-

Paramount Equity Mortgage sold a solar finance business to SolarCity (now Tesla) in 2013; it has since rebranded itself as Loanpal and is readying its first solar loan securitization.

March 7 -

Nissan's is offering fewer investor protections than on its prior four securitizations; NextGear is set to close on its 10th securitization of floorplan receivables of mostly independent used-car dealers.

March 1 -

Three years after Verizon issued its first term securitization of device payment plans, it remains the sole issuer; Sprint, T-Mobile and AT&T appear to have other priorities.

February 27 -

The move, reported by The Wall Street Journal, could be part of a deeper foray into cobranded cards by Goldman, which has been expanding into consumer finance through its Marcus unit.

February 21 -

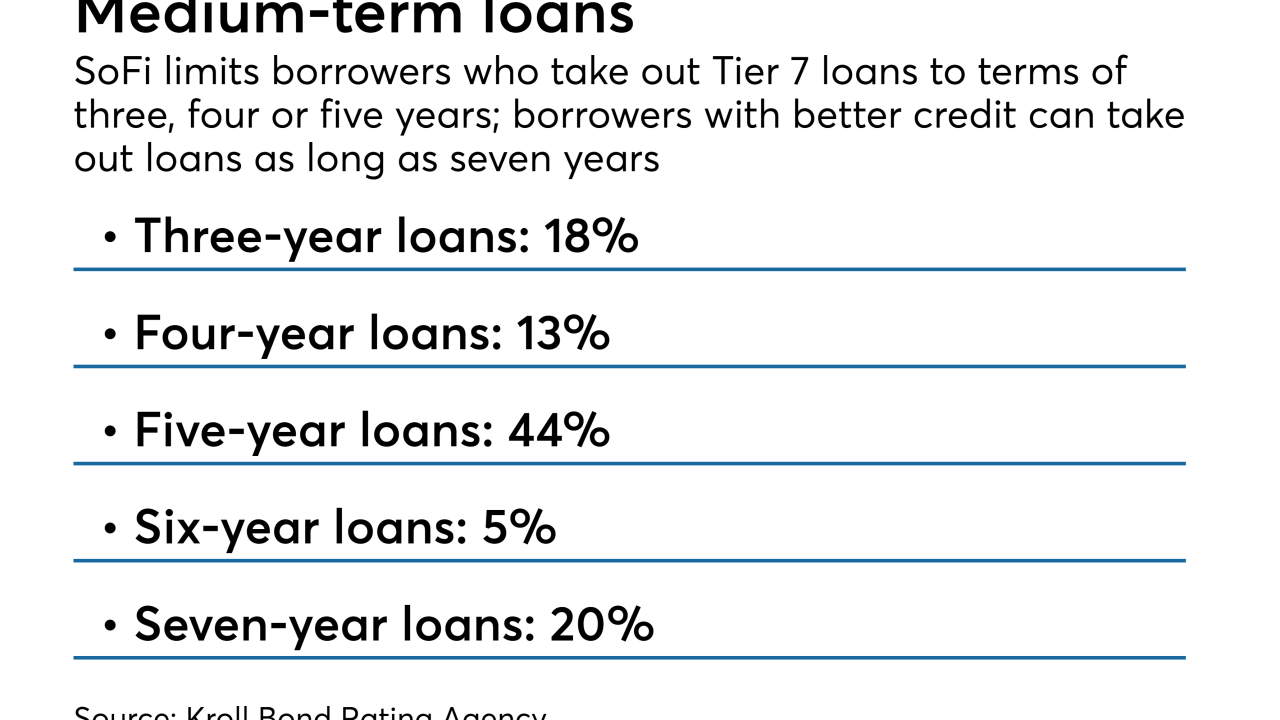

Tier 7 loans, which have lower limits on free cash flow and allow negative personal income, account for 7.26% of the collateral for the online lender's next transaction, according to Kroll.

February 8 -

The New York and Israel-based investment management startup selected the initial collateral using machine-learning decisions; AI will also be used in determining when to sell consumer loans in the portfolio or buy additional assets.

February 6 -

The new unit will be based in Charlotte, N.C., and led by Bo Weatherly; it will provide warehouse lines of credit to nonbank consumer and commercial lenders; it will also provide underwriting services.

January 31 -

The remainder of the collateral was contributed by Goldman Sachs, which is also holding onto 5% of the risk in the deal to comply with risk retention rules.

January 28 -

Ford Motor Credit added a one-time seven-year revolving period to its previous open pool of auto loan receivables.

January 11 -

The $748 million Navient Student Loan Trust 2019-1 looks a lot like the four FFELP deals the sponsor completed in 2018; it is backed by a mix of rehab (19.6%) and non-rehab (80.4%) loans.

January 9