-

Trucks and SUVs make up 84.7% of the collateral for $1.58 billion Ford Credit Auto Owner Trust 2018-A, reflecting consumer declining demand for passenger vehicles.

By Glen FestMay 14 -

The London interbank offered rate has its faults, but at least it compensates for counterparty risk; not so the benchmark being touted as a replacement.

By Glen FestMay 14 -

The credit characteristics of borrowers are similar to those of the insurer's previous transaction in March, with a weighted average FICO of 777, income of $243,738 and liquid reserves of $236,904.

By Glen FestMay 10 -

The Dallas-based lender, a unit of the global banking giant Banco Santander, was able to lower credit enhancement on the senior notes to 63.55% from 65.25% on the previous deal in February.

By Glen FestMay 10 -

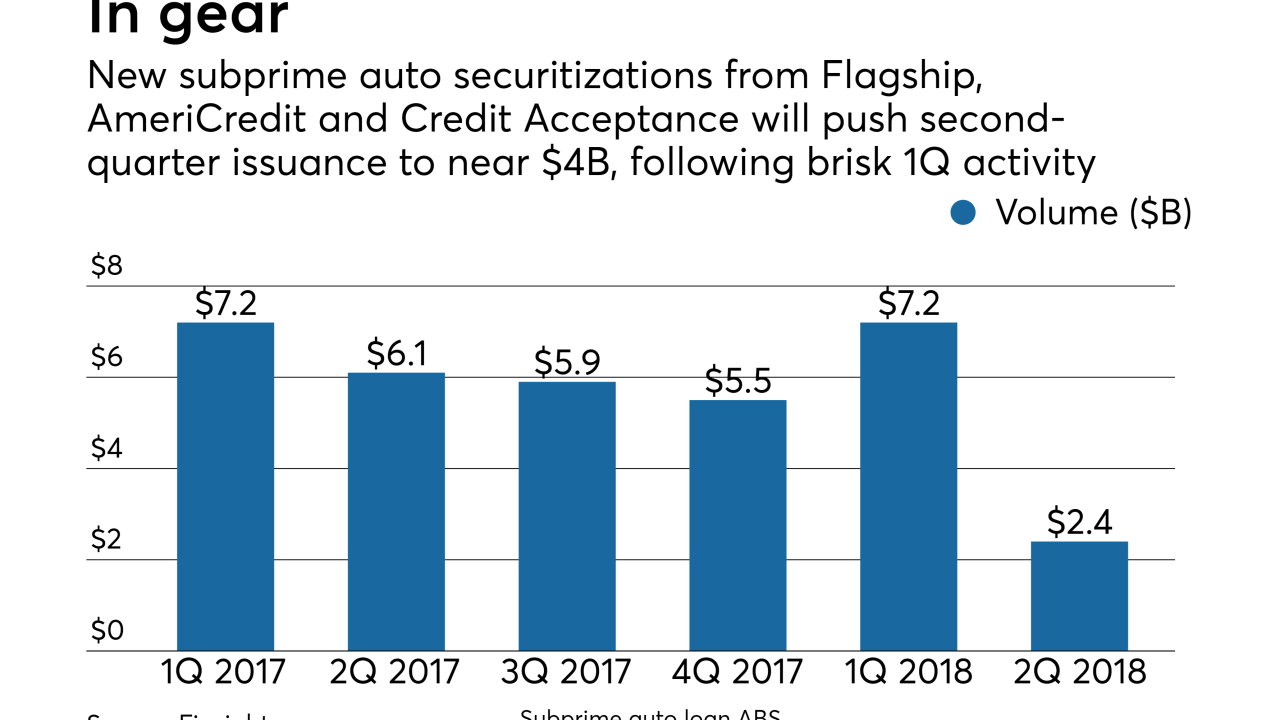

AmeriCredit returns to securitization for the first time since November with a $1.1 billion deal, while Flagship's $223 million deal, its second of 2018, takes a step back in collateral quality.

By Glen FestMay 9 -

The senior tranche of Credit Acceptance Auto Loan Trust 2018-2 benefits from initial credit enhancement of 51.61%, up from 49.93% in a February deal; it comes from additional subordination.

By Glen FestMay 9 -

The average AAA note coupon of 103 basis points above Libor widened from 98.4 in March, which had been the tightest CLO spread level in approximately five years.

By Glen FestMay 8 -

The deal provides inventory financing for 279 Daimler AG-affiliated dealers from a pool of more than $3 billion in receivables.

By Glen FestMay 7 -

While DBRS maintained a rating of AA for the Lendmark Financial's first ABS of 2018, S&P issued an A rating after estimating higher net losses on the underlying subprime accounts.

By Glen FestMay 4 -

Toyota Motor Credit $1.25B deal is its second captive-finance receivables securitization of 2018, with an upsizing option to $1.6 billiion.

By Glen FestMay 4 -

“We’re comforted by the fact our position in the market is so strong, and our ability to gain [loan] allocation is quite important," co-CEO Kewsong Lee says.

By Glen FestMay 2 -

The €300 million Taurus 2018-1 also finances Italian retail assets that the Partners Group, based in Switzerland, purchased from the Blackstone Group in February.

By Glen FestApril 30 -

The former Kirkland & Ellis partner will remain in Chicago, where he has performed work for clients in automotive finance, technology, banking and marketplace lending.

By Glen FestApril 30 -

The ICE Benchmark Administration is changing how banks submit interbank interest-rate quotes used to derive daily Libor rates.

By Glen FestApril 26 -

Nineteen of the aircraft collateralizing MAPS 2018-1 were previously securitized in a 2013 Merx-sponsored deal dubbed AABS Ltd.

By Glen FestApril 24 -

All four tranches mature in five years, matching with revolving period for the rotation of new autos and trucks in the rental fleets.

By Glen FestApril 23 -

The notes are being issued from a a master trust collateralized by over $1.4 billion in corporate leases originated and serviced by Donlen Corp., which Hertz acquired in 2011.

By Glen FestApril 19 -

Nearly four in five expect spreads to widen this summer, which is not good news for spec-grade U.S. companies that binged on borrowing levels over the last two years.

By Glen FestApril 19 -

After the second-busiest quarter for primary European CLO issuance to start 2018, a two-week April lull in the market was ended with deal pricings by Intermediate Capital and Investcorp.

By Glen FestApril 16 -

Jay Huang, a longtime Citigroup veteran who joined in January, is developing a high-tech trading-desk operation to enhance the company's portfolio of CLO investments.

By Glen FestApril 16