-

The two deals will add to the pipeline of 2021 prime auto-lease transactions led earlier this month by Hyundai Capital America.

January 19 -

More may be on the horizon as lenders lose patience with defaulting property owners.

January 19 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.7-14

January 15 -

A slower-than-expected rollout of the COVID-19 vaccines and the threat of social unrest after the Jan. 6 riot at the U.S. Capitol could threaten the recovery, according to an American Bankers Association panel.

January 14 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

The notes offering is the largest among the 21 auto-lease deals HCA has issued since 2011, and the fourth that has topped $1 billion in offered notes.

January 11 -

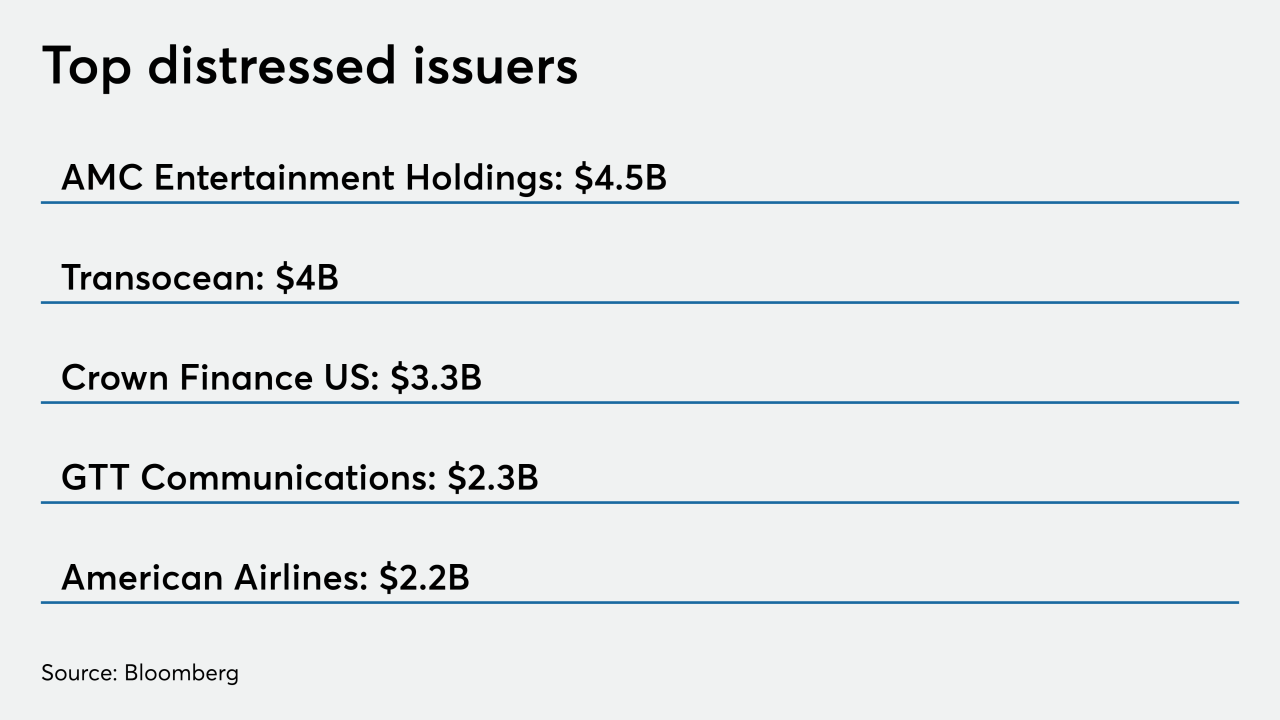

Distressed debt funds on average gained 11.4%, according to Hedge Fund Research Inc., compared to the riskiest corporate bonds rising 2.3%.

January 11 -

Energy, retail and consumer services companies led a total of 244 filings, according to data compiled by Bloomberg.

January 5 -

Reports indicate distressed owners would rather surrender their hotel or retail properties instead of negotiate workouts on delinquent loans as the pandemic spread carries on.

January 4 -

Bausch, formerly Valeant Pharmaceuticals, has paid down more than $24 billion of the $32 billion in leverage it owed five years ago from a debt-driven acquisition spree — which ended after a drug-pricing scandal.

January 4 -

The agency cited improving used-car prices that have elevated resale values of off-lease vehicles that drivers are turning back into dealerships.

December 31 -

The buyout industry has about $3 trillion of unrealized value on its books, according to Preqin. And it’s tapping that to land loans for bolt-on deals, to refinance debt or bail out struggling companies in their portfolios.

December 31 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 18-23

December 23 -

The legislation would let banks postpone the start date of the Current Expected Credit Losses accounting standard and delay categorizing pandemic-related loan modifications as troubled debt restructurings.

December 23 -

Bankruptcies reached levels not seen in a decade, distressed debt soared to almost $1 trillion and it may take years to repair the damage to airlines, restaurants and hotels. While 2020 may be over, the drama probably isn’t.

December 23 -

Win or lose, Citibank’s battle to recover half a billion dollars from an accidental payment is sure to prompt a review of internal controls in the industry and could have a lasting impact on the more than $1 trillion syndicated loan market.

December 21 -

The online lender, which raised $240 million, wants to take its artificial intelligence technology for evaluating borrowers to the next level and expand its partnerships with banks, its CEO says.

December 20 -

Investment firms and hedge funds are increasingly engineering bankruptcy loans and side deals to take control of Chapter 11 reorganizations from the outset, locking in rich rewards for themselves while potentially locking out rivals and lower-ranking creditors with little transparency. The trend is sure to speed up cases, but it also forces judges to make quick decisions that may shortchange some valid claims.

December 17 -

Promising vaccines may not reach the general public fast enough to save a number of struggling companies next year, and workout professionals and distressed investors are expecting smaller private companies will search for cash in 2021. They’re also anticipating that businesses of all sizes may struggle to adjust to changing consumer habits in a post-pandemic world.

December 16 -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

December 13