-

The alliance should help the asset registry and communications platform, accelerate its expansion beyond leveraged loans and structured finance and into more overseas markets.

July 20 -

Investors in hundreds of millions of dollars of bonds backed by private student debt could pay the price for shoddy paperwork and aggressive pursuit of troubled borrowers.

July 18 -

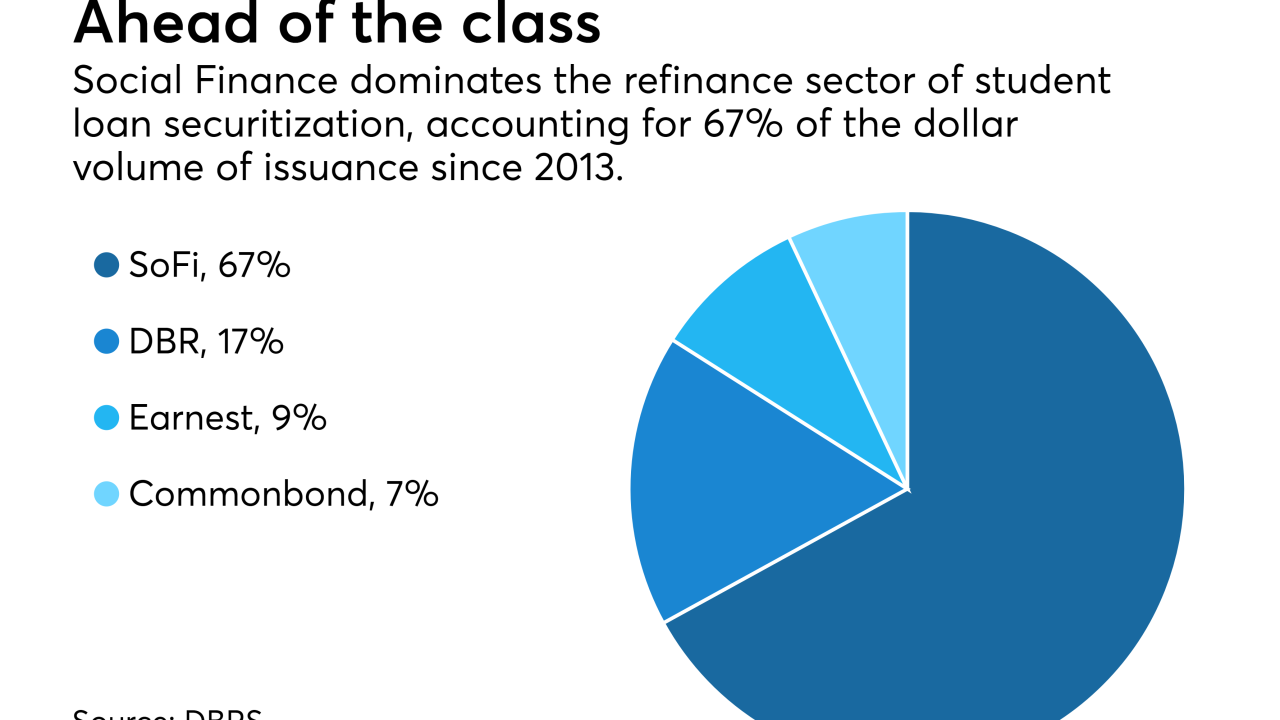

Navient and Social Finance are kicking off what’s expected to be a busy second half for student loan securitization with two deals totaling nearly $1.5 billion.

July 17 -

The collateral pool has a slightly higher percentage of new vehicles (24.53%) than the sponsor’s previous deal, and a shorter remaining weighted average term (62 months).

July 16 -

Banco Santander plans to go ahead with a proposal to increase control of its U.S. subprime auto loan unit, after the business passed the Federal Reserve's stress test last month, according to people familiar with the matter.

July 12 -

AutoGravity of Irvine, Calif., has received $30 million in equity financing from VW Credit, according to a source familiar with the matter.

July 6 -

The German automaker was compelled to shift funding to asset-backeds in the wak of an emissions cheating scandal; it has now resumed issuing unsecured debt

July 6 -

The liquidation of Veneto Banca and Banca Popolare puts increasing pressure on other banks in the Eurozone to reduce their holdings of bad loans, according to Fitch Ratings; it remains to be seen whether securitization will play a significant role.

July 2 -

Synchrony Financial and Alliance Data Systems are particularly vulnerable to recent shifts in Americans’ shopping habits, according to new research from Moody’s Investors Service.

June 28 -

College Ave, founded by two former Sallie Mae executives, makes both in-school and refinance loans; borrowers have the option of making payments before they graduate

June 27