-

A solid majority of decision-makers at these companies expect to expand their workforces again this year, a Citizens Financial survey found. Loan losses are normally low in eras of economic expansion.

By Jim DobbsApril 9 -

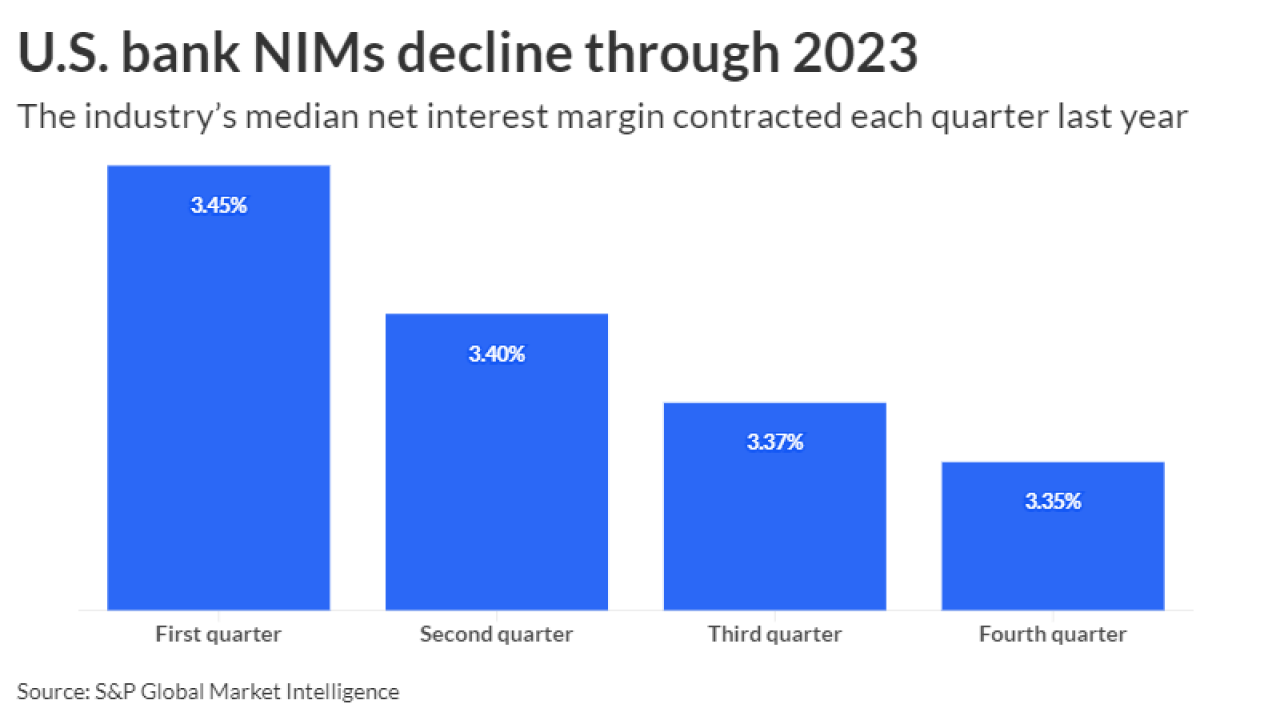

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

By Jim DobbsApril 2 -

First National has agreed to buy Touchstone Bankshares. The combined company would have more than $500 million each of deposits and loans.

By Jim DobbsMarch 26 -

Bank mergers and acquisitions have slowed in recent years amid recession fears and other economic uncertainties. But bank consolidation is a century-old trend that's expected to rev up again as early as this year due to higher costs, tougher regulation and fierce competition.

By Jim DobbsMarch 15 -

The USDA forecasted farm profits will plunge 26% this year, potentially creating credit quality challenges for lenders.

By Jim DobbsFebruary 23 -

The deal involving Southern California Bancorp and California BanCorp, expected to close in the third quarter, would form a $4.6 billion-asset lender with a footprint spanning San Diego, Greater Los Angeles and the San Francisco Bay Area.

By Jim DobbsJanuary 30 -

As part of a settlement with the Justice Department, Patriot Bank must invest more than $1 million of the total in a loan subsidy fund for minority homeowners and take other corrective steps in its everyday business. The bank denied any wrongdoing.

By Jim DobbsJanuary 17 -

Funding pressures moderated in recent months, but loan charge-offs climbed. With festering concerns about a vulnerable economy, the potential for elevated credits costs could loom large over the upcoming bank earnings season.

By Jim DobbsDecember 21 -

The lawsuit accuses Navy Federal of violating the Fair Housing Act and the Equal Credit Opportunity Act after a CNN report that the lender approved a lower percentage of Black and Latino mortgage applicants.

By Jim DobbsDecember 18 -

The Pittsburgh-based regional bank expects to save $325 million next year as it reduces its staff by 4%. Executives said the cuts are necessary because revenue has fallen amid a surge in interest rates and a decline in loan volumes.

By Jim DobbsOctober 13 -

The American Bankers Association's Economic Advisory Committee said access to loans is likely to further soften, while defaults and credit losses could increase in the second half of the year.

By Jim DobbsJune 20 -

The beleaguered bank said it is selling 74 loans totaling about $2.6 billion to a subsidiary of Kennedy-Wilson Holdings. The move is part of a plan to pursue strategic asset sales, trim expenses and shore up its balance sheet.

By Jim DobbsMay 24 -

Community banks tapped the brakes during the first quarter, citing higher interest rates, recession threats and fallout from regional-bank failures. Fed data shows the trend has continued into May, and executives are preaching caution.

By Jim DobbsMay 17 -

The Tennessee bank confirmed in its earnings report that the deal, already delayed by several months amid heightened regulatory scrutiny, likely would not close by a May 27 deadline. No new target date has been set.

By Jim DobbsApril 18 -

The American Bankers Association's latest Credit Conditions Index points to a drop in lending and a rise in loan delinquencies through the second and third quarters.

By Jim DobbsApril 11 -

The two banks are now targeting May 27, three months later than their previous goal. The transaction, which would create a top-six U.S. bank by asset size, was originally expected to be completed last fall.

By Jim DobbsFebruary 10 -

Indexes show heightened expectations for a recession and souring loans. But executives are upbeat about middle-market businesses and overall job growth.

By Jim DobbsJanuary 30 -

Members of the American Bankers Association's Economic Advisory Committee expect gross domestic product to stall in 2023. Other surveys show a modest contraction. Lenders say sentiment among their borrowers also points to a slight slowdown.

By Jim DobbsJanuary 24 -

The Pittsburgh bank posted a solid profit and said that it expects continued loan growth. But the pace of business expansion could slow alongside an economic downturn.

By Jim DobbsJanuary 18 -

Dicier credit conditions, recession fears and tougher regulatory scrutiny combined to weaken merger activity in 2022. A push for scale is bound to resume when interest rates level off — at least among smaller banks, analysts say.

By Jim DobbsDecember 19