LendingClub’s prime consumer loan securitizations keep getting more, well, prime.

This week the marketplace lender launched a $272.4 million offering of bonds backed by unsecured consumer loans to borrowers with a weighted average FICOs of 703; that’s up, albeit slightly, from 701 for LendingClub’s prior two prime deals, completed in September and June.

There are also fewer 60-month loans in the new transaction, 55.7% compared with 56.83% and 60.43% in the two prior deals.

The weighted average coupon of 14.58% is also lower than the prior transactions, which could reflect both the higher weighted average FICO and the increased proportion of 36-month loans.

Kroll Bond Rating Agency cited all three factors in projecting lower cumulative net losses. It’s called for losses in the range of 11.60% - 13.60%, its base-case scenario. That’s down from 12.20%-14.20% for the September 2018 deal, 12.50% - 14.50% for the June 2018 deal, 13.25% - 15.25% for a December 2017 deal and 14.00% - 16.00% for a September 2017 deal.

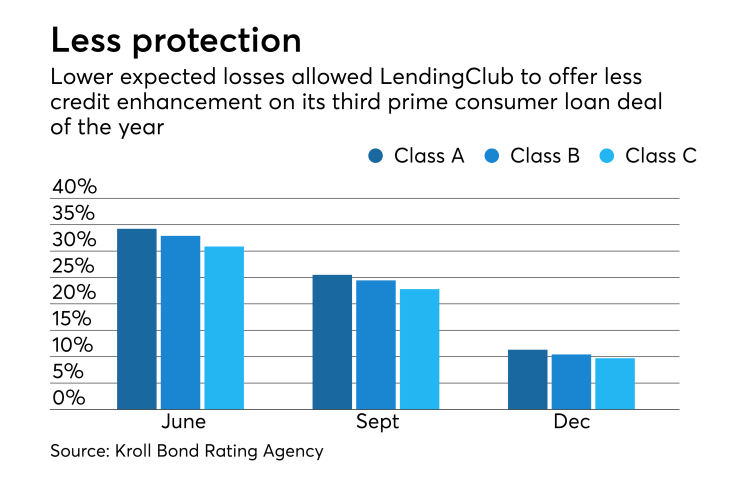

The lower loss expectations allowed LendingClub to offer slightly less credit enhancement on the new transaction.

Consumer Loan Underlying Bond (CLUB) Credit Trust 2018-P3 will issue three tranches of rated notes. The $208.9 million tranche of Class A notes is rated A- and benefits from 30.87% credit enhancement, down from 32.88% in the comparable tranche of the September deal and 34.22% in the June deal.

Likewise, $24.2 million of BBB-rated notes benefit from 22.8% credit enhancement, down from 24.45% and 25.5% in the new prior deals.

And the $39.3 million of BB-rated notes have 9.7% credit enhancement, down from 10.42% and 11.32%.

In a shift that introduces some risk to the deal, LendingClub is acting as custodian for the loan documents in this securitization and will maintain loan documentation in its own electronic vault.

The designated originals of the loan documents for each loan obtained through the LendingClub Platform are maintained in electronic form. For previous CLUB transactions, LendingClub used eOriginal, an unrelated third party, as custodian.

When a borrower signs a loan agreement, LendingClub creates two forms of the PDF: the authoritative PDF document and a watermarked PDF copy. Both copies are securely stored and access to the authoritative PDF document is restricted. Loan ownership is tracked and recorded in the LendingClub system of record.

Similar to previous CLUB transactions, on the closing date, an electronic vault will be established in the name of the Grantor Trust. The backup servicer and sub-backup servicer will be granted access to the watermarked PDF documents.

“In the event LendingClub files for bankruptcy, the fact that it custodian may make it more difficult to access loan documents and may cause a delay in timing and reduction in recovery amounts,” Kroll stated in its presale report.

However, while LendingClub has less experience handling digital loan documents compared to third party custodians, Kroll believes it has implemented appropriate systems and control processes to help address document control risks.

LendingClub has securitized a total of $930 million in its three prime consumer loan securitizations this year. (The marketplace lender also makes nonprime loans that are securitized via a separate platform.) As of Sept. 30, 2018, it held $492.6 million in loans on its balance sheet, of which $479.3 million were being held for primarily for upcoming securitizations and sale to investors via pass-through certificates.

Kroll noted that in the third quarter, LendingClub was less dependent on sales of whole loans to banks, which accounted for 38% from 40% in the prior quarter. However, the proportion of loans that LendingClub fund by holding them on its own balance sheet also decreased, to 15% from 18%.

In the third quarter, of the $2.89 billion invested on the LendingClub’s platform, 21% came from managed accounts, 7% from self-managed individuals, 38% from banks and finance companies and 19% from other institutional investors including pension funds, assets managers and insurance companies. LendingClub funded the remaining 15%.