-

The $423.2 million Master Credit Card Trust 2018-3 consists of three tranches of notes maturing in January 2022, one floating-rate and two fixed-rate.

August 8 -

Conn’s has increased the credit enhancement on its latest consumer loan securitization to account for rising losses on its managed portfolio, according to rating agency presale reports.

August 7 -

As a result of the forward flow agreement, Kroll has increased expected recoveries, allowing Upstart to lower credit enhancement on its next securitization.

July 31 -

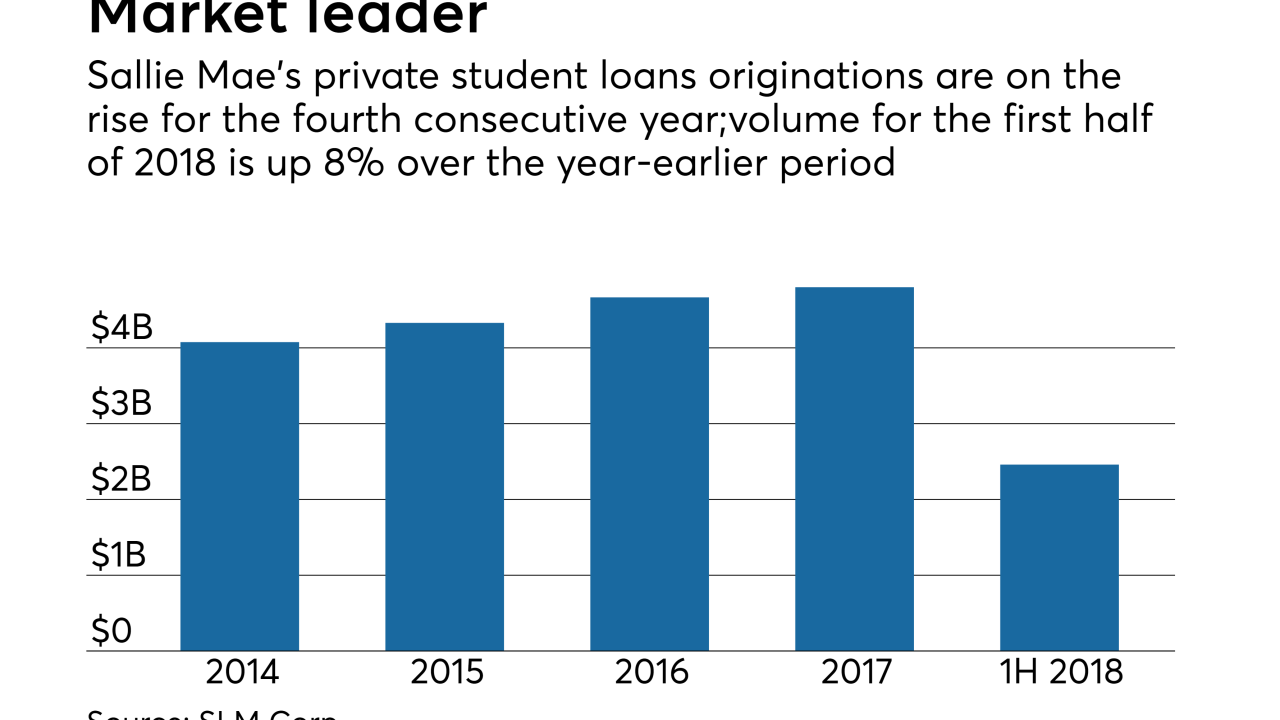

The amount of loans cherry picked by the likes of SoFi and CommonBond fell by 3%, to $221 million; just as well, since Sallie Mae's grad school loans are off to a slow start.

July 25 -

The notes, which are rated by DBRS, are backed by a mix of products to borrowers with weak credit; the pool of collateral will revolve over the first two years of the transaction.

June 29 -

American Express prevailed Monday in an eight-year antitrust battle with the government. Here’s a look at how other card networks, banks, retailers and consumers will be affected.

June 25 -

Noria 2018-1 is a €1.6 billion securitization of unsecured personal loans, of which 30% are debt consolidation accounts.

May 28 -

The online lender was able to lower the credit enhancement (again) on its latest securitization of consumer installment loans, the $221.9 million Avant Loans Funding Trust 2018-A.

May 21 -

While DBRS maintained a rating of AA for the Lendmark Financial's first ABS of 2018, S&P issued an A rating after estimating higher net losses on the underlying subprime accounts.

May 4 -

The percentage of 84-month loans has been shaved to 37.5% of the pool in SoFi's consumer loan program 2018-2 issuance, down from 45.4% in its prior transaction in January.

April 8