-

Westlake increased the size of all eight classes of notes by at least 37% as investor demand surges for subprime ABS paper

By Glen FestAugust 13 -

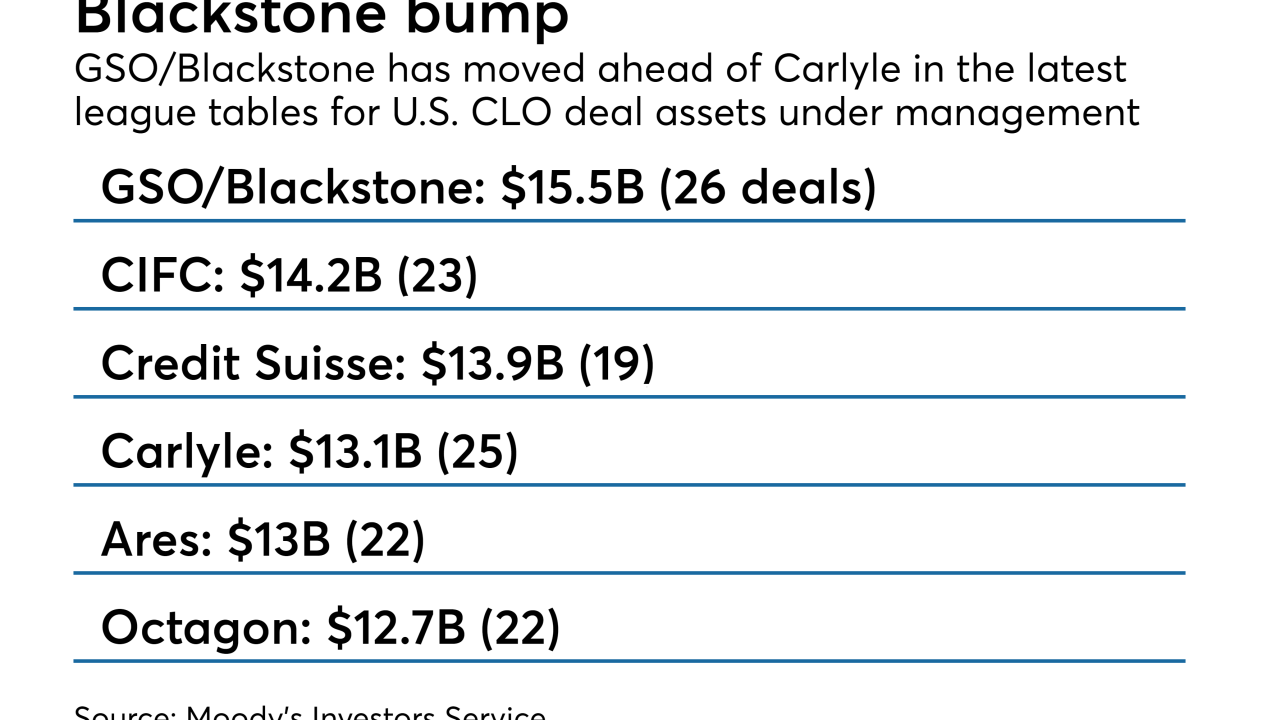

The distressed-debt manager now manages 26 U.S. CLOs totaling $15.5 billion, the most of any domestic CLO market manager.

By Glen FestAugust 13 -

The £325 million Dryden 63 CLO, sponsored by PGIM, will issue six classes of sterling-denominated notes; Barclays’ £4.5 billion Sirius Funding is issuing three tranches in three different currencies.

By Glen FestAugust 6 -

The Series 2018-3 consists of five tranches of fixed-rate, two-year notes and the Series 2018-4 consists of five tranches of floating-rate, three-year notes.

By Glen FestAugust 3 -

Loans backing the $1.2 billion AmeriCredit Automobile Receivables Trust 2018-2 have the highest weighted average FICO score in the history of the platform.

By Glen FestAugust 2 -

While Carlyle has been judicious with new issuance, it had a busier second quarter in refinancing older deals; several more will be ripe for refinancing in the third quarter.

By Glen FestAugust 2 -

The $259.1M transaction amortizes features a lower-than-average annual amortization (7.2%) and a longer-than-usual weighted-average list test, and a hiigh concentration of dry containers.

By Glen FestJuly 30 -

"Administrative" issues from a merger of servicing centers had caused a spike in its 2017 corporate auto-fleet lease delinquencies. But the Toronto fleet manager's late-payment problems have subsided this year.

By Glen FestJuly 30 -

Towd Point Mortgage Funding 2018 Auburn 12 Plc is backed by 2,913 properties, all of which were previously securitized in the sponsor’s 2015-vintage Auburn Securities 9 portfolio.

By Glen FestJuly 29 -

Recent documentation tweaks that afford "excessive amounts of flexibility" to CLO managers can introduce "material, and even unquantifiable, risks" into transactions, according to the rating agency.

By Glen FestJuly 27 -

The credit quality of the initial collateral pool is similar to that of United Auto Credit Corp.'s previous transaction, but the performance of the lender's managed portfolio of subprime loans is improving.

By Glen FestJuly 26 -

Should cash flow for subordinate classes fall short, a debt-service coverage ratio trigger would defer interest payments and prevent a default event.

By Glen FestJuly 24 -

The Chicago-based corporate small-business lender and CLO management firm also reduced the cost in subordinate notes as it chose to maintain the existing reinvestment and maturity periods limiting the deal's shelf life.

By Glen FestJuly 24 -

It's the Canadian bank's second deal of the year aimed at U.S. investors and adds to what has been a slow pace of credit card issuance this year. Two subordinate Canadian dollar tranches will be retained.

By Glen FestJuly 23 -

The triple-A rated senior tranche of Ares European CLO X has a coupon of 85 basis points above Euribor, an indication that a four-month widening trend in Europe CLO spreads continues; the deal is expected to close in September.

By Glen FestJuly 23 -

The New York State Supreme Court has ruled that Sound Point is within its rights to enforce a 90-day noncompete agreement with a manager who joined GoldenTree two weeks after his resignation.

By Glen FestJuly 22 -

The $300 million issue is secured by receivables from inventory financing for 160 Volvo- and Mack-branded trucking and construction equipment dealers.

By Glen FestJuly 19 -

The $455 million in bonds issued by the company just two months ago have sold off sharply, according to Kroll Bond Rating Agency, which is trying to reassure investors.

By Glen FestJuly 19 -

Concerns over widening spreads in global credit portfolios are at a peak level in the post-crisis era, according to a quarterly survey of global credit-portfolio managers.

By Glen FestJuly 19 -

Credit metrics for the $799.9 million deal are better, by some measures, but rating agencies are concerned that delinquencies in the $10.2 billion managed portfolio are slightly higher, year-on-year.

By Glen FestJuly 19