-

On average the receivables have a balance of $971, a WA average percentage rate of 32.88%, and a WA age of 24 months. Also, cardholders might pay an annual membership of up to $75.

September 28 -

U.S. stocks ended the day higher and Treasury yields fell Thursday. Federal Reserve Chair Jerome Powell sidestepped investor concerns over the outlook for rates at an event.

September 28 -

Federal Deposit Insurance Corp. Chairman Martin Gruenberg said despite earlier proposals for reforming deposit insurance following this spring's bank failures, congressional interest in major reforms has waned and prospects for legislative changes are dim.

September 28 -

Public policy experts debated the effect of rising rates on the mortgage market, the impact on homebuyers and ways that Fannie Mae and Freddie Mac could exit conservatorship at the National Mortgage News Digital Mortgage Conference.

September 28 -

The deal will be secured by payments on subprime auto loans and comes shortly after officer Jill Rockwood joined as chief financial officer.

September 28 -

Even as Freddie Mac's survey put rates at their highest since December 2000, factors like rising oil prices and a government shutdown could slow the economy.

September 28 -

Equify ABS 2023-1 is expected to close on October 11 and will issue three classes of notes secured by revenue from mid- to large-ticket equipment contracts and related assets.

September 27 -

The Federal Reserve Bank of New York's gauge of the 10-year term premium became positive on Monday, after having been negative for most of the past seven years, reflecting steep increases in longer-maturity Treasury yields.

September 27 -

Credit unions and banks are lending more to merchants based in the Western U.S., reflecting trends reported in the Umpqua Bank 2023 Business Barometer and running against broader economic pessimism.

September 27 -

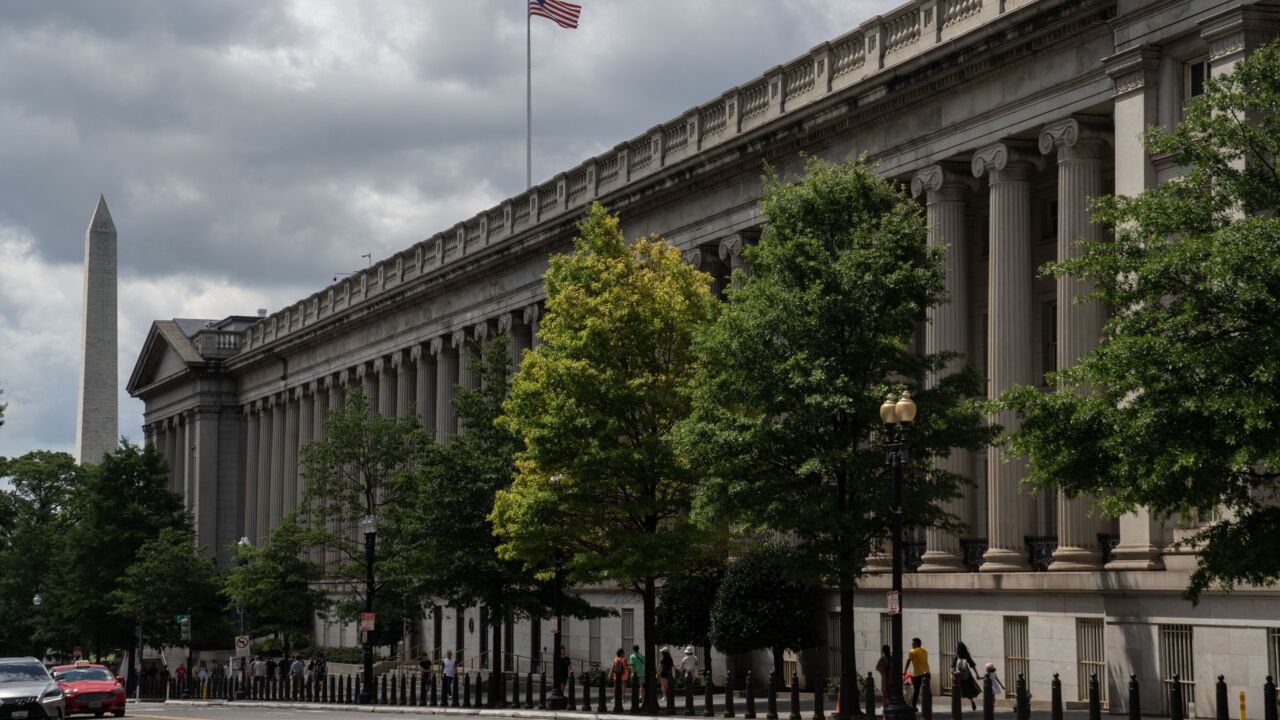

The Department of Justice reached a $9 million settlement Wednesday with Westerly, R.I.-based Washington Trust over race-based lending discrimination and redlining in the state, saying the bank denied lending services to Black and Hispanic neighborhoods from 2016 to 2021.

September 27