-

Minnwest Bank, which focuses largely on agriculture lending, said it will “become more sophisticated" with its mortgage and consumer lending services by acquiring Roundbank.

By Jim DobbsAugust 16 -

The Arkansas bank has hired an 11-member team to develop its new operation. Much of the team joins from TCF Financial, which was sold to Huntington Bancshares in June.

By Jim DobbsAugust 10 -

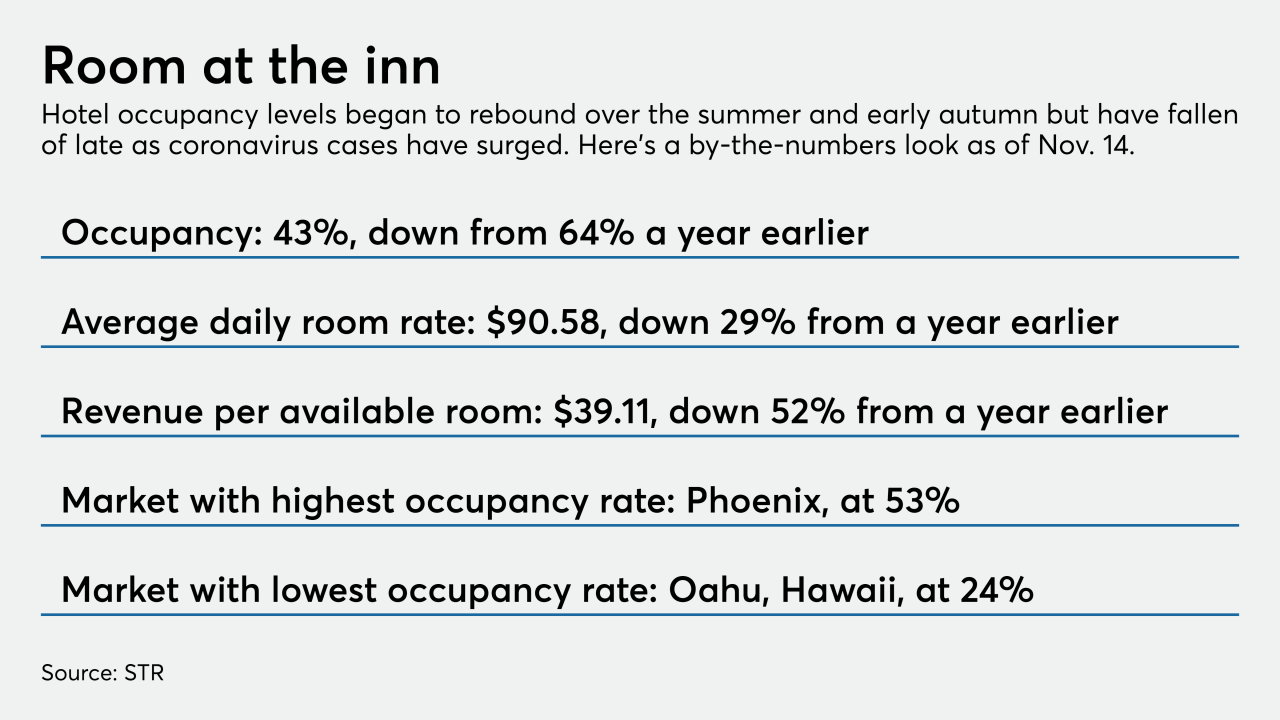

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

By Jim DobbsJuly 19 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

By Jim DobbsApril 30 -

Hildene Capital, which is pressuring CIB Marine to issue subordinated debt to redeem preferred stock, has nominated two individuals to stand for election to the company's board.

By Jim DobbsFebruary 24 -

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

By Jim DobbsNovember 23 -

Commercial real estate loans are vulnerable as financial assistance for tenants winds down and might not be fully renewed. Late rent payments could rise, leading lenders to press landlords to pay up.

By Jim DobbsSeptember 23 -

More consumer and commercial borrowers are paying their loans, increasing the likelihood that charge-offs will be manageable for banks despite the ongoing pandemic.

By Jim DobbsSeptember 11 -

Community bank earnings are usually easy to understand, but loan deferrals and modifications as well as the complexities of the Paycheck Protection Program are skewing financial statements.

By Jim DobbsAugust 4 -

Bankers had asserted in April that they could handle a slump in oil prices tied to the coronavirus pandemic. Continued volatility, combined with declining collateral values and a rise in bankruptcies for exploration companies, is denting their confidence.

By Jim DobbsJuly 13 -

As revenue-starved retailers fall further behind on rent payments, landlords' cash flow will be strained, and defaults on commercial real estate loans could rise.

By Kate BerryJune 10 -

Banks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.

By Jim DobbsMay 11 -

Lenders that scrambled to grant forbearance as the coronavirus pandemic took hold are unsure about the extent of potential losses.

By Jim DobbsMay 7 -

By helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.

By Jim DobbsApril 13 -

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

By Jim DobbsMarch 30 -

Compliance, risk management and staffing will likely come under added scrutiny as regulators lay out a framework for future fintech-bank mergers.

By Jim DobbsMarch 5 -

Regulators are alarmed about banks' rising exposure to high-risk corporate credits and want more data on how they would perform in a recession.

By Jim DobbsFebruary 11 -

Mortgages, auto loans and credit cards should perform well for the next two quarters. Beyond that, all bets are off.

By Jim DobbsJanuary 31 -

Though details of a potential pact with China aren't clear, bankers are hoping it could convince leery customers to finally go through with delayed investments.

By Jim DobbsDecember 13