-

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

SEMT 2025-12's collateral profile is slightly weaker compared with the prior transaction, with a slightly lower weighted average FICO score.

November 12 -

MP 2025-1's loan-to-value ratio will not exceed 70% of aggregate appraised value. To maintain this leverage level, the deal will also collect supplemental principal payments.

November 12 -

While the figures show a decrease in growth from the prior year, when the value of the securitizations rose 23% to about $572 billion, it still underscores the rapid pace of synthetic risk transfers expansion.

November 12 -

Second-lien mortgages make up the collateral pool. Those assets normally have a high expected loss severity, but the borrowers appear to be of prime credit quality.

November 11 -

In addition to that subordination, the deal structure includes cash trap and sweep conditions to support cash flow to the deal.

November 11 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

With borrowing costs near multi-year lows, median equity distributions for the securities reached an annualized rate of 12.1%, the lowest since 2020.

November 10 -

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

November 10 -

Senior notes are supported by an interest reserve account, and class A2 notes have a scheduled annual amortization of 1.0% before their anticipated repayment.

November 10 -

Jamaica's cat bond success could spur issuer and investor interest in the product, putting Beryl's failure to trigger any compensation in the past.

November 10 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

ABCLN 2025-B also benefits from a line of credit sized to cover up to five months of missed interest payments in the event Ally defaults on its interest obligations.

November 7 -

The buyout firm gathered $43 billion during the three months through September. KKR's Global Atlantic insurance unit, collateralized loan obligation issuance and its high grade and asset-based finance groups fueled the credit results.

November 7 -

AMDR 2025-1 is the inaugural securitization for Americor, an Irvine, Calif.-based which offers debt resolution services, personal loans, debt resolution loans, mortgages and home equity lines of credit.

November 6 -

Despite record loan applications, Upstart's AI pulled back, causing a revenue miss and raising "incremental uncertainty" about its core underwriting model.

November 5 -

The issuance can be expanded to $1.2 billion, with virtually the same capital structure characteristics.

November 5 -

LADAR 2025-3's loss levels are notably lower than the rating agency's assumptions on the LADAR 2025-1 because the sponsor excluded borrowers with credit scores lower than 701 from the collateral pool.

November 4 -

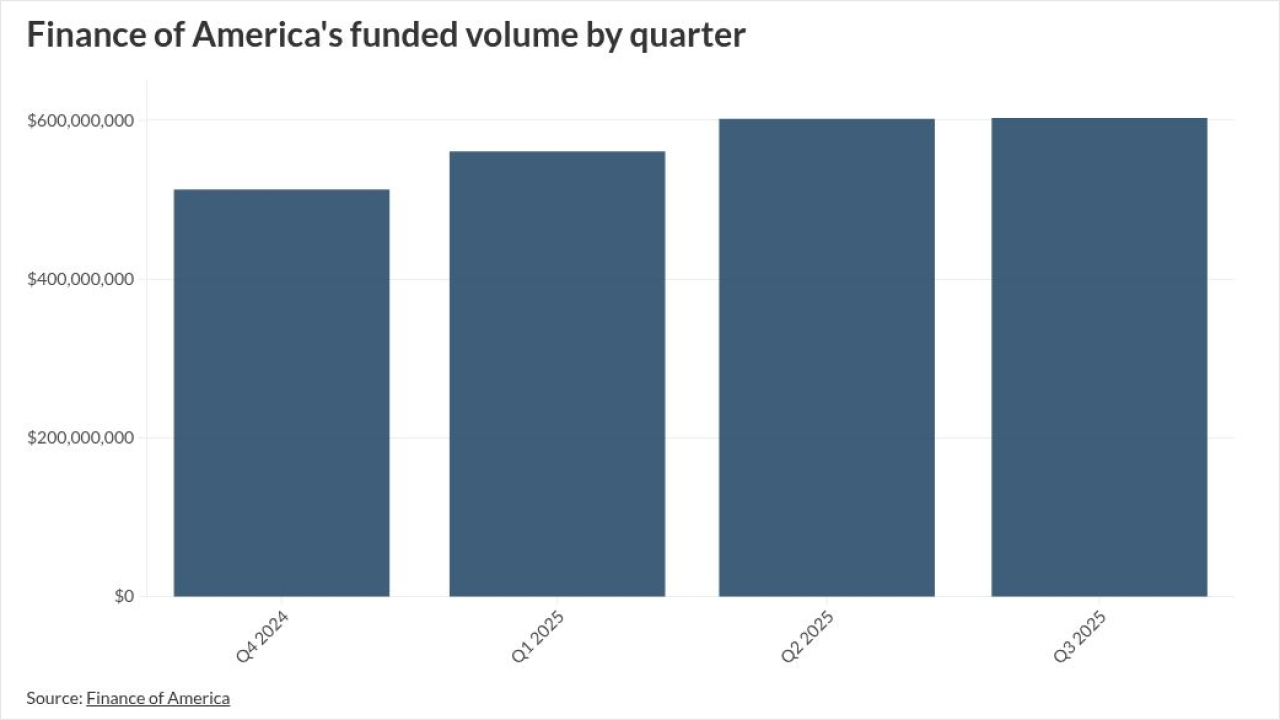

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

WFLOOR 2025-1's annualized monthly yield, which averaged 20% since 2018, has been consistently higher than most other dealer floorplan trusts that Moody's rates.

November 4