-

The only change to the deal is a slightly smaller prefunding amount; one loan that had been expected to be acquired after settlement has already been closed.

January 24 -

It may not signal a recession, but structured finance pros are still preparing for a more risk-off environment.

January 16 -

Loans in commercial mortgage-backed securities originated after 2009 by nonbank lenders have a significantly higher default rate than those originated by banks, a Fitch Ratings report said.

January 14 -

The asset manager obtained a leasehold on floors 28-50 of 620 Eighth Avenue through its purchase of Forest City; the property is now encumbered by $750 million of loans from four banks.

January 8 -

Lagging construction, rising interest rates and the broader economy don't really bode well for buyers of commercial real estate, but most CRE lenders still expect originations to increase in 2019, according to the Mortgage Bankers Association.

January 8 -

Most of the properties were previously securitized in various conduit transactions in 2014 and 2015; they are now being bundled into a single transaction that returns $107.7 million of equity to the sponsor.

January 7 -

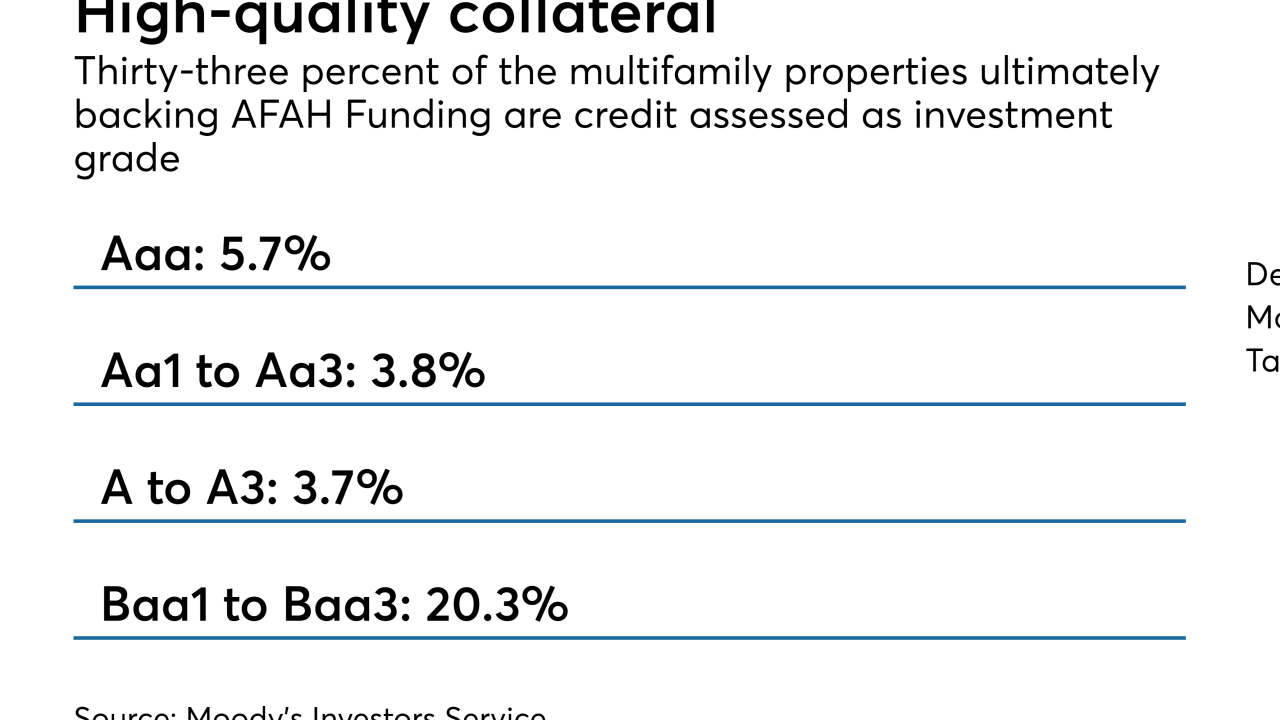

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

The Property Assessed Clean Energy sector is getting a boost from the expansion of improvements eligible to be financed via tax assessments, including fire resiliency and total building renovations, according to DBRS.

December 19 -

The buyers obtained a $597 million mortgage and $53 million of mezzanine financing from Deutsche Bank and Wells Fargo to purchase the JW Marriott Grande Lakes and Ritz-Carlton Grande Lakes.

December 13 -

Stricter energy regulations for European residential and commercial buildings, effective in 2020, will likely depress cash flow and property values, though the impact will vary by country, according to Moody's Investors Service.

December 12