-

The lender increased credit enhancement for the subordinate tranches of Springleaf Funding Trust 2017-A to offset lower FICOs and larger balances.

June 19 -

As of late Thursday, there were two bond offerings backed by prime auto loans (Ford, Honda), three backed by subprime auto loans (Santander, GLS, UACC) and two backed by dealer inventory financing (Ally, Navistar).

June 16 -

Credit card losses are climbing as consumers take on more debt, but so far the performance of bonds backed by credit card receivables is holding up.

June 9 -

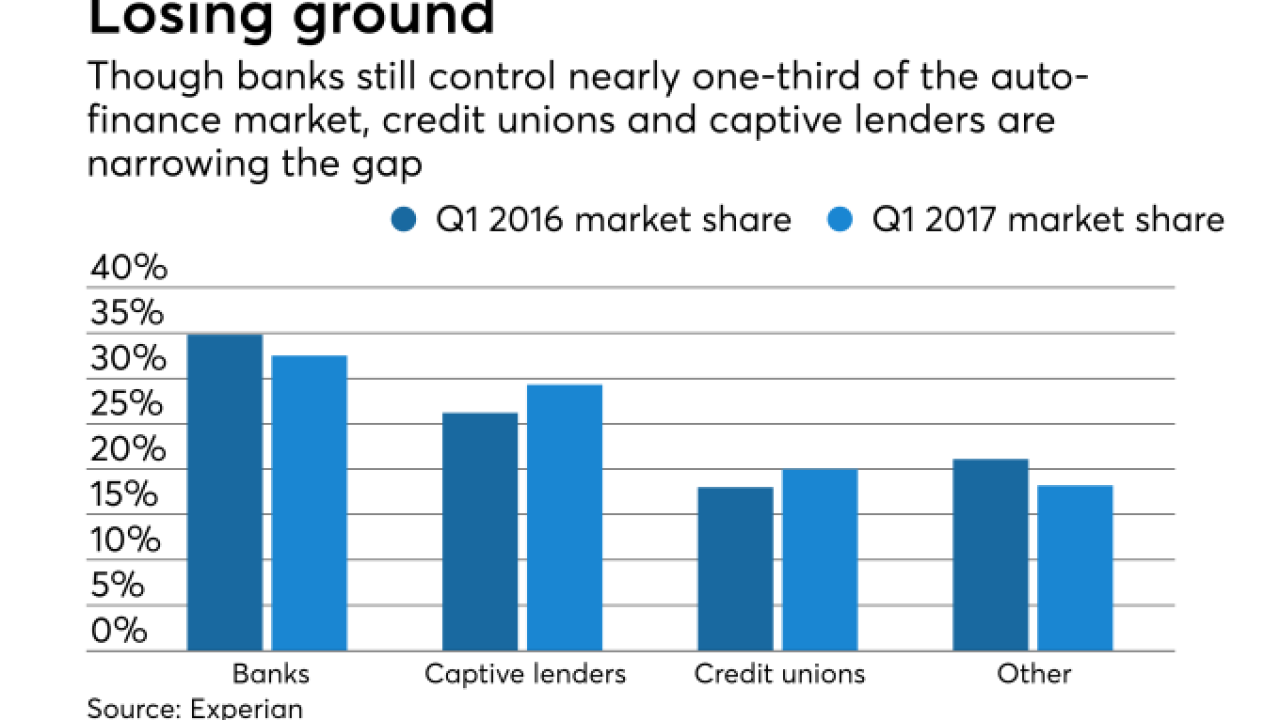

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 8 -

Upstart (that's it's name), which was founded by several former Google employees, makes unsecured installment loans to prime and near-prime borrowers.

June 6 -

The German subsidiary of Spanish lender Santander Consumer Finance is planning its first auto loan securitization of the year.

June 5 -

Credit metrics in a $147.5 million deal deteriorated mildly compared with the lender's previous securitization, but the real issue, according to S&P Global, is a new repossession fee that eats into recoveries.

June 1 -

GrandSouth Bancorp's issues with floor-plan loans to car dealers serve as a reminder of another pitfall in auto lending besides consumer loans.

May 31 -

The investment bank, which co-lead the lender's previous two transactions, contributed a portion of the collateral for the $232 million student loan securitization.

May 30 -

The broad bill, sponsored by House Financial Services Committee Chairman Jeb Hensarling, R-Tex., would provide an off-ramp for banks that agree to hold a leverage ratio of at least 10% and would gut the Consumer Financial Protection Bureau, among other provisions.

May 25