Eight issues of auto-related securitizations totaling over $5 billion hit the market Wednesday and Thursday, marking one of the busier weeks of the year. As of late Thursday, there were two bond offerings backed by prime auto loans (Ford, Honda), three backed by subprime auto loans (Santander Consumer, GLS, United Auto Credit Corp.), two backed by dealer inventory financing (Ally, Navistar), and one by commercial fleets (Enterprise).

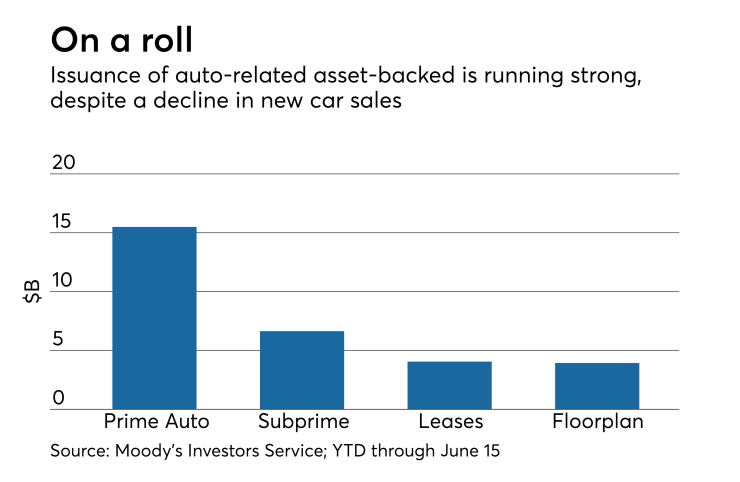

Issuance of all kinds of asset-backeds is on the rise, thanks to a credit environment and a risk-on investment setting. Still, the heavy volume of auto-related issuance stands in sharp contrast with the decline in auto sales this year. Some $10 billion of auto loan, leases, floorplans and rental car ABS was issued in May, bringing the total for the first five months of the year to $45 billion, per S&P Global.

S&P has speculated that expectations for further increases in interest rates may be driving issuers of all kinds of ABS to move more assets off their balance sheet to free up capacity.

Regardless of what’s driving issuance, the wide range of deals on offer this week offer a snapshot of underwriting trends.

Prime auto loans

Retail loans to prime borrowers continue to perform well, but terms are lengthening, suggesting that consumers are stretching to buy more car than they can easily afford.

Ford Motor Credit and American Honda Finance Corp. are each marketing $1.3 billion of bonds backed by prime auto loans. (Honda’s deal may be upsized to $1.6 billion, according to Moody’s Investors Service.) The credit quality of the collateral for both deals is largely consistent with recent transactions, according to Moody’s Investors Service, which is rating both deals. But in Honda’s case, close to 25% of the pool consists of loans with original terms of greater than 60 months, in line with the lender’s previous deal, but up from 20% in its 2016 deals. In Ford’s transaction, FCAOT 2017-B, 57% of the pool balance consists of loans with terms of over 60 months, higher than its three previous deals.

Moody’s warns in its presale report on Honda’s deal that longer term loans in the prime segment “generally have weaker performance compared to loans with shorter original payment terms.”

Subprime auto

The performance of subprime auto ABS, by comparison has been deteriorating rapidly. That’s particularly true for Santander Consumer, which is marketing $1 billion of bonds backed by some of its riskiest loans. Moody’s expects cumulative net losses for the deal, DRIVE 2017-1, to reach 27%. While that’s unchanged from recent DRIVE transactions, it is the the highest level for any auto loan securitization that Moody’s rates.

In order to earn an AAA rating for the senior tranche, Santander had to offer 65% credit enhancement. In addition, the bank, in its role as servicer of the transaction, has for the first time committed to repurchase any loans that default before making two payments. In practice, according to Moody's, this is what Santander has been doing. In previous deals, however Santander has only committed to repurchase loans that default before their first payment.

While Santander has cut back on subprime lending, GLS, the subprime lender backed by private equity firm BlueMountain, continues to expand. The firm grew its origination volume to $155.3 million in the first quarter, more than double the $69.8 million in the same period of 2016, according to Kroll Bond Rating Agency. GLS Auto Receivables Trust 2017-1 will issue $208 million of notes. The credit characteristic of the collateral for GCAR 2017-1 are roughly similar to shoe of its previous transaction, completed in May 2016: the weighted average FICO is higher (556 vs 549), the weighted average LTV is slightly lower ( 119% vs 120%), and seasoning is unchanged, at six months. However, the initial credit enhancement on the AA rated senior notes is slightly higher (44.3% vs 44%).

United Auto is also in the market with $147 million of subprime auto bonds; the senior tranche, which benefits form 60.48% credit enhancement, is rated triple-A by S&P and DBRS. DBRS sees cumulative net losses reaching 20.75%, in its base-case scenario. Credit characteristics are similar to those of United Auto’s recent transactions, with a weighted average FICO of 577, weighted average remaining term of 38 months.

Dealer inventory financing

Ally is marketing two $250 million series of floorplan notes, one with a final maturity of July 2021 and the other with a final maturity of 2022. Moody’s expects to assign an Aaa rating to the senior notes of each series, which benefit from 25.25% credit enhancement.

In its presale report, Moody’s notes that monthly payment rates have been stable, and dealer defaults remain minimal despite a slowing operating environment. However, asset yield remains under pressure due to heightened competition. Absorption rates, or the percentage of overhead costs a dealer can cover from its servicing operations alone, a key metric in this sector, have also started to decline from the peak levels seen from 2012-2015.

Navistar Financial Corp. is also in the market with $250 million of floorplan notes. Fitch Ratings expects to assign an AAA rating to the senior tranche of notes to be issued by Navistar Financial Dealer Note Master Owner Trust II, Series 2017-01, which are backed by lines of credit that primarily finance inventories of trucks and buses. Fitch notes that absorption rates of the truck dealers in the collateral pool are at 90%, among the highest it has seen on this platform.

Equipment finance

A $750 million securitization of commercial fleet leases from Enterprise rounds out the week’s offerings. The senior term tranches of Enterprise Fleet Financing 2017-2 are rated by triple-A by both Fitch and S&P. The notes are supported by 8.65% credit enhancement, which includes an initial 1% cash reserve account; that’s in line with Enterprise’s prior securitizations, but below credit enhancement offered on comparable offerings from competitors such as ARI Global Fleet Management Services and Chesapeake Fleet Services.

m