-

Lagging construction, rising interest rates and the broader economy don't really bode well for buyers of commercial real estate, but most CRE lenders still expect originations to increase in 2019, according to the Mortgage Bankers Association.

January 8 -

Most of the properties were previously securitized in various conduit transactions in 2014 and 2015; they are now being bundled into a single transaction that returns $107.7 million of equity to the sponsor.

January 7 -

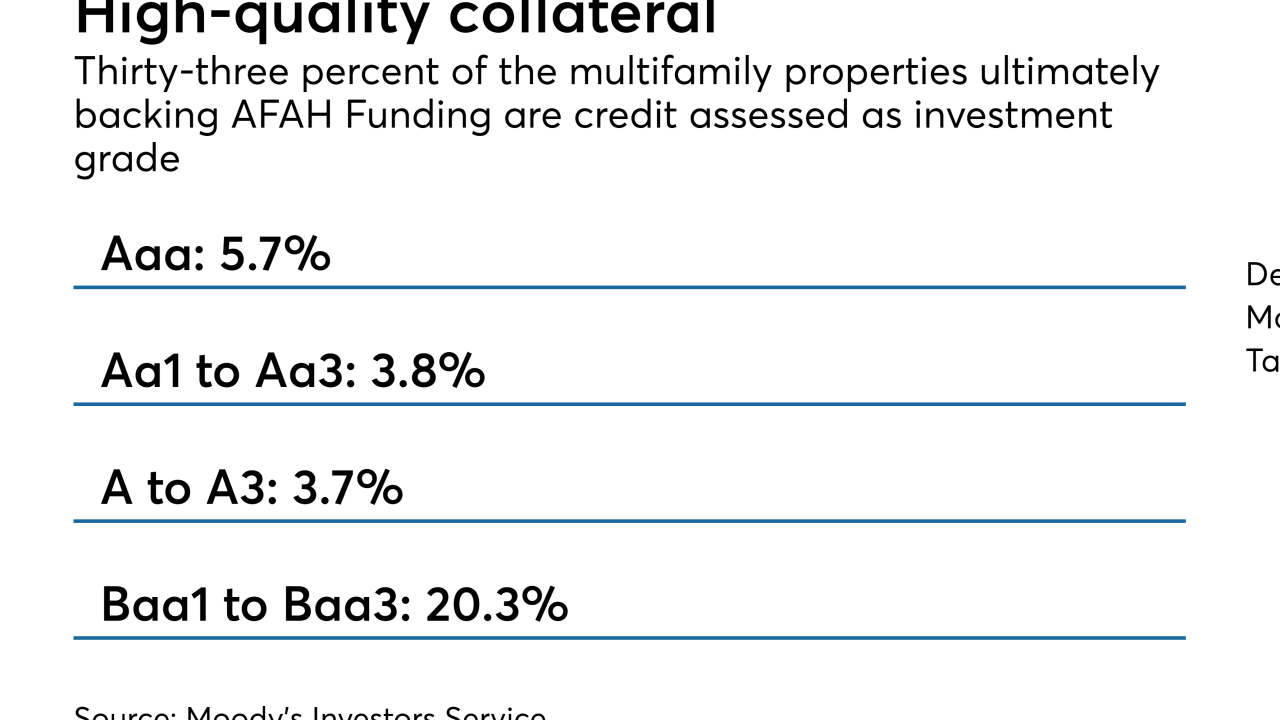

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

The Property Assessed Clean Energy sector is getting a boost from the expansion of improvements eligible to be financed via tax assessments, including fire resiliency and total building renovations, according to DBRS.

December 19 -

The buyers obtained a $597 million mortgage and $53 million of mezzanine financing from Deutsche Bank and Wells Fargo to purchase the JW Marriott Grande Lakes and Ritz-Carlton Grande Lakes.

December 13 -

Stricter energy regulations for European residential and commercial buildings, effective in 2020, will likely depress cash flow and property values, though the impact will vary by country, according to Moody's Investors Service.

December 12 -

Both the $646M UBS 2018-C15 and the $796M MSC 2018-H4 deals have relatively low leverage, helped by the inclusion of loans with investment grade characteristics.

December 11 -

BSREP International, an entity controlled by Brookfield, obtained a £367.5 million mortgage and £91.9 million of mezzanine debt on CityPoint from Morgan Stanley.

December 7 -

A joint venture between the REIT and two Chinese investors obtained a $364 million five-year, fixed-rate loan on the portfolio from Column Financial.

December 6 -

FORT CRE 2018-1 will include four loans recycled from the prior deal, including one that Kroll has identified as a loan of concern due to weak operating performance.

December 5