-

The biggest U.S. banks reduced the portion of their collective balance sheets they’re dedicating to loans to a new low, extending a trend that’s seen the largest lenders put less and less of their firepower behind everyday borrowers.

February 8 -

The rise in sales comes as risk premiums for new transactions have tightened to pre-pandemic levels, marking a stark turnaround in a sector with heavy exposure to company bankruptcies caused by the lockdowns.

February 8 -

A consensual deal cuts legal costs and hastens a Chapter 11 exit, but plans block possible restructuring proposals that can curb cash payouts to lower-ranking creditors.

February 3 -

Environmental, social and governance issues topped the list of risk managers’ concerns in a Deloitte poll .

February 2 -

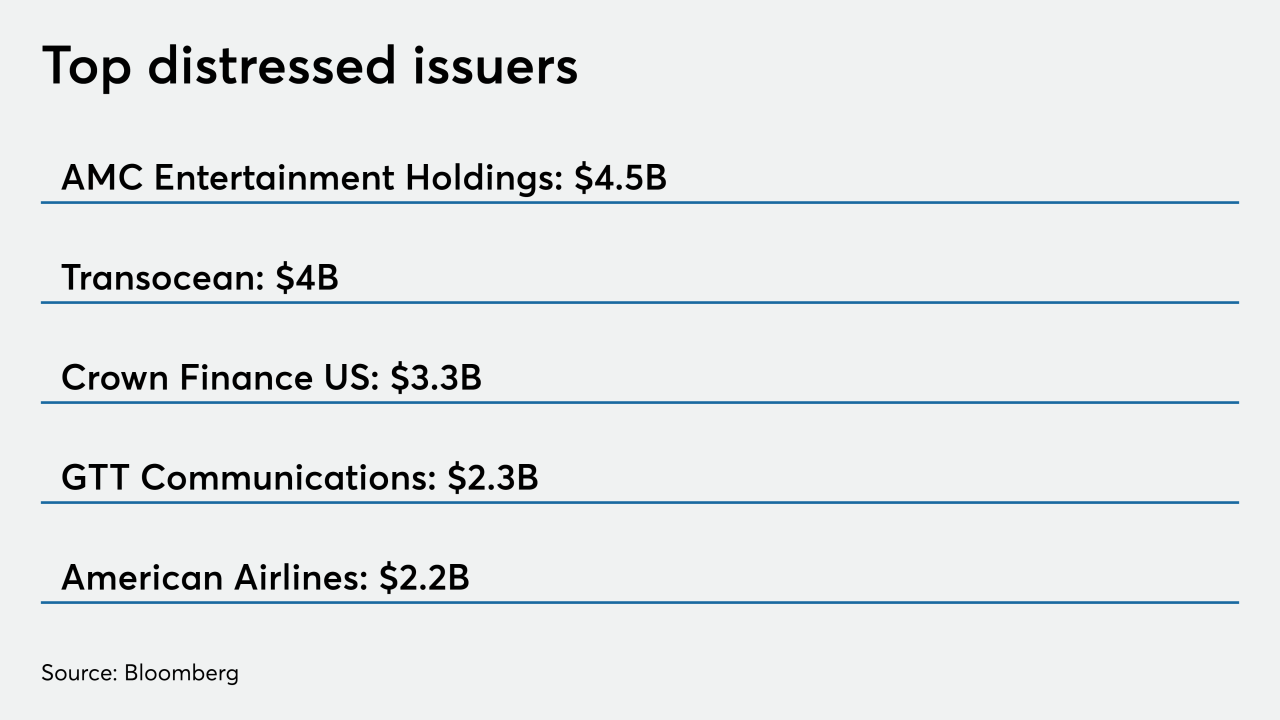

AMC and American Airlines took advantage of surprise stock-price surges to cash out shares and raise liquidity for possible debt reduction — a massive stroke of good fortune for the companies as well as their creditors.

February 1 -

The struggling movie-theater chain is among once-risky debt investments reaping big gains after day traders helped fuel the sudden stock surge.

January 29 -

Cheap funding costs have extended a lifeline to many troubled companies, slowing the pace of U.S. bankruptcy filings, but shops, offices and hotels have been particularly vulnerable to the pandemic this month.

January 27 -

About $16 billion across 43 deals in both new-issue and refinancing has prompted analysts into making early revisions to raise their initial volume forecasts.

January 26 -

The online lender is looking to price its second securitization deal of 2021, following last week's closing of a pass-through notes offering via its master trust.

January 25 -

Declining month-over-month delinquency levels and the rollout of COVID-19 vaccinations potentially give hope to more normalized economic activity.

January 20 -

The two deals will add to the pipeline of 2021 prime auto-lease transactions led earlier this month by Hyundai Capital America.

January 19 -

More may be on the horizon as lenders lose patience with defaulting property owners.

January 19 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.7-14

January 15 -

A slower-than-expected rollout of the COVID-19 vaccines and the threat of social unrest after the Jan. 6 riot at the U.S. Capitol could threaten the recovery, according to an American Bankers Association panel.

January 14 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

The notes offering is the largest among the 21 auto-lease deals HCA has issued since 2011, and the fourth that has topped $1 billion in offered notes.

January 11 -

Distressed debt funds on average gained 11.4%, according to Hedge Fund Research Inc., compared to the riskiest corporate bonds rising 2.3%.

January 11 -

Energy, retail and consumer services companies led a total of 244 filings, according to data compiled by Bloomberg.

January 5 -

Reports indicate distressed owners would rather surrender their hotel or retail properties instead of negotiate workouts on delinquent loans as the pandemic spread carries on.

January 4 -

Bausch, formerly Valeant Pharmaceuticals, has paid down more than $24 billion of the $32 billion in leverage it owed five years ago from a debt-driven acquisition spree — which ended after a drug-pricing scandal.

January 4