Strong demand and higher credit enhancement allowed Social Finance to offer lower spreads on its first consumer loan securitization of the year, even after upsizing the deal to $850 million from $650 million originally.

The deal was launched shortly after SoFi announced that

While investors may have been encouraged by Noto’s appointment, the latest consumer loan securitization also benefits from some additional investor protections.

Four tranches of rated notes were issued, resulting in an advance rate of 91%, according to a person familiar with the transaction. The amount of overcollateralization in the deal will gradually build from 9% to 16%.

By comparison, SoFi’s previous consumer loan securitization, completed in November, had an

Two senior tranches of notes rated AA + by KBRA were issued. The Class A-1 tranche, which has a shorter expected life, pays 50 basis points over the Eurodollar synthetic forward curve, in from 57 basis points on the comparable tranche of the previous transaction. The Class A-2 tranche pays 75 basis points over the interpolated swaps curve, in from 90 basis points on the previous deal.

The narrower spreads may be partly explained by the fact that SoFi offered additional investor protection, in the form of credit enhancement, on the senior notes this time. Credit enhancement for the Class A notes rose by more than four percentage points to 29.3% from 25.07% for the Class A notes of the November deal.

The Class B tranche, which is rated A, pays 115 basis points over swaps, down from 150 basis points for the November deal. Credit enhancement, which rose to 16.84% from 13.53%, may have helped here as well.

And the Class C tranche, which is rated BBB, pays 145 basis points over swaps, in from 200 basis points on the previous transaction. This was only the second transaction in the past year that included a BBB rated tranche. SoFi lowered the credit enhancement slightly, to 9.46% from 9.53%.

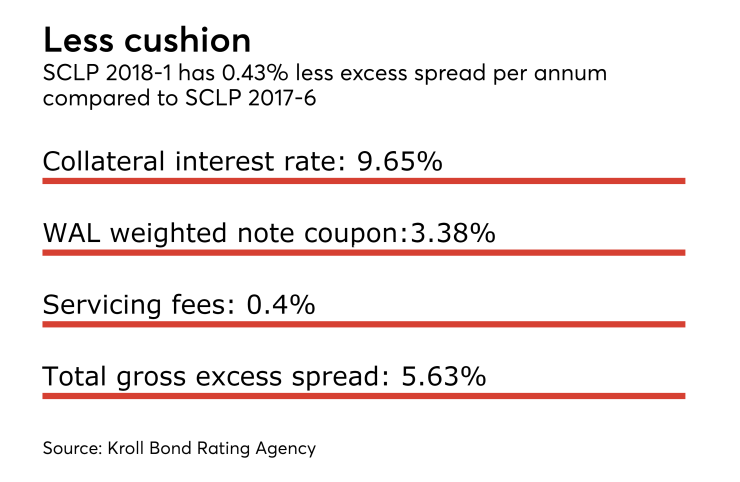

The credit quality of the collateral is in line with that of previous deals. The weighted average FICO score is 744 (on the original pool, before the deal was upsized), the weighted average original term is 67 months, the average loan size is $31,570 and the weighted average borrower rate is 9.65%, according to Kroll.

However, Kroll has increased its loss assumptions for the latest transaction by 30 basis points; it expects losses over the life of the deal to reach 7.9%, up from 7.6% for the November transaction.

The latest transaction, as originally sized, also benefits from 0.43% less excess spread per annum compared with the November transaction, according to Kroll. That’s because the coupon on the notes being issued has risen, reflecting higher prevailing interest rates, while the loans used as collateral pay slightly lower rates of interest.

Like many marketplace lenders, SoFi relies on a diverse mix of funding, including warehouse lines of credit, whole loan sales and securitization. The collateral for the latest asset-backed transaction includes loans owned by SoFi and loans previously sold to other investors.