Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

Wells Fargo reports senior bondholders still hold significant protections against a worldwide slowdown in travel or a decline in aircraft values despite the reclassification of the global coronavirus outbreak as a pandemic.

Prices for major term loans issued by operators such as Marriott International, Hilton Worldwide and Caesars Entertainment have fallen in recent weeks as investors grow worried about the impact of the COVID-19 outbreak on global tourist and business travel.

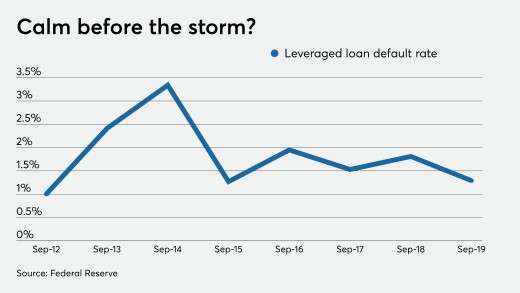

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

Kathy Kraninger was grilled about whether her agency and others were doing enough to cushion consumers from the economic blow of the coronavirus crisis.

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

Sen. Mark Warner led a group of Democratic senators in calling on bank, credit union and GSE regulators to give detailed instructions on helping consumer and commercial borrowers hurt by the COVID-19 outbreak.

Exchange traded funds tracking leveraged-loan performance saw sharp declines on Monday, following a Friday leveraged loan index decline that was the steepest in nearly a decade.

-

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

March 12 - asr daily lead

Wells Fargo reports senior bondholders still hold significant protections against a worldwide slowdown in travel or a decline in aircraft values despite the reclassification of the global coronavirus outbreak as a pandemic.

March 12 -

Prices for major term loans issued by operators such as Marriott International, Hilton Worldwide and Caesars Entertainment have fallen in recent weeks as investors grow worried about the impact of the COVID-19 outbreak on global tourist and business travel.

March 11 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

Kathy Kraninger was grilled about whether her agency and others were doing enough to cushion consumers from the economic blow of the coronavirus crisis.

March 10 -

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

March 9 -

Sen. Mark Warner led a group of Democratic senators in calling on bank, credit union and GSE regulators to give detailed instructions on helping consumer and commercial borrowers hurt by the COVID-19 outbreak.

March 9