SITE Centers, a real estate investment trust, is tapping the commercial mortgage bond market to help finance the sale of a stake in 10 shopping malls located in nine different states.

SITE (until October known as DDR) previously owned 100% of the portfolio. On Nov. 29, it obtained a $364.3 million loan from Column Financial that is being bundled into collateral for mortgage bonds, according to Moody’s Investors Service.

When the loan closed, SITE sold an 80% joint venture interest in the portfolio two Chinese investors, China Life Insurance and China Merchants Group, a commercial bank, for $485.8 million.

Based on the portfolio’s appraised value of $620 million, the joint venture still has $255.7 million of equity in the properties.

So SITE now has $485.8 million in cash along with a 20% interest in a joint venture that has $255.7 million of equity in the portfolio.

The $364.3 million loan from Column has an initial term of 64 months (5.33 years) and pays a fixed rate 4.8% interest, and no principal, for its entire term. It is comprised of three promissory notes, two of which will be bundled into collateral for a transaction called CSMC 2018-SITE trust: a $170 million senior note A-1 and a $144.2 million junior note B. The remaining $50 million senior note A-2 is expected to be contributed to future securitizations.

CSMC 2018-SITE will issue even tranches of mortgage bonds; Moody’s expects to assign an Aaa to $136.69 million of Class A notes. The remaining tranches have ratings ranging from Aa1 (for the Class X certificates which pay only interest, and no principal) to B1 for the horizontal risk retention interest.

Among the strengths of the deal, according to Moody’s is the strong anchor tenancy of the shopping malls: All are either anchored or “shadow-anchored” by high-quality discount retailers and mass merchandisers such as TJX brands (T.J. Maxx, Marshalls, HomeGoods), AMC Theaters, Ross Dress for Less, Burlington, Cost Plus World Market, Target and Kohl’s.

Additionally, four properties (39.7% of NRA, 42.7% of Moody’s NCF) are anchored by traditional or specialty grocers.

Moody’s also takes comfort from the granular tenant roster: The portfolio’s rentable square footage is approximately 93.4% occupied by 200 national, regional, and local retailers. The top 10 tenants account for 46.9% of the aggregate net rentable area and 43.3% of in-place base rent.

Six of the top 10 tenants are assigned senior unsecured investment grade ratings and nine are publicly traded companies. No single tenant represents more than 7.6% of the aggregate NRA or 9.6% of the in-place base rent.

In addition, the portfolio has consistently maintained occupancy rates in excess of 94% between 2014 and the trailing 12 months ending July 2018, averaging 94.4%.

However, the portfolio occupancy as of September 2018 is below the historical average at 93.4% following the bankruptcy of Toys/Babies R Us, which occupied three spaces totaling 137,899 square feet, or 4% of net rentable area.

Rollover risk is also a concern. Leases representing 66.3% of net rentable area ans 66.8% of base rent expire before the end of 2023.

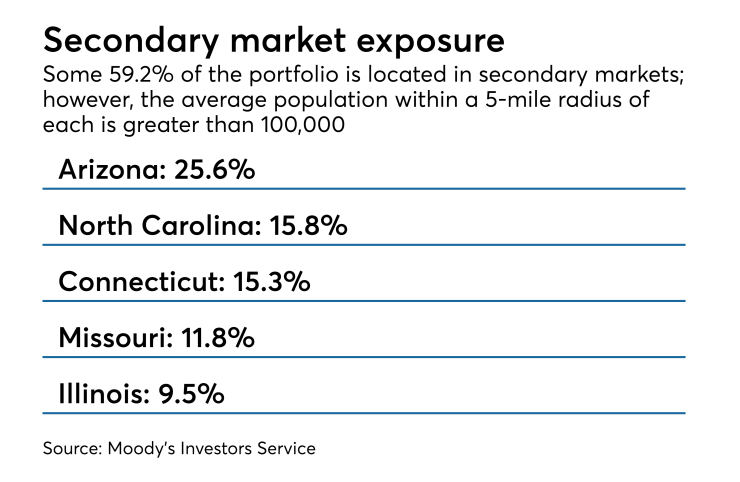

And approximately 59.2% of the portfolio’s allocated loan balance is located in secondary markets.

SITE’s portfolio as of September 30, 2018, totals 182 shopping centers, of which 78 are wholly owned with 104 owned in joint ventures, containing a total of 49.5 million square footage of owned gross rentable area.