Consumer banking

Consumer banking

-

Bank stocks are up this year as interest rates have leveled off and there are hopes that pressure on lenders' profits could moderate.

May 8 -

The Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency issued a 30-page guidebook on managing affiliate risks. The report builds on formal guidance issued last year.

May 3 -

In talks with OCC officials, "it became obvious that we would not gain near-term approval given their recent experience with multifamily and CRE positions," FirstSun CEO Neal Arnold says. The companies announced other revisions to their deal, too.

May 3 -

Consolidation has slowed since the pandemic, but UMB's agreement to buy Heartland Financial — the largest deal in three years — is one of several merger announcements in the past two weeks. Talks among other potential buyers and sellers are said to be picking up.

April 30 -

The Philadelphia-based bank's parent company, Republic First Bancshares, had been roiled by a yearslong proxy battle involving activist investors groups and its former CEO.

April 26 -

Net charge-offs at the Charlotte, North Carolina-based bank increased by more than 80% in the first quarter compared with a year earlier. BofA executives say that the rising losses were in line with the bank's risk appetite.

April 16 -

Should the all-stock transaction close as planned later this year, Wintrust Financial in the Chicago area would gain about $2.7 billion of assets.

April 15 -

A solid majority of decision-makers at these companies expect to expand their workforces again this year, a Citizens Financial survey found. Loan losses are normally low in eras of economic expansion.

April 9 -

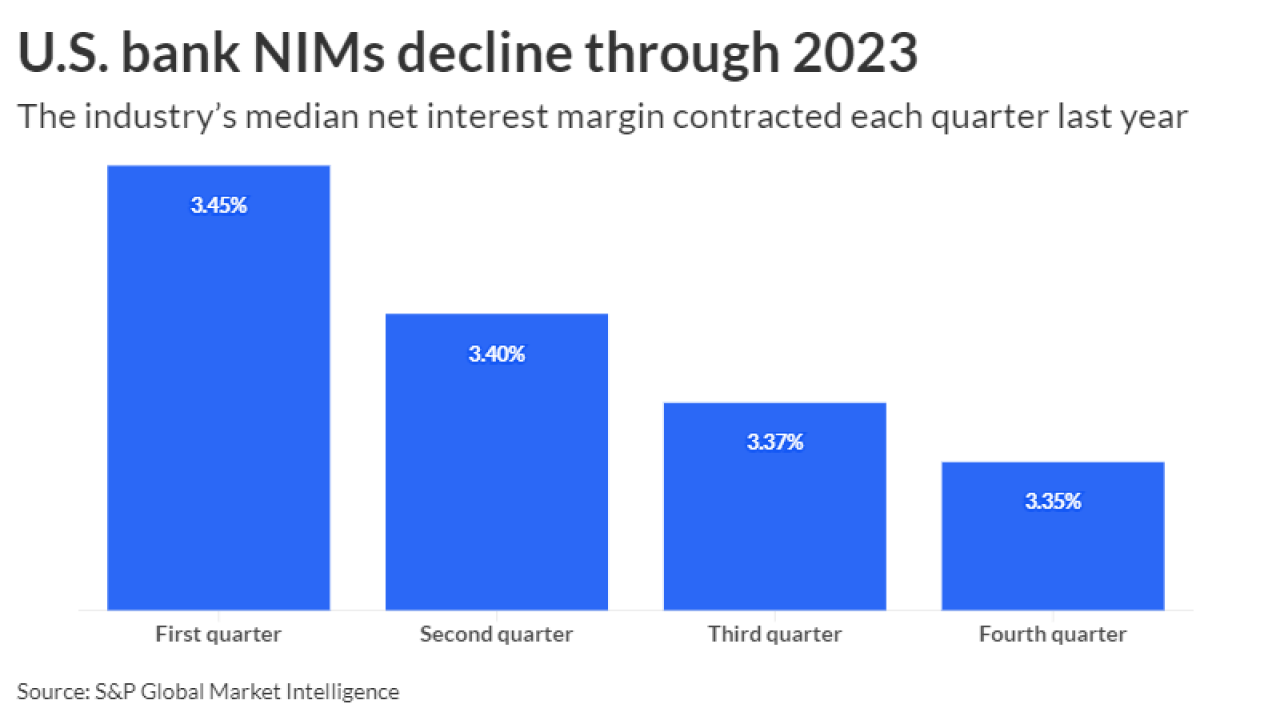

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

First National has agreed to buy Touchstone Bankshares. The combined company would have more than $500 million each of deposits and loans.

March 26 -

Bank mergers and acquisitions have slowed in recent years amid recession fears and other economic uncertainties. But bank consolidation is a century-old trend that's expected to rev up again as early as this year due to higher costs, tougher regulation and fierce competition.

March 15 -

The USDA forecasted farm profits will plunge 26% this year, potentially creating credit quality challenges for lenders.

February 23 -

Lenders collected an estimated $25 billion in additional interest income last year by raising the average margin on annual percentage rates, or the amount above the prime rate, according to the Consumer Financial Protection Bureau.

February 22 -

The median interest rate that large credit card issuers charged consumers with good credit in the first half of 2023 was 28.2%, compared with 18.15% at smaller banks and credit unions, according to a study by the Consumer Financial Protection Bureau, which is on a campaign against excessive fees.

February 18 -

Car loan delinquencies are worsening across all age groups and income levels, as high interest rates and elevated car prices take a toll, according to the New York Fed. But executives at some large auto lenders remain relatively confident about their customers' ability to stay afloat.

February 6 -

The deal involving Southern California Bancorp and California BanCorp, expected to close in the third quarter, would form a $4.6 billion-asset lender with a footprint spanning San Diego, Greater Los Angeles and the San Francisco Bay Area.

January 30 -

The stable outlook is an indication that — at least for some lenders — the much-feared cycle of cardholders defaulting on their obligations in the wake of the COVID-19 pandemic may not turn out to be so bad.

January 26 -

The private student loan market is in flux after one major lender, Discover Financial Services, said it's leaving the sector. Sallie Mae is gearing up to compete for that business, much as it did when Wells Fargo pulled up stakes in 2020.

January 25 -

The private equity firm Caryle is buying a $415 million student loan portfolio from Truist Financial. It's also investing in a nonbank student lender called Monogram that works with banks and credit unions.

January 24 -

As part of a settlement with the Justice Department, Patriot Bank must invest more than $1 million of the total in a loan subsidy fund for minority homeowners and take other corrective steps in its everyday business. The bank denied any wrongdoing.

January 17