-

Jamaica's cat bond success could spur issuer and investor interest in the product, putting Beryl's failure to trigger any compensation in the past.

November 10 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

ABCLN 2025-B also benefits from a line of credit sized to cover up to five months of missed interest payments in the event Ally defaults on its interest obligations.

November 7 -

The buyout firm gathered $43 billion during the three months through September. KKR's Global Atlantic insurance unit, collateralized loan obligation issuance and its high grade and asset-based finance groups fueled the credit results.

November 7 -

AMDR 2025-1 is the inaugural securitization for Americor, an Irvine, Calif.-based which offers debt resolution services, personal loans, debt resolution loans, mortgages and home equity lines of credit.

November 6 -

Despite record loan applications, Upstart's AI pulled back, causing a revenue miss and raising "incremental uncertainty" about its core underwriting model.

November 5 -

The issuance can be expanded to $1.2 billion, with virtually the same capital structure characteristics.

November 5 -

LADAR 2025-3's loss levels are notably lower than the rating agency's assumptions on the LADAR 2025-1 because the sponsor excluded borrowers with credit scores lower than 701 from the collateral pool.

November 4 -

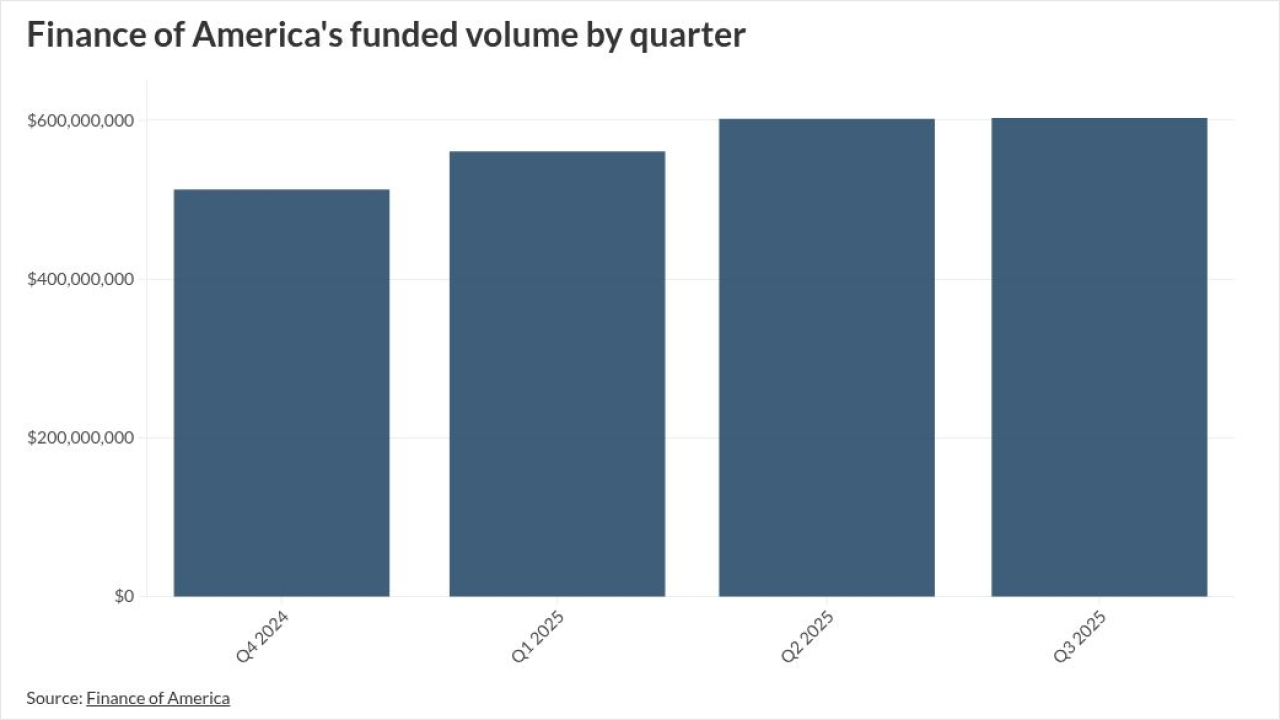

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

WFLOOR 2025-1's annualized monthly yield, which averaged 20% since 2018, has been consistently higher than most other dealer floorplan trusts that Moody's rates.

November 4 -

Most of the pool of 1,011 residential mortgages, 69.7%, are considered non-prime mortgages, primarily due to the documentation and styles of underwriting.

November 3 -

The buy now/pay later firm, which reports earnings Thursday, has inked deals with Worldpay to expand potential borrowers and with New York Life to obtain more capital for future lending.

November 3 -

The ECB will argue that shifting credit risks off the balance sheet through so-called synthetic significant risk transfers could expose banks to refinancing risks during market stress.

November 3 -

HINNT's sellers can repurchase defaulted loans, which increases the transaction's recovery rate, and enhances the credit to the notes.

November 1 -

The Tacoma, Washington-based bank, which has completed two mergers since 2023, said Thursday that it will buy back up to $700 million of its own shares over the next year.

October 31 -

Lemin's team of generalists seek risk-adjusted returns across the securitization spectrum. But not every asset class makes the cut.

October 31 -

Oxford Finance's collateral has a maximum advance rate of 72.0% on the A1 and A2 notes and 82.0% on the class B notes.

October 30 -

Top SBA lenders are warning about the impact of a prolonged shutdown. NewtekOne skipped providing fourth-quarter guidance after its CEO said the situation was too cloudy to forecast.

October 30 -

FFIN 2025-3's average loan balance, $16,366 was lower compared with the 2025-2 deal, when it was $19,993, and the WA interest rate on the current deal is 12.15%, down from 12.56%.

October 30 -

Each manufacturer commits to repurchasing unsold new vehicles in inventory when the dealer terminates the agreement—if they are undamaged and unused.

October 29