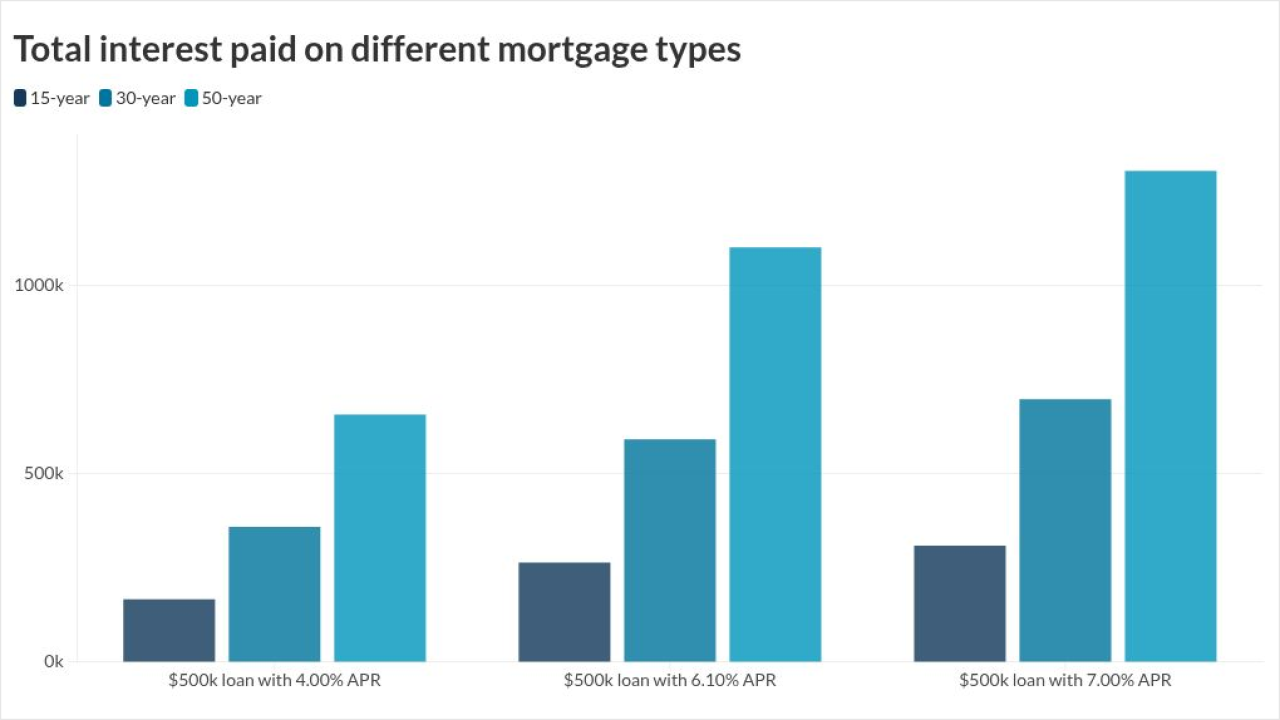

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

The securities will mainly hold dollar-denominated floating-rate loans made to US companies. The unit aims to launch the fund in January.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

SEMT 2025-12's collateral profile is slightly weaker compared with the prior transaction, with a slightly lower weighted average FICO score.

November 12 -

MP 2025-1's loan-to-value ratio will not exceed 70% of aggregate appraised value. To maintain this leverage level, the deal will also collect supplemental principal payments.

November 12 -

While the figures show a decrease in growth from the prior year, when the value of the securitizations rose 23% to about $572 billion, it still underscores the rapid pace of synthetic risk transfers expansion.

November 12 -

Second-lien mortgages make up the collateral pool. Those assets normally have a high expected loss severity, but the borrowers appear to be of prime credit quality.

November 11 -

In addition to that subordination, the deal structure includes cash trap and sweep conditions to support cash flow to the deal.

November 11 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

With borrowing costs near multi-year lows, median equity distributions for the securities reached an annualized rate of 12.1%, the lowest since 2020.

November 10 -

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

November 10 -

Senior notes are supported by an interest reserve account, and class A2 notes have a scheduled annual amortization of 1.0% before their anticipated repayment.

November 10