Elliott Management and Trinity Real Estate Investment are tapping the commercial mortgage bond market to finance the acquisition of a pair of luxury hotels in Orlando, Florida, from the Blackstone Group.

The buyers recently obtained a $597 million first mortgage and $53 million of mezzanine financing from Deutsche Bank and Wells Fargo. Proceeds were used to purchase the JW Marriott Grande Lakes and the Ritz-Carlton Grande Lakes.

The first mortgage has an initial term of two years and can be extended by one year up to five times. It pays only interest, and no principal, for its entire extended term. It is being used as collateral for a mortgage bond offering called DBWF 2018-GLKS, according to Fitch Ratings.

The JW is a 998-room, full-service hotel and RC is a 582-room, full-service hotel. Fitch considers both to be A quality.

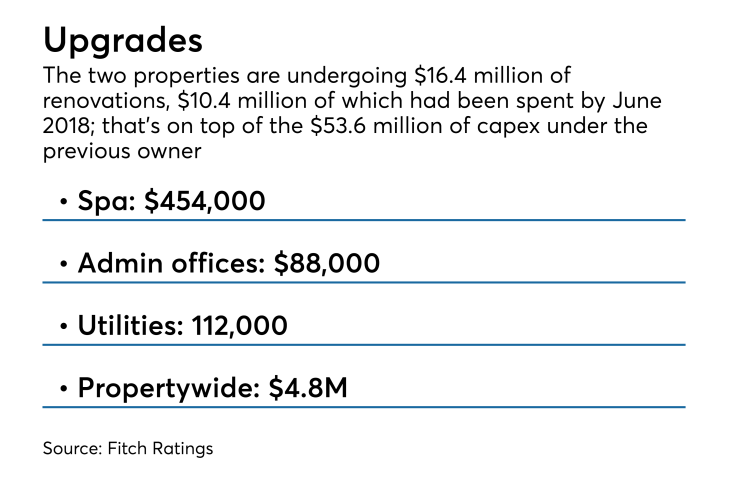

The seller, Blackstone, invested $53.6 million, or $33,946 per room, between June 2015 and June 2018.

The only known new development that could affect performance is the 516-room JW Marriott Bonnet Creek, which began construction in January 2018 and is expected to open in January 2020, and a 350-room Autograph Collection, which has been proposed for development as an expansion of the Swan and Dolphin resort complex and would open in 2021.

The properties are managed by Marriott under a contract that expires at the end of December 2020 and has five automatic, 10-year renewals. Under the terms of the loan, if the management contract with Marriott is terminated, the borrower must enter into a new agreement with a manager approved by the lender.