Ratings agencies delivered preliminary split ratings to the Lendmark Financial Services’ first nonprime consumer loan ABS of 2018, divided mainly on loss prospects for its mostly secured borrower accounts.

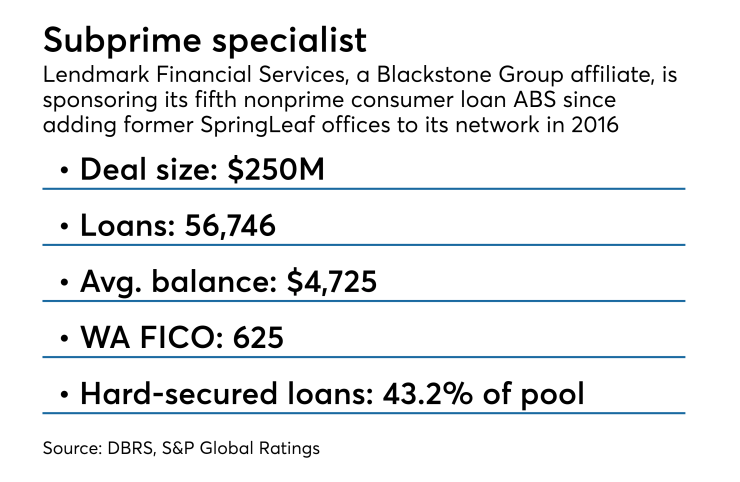

DBRS expects to assign an AA to the senior notes in the $250 million Lendmark Funding Trust 2018-1, while S&P Global Ratings issued only a single A to the $196.2 million Class A notes.

DBRS’ rating is based on its assumption that losses will reach 10.35% over the life of the deal, while S&P expects losses to be much higher, in its worst-case, expected annualized monthly loss rate of 15.49% to the portfolio.

This is the fifth overall securitization of nonprime and subprime loans originated and serviced by the Blackstone Group-affiliated lender, which operates 319 branches concentrated in the Southeastern and Mid-Atlantic regions.

Those branches include 127 former Springleaf Holdings consumer loan offices acquired in 2016, after Springleaf divested them in 2015 as part of its own acquisition of Citigroup's OneMain Financial. The former Springleaf offices were later incorporated and rebranded into the Lendmark footprint.

The loans in the 2018-1 pool were issued through both legacy Lendmark and Springleaf branches as well as from direct-mail solicitations.

The transaction includes three classes (B, C and D) of subordinate notes totaling $53.72 million, with ratings of A, BBB and BB from DBRS. S&P gave lower ratings to the Class B (A-) and Class C (BBB-), but matched DBRS’ rating on the most junior tranche.

The pool includes 56,746 loans with an aggregate balance of $268.1 million, or an average balance of $4,725 with weighted average coupon of 27.12%. The loans have average terms of 49 months, with seven months of seasoning and a weighted average borrower FICO of 625.

LendMark has included a higher

The hard-secured loans are primarily accounts secured by an auto, while other secured loans are backed by consumer goods such as computers, furniture and home furnishings.

The new deal has an extended three-year revolving period vs. two years in Lendmark’s prior transaction, allowing Lendmark to add additional loans that meet investment criteria. (The percentage of unsecured loans could be as high as 30% under deal covenants.)