TD Bank is marketing its second offering of the year of notes secured by credit-card receivables, undeterred by headwinds that have slowed issuance across the bank-card sector in 2018.

According to Fitch Ratings, Evergreen Credit Card Trust Series 2018-2 will include a U.S. dollar $500 million Class A notes tranche with an expected AAA rating. The trust will also issue two subordinate classes in Canadian dollars (size to be determined), which will be retained by TD Bank itself.

The receivables will be from a pool of 4.7 million accounts expected to total CAD$8.36 billion (US$6.35 billion), providing monthly payments to the Class A notes and semiannual to the subordinate notes.

This is the sixth securitization out of the Evergreen trust since TD Bank launched the platform in 2016. The March 2018 Evergreen 2018-1 series was affixed with a fixed 2.95% coupon benchmarked to swaps.

Credit enhancement for the two-year Class A notes consists of 4% subordination and excess spread estimated at 2.5%. They will receive monthly interest payments, while the unrated B and C notes (which are also expected to mature in July 2020) are entitled only to semiannual interest payments beginning next year.

Fitch says TD Bank’s ABS collateral performance compares well with its various industry indexes, including “historically strong” levels in chargeoffs and 60-plus-day delinquencies, consistent monthly payment rates from borrowers and “robust” gross yield in the managed portfolio. The portfolio had only a 0.53% 90-plus-day delinquency level, net losses of 2.19% and an average revenue yield of 22.66%, as of April 30, according to Fitch.

TD Bank’s first issuance of the year in March had a Class A notes upsizing to $600 million from a proposed $400 million.

TD Bank sponsored only one transaction from the Evergreen Trust in 2017, following the debut of the platform in 2016 with three separate issues totaling $2 billion. The initial transactions were all floating rate tied to one-month U.S. dollar Libor.

TD Bank’s card issuance is the third this month, following American Express’ pricing of $1.7 billion in fixed- and variable-rate notes on July 16 and Barclays’ $640 million U.S.-dollar notes issue through its Gracechurch Card Programme Funding Plc (Gracechurch collateral is secured by pound-sterling receivables from Visa cards originated or acquired in the U.K. by Barclaycard).

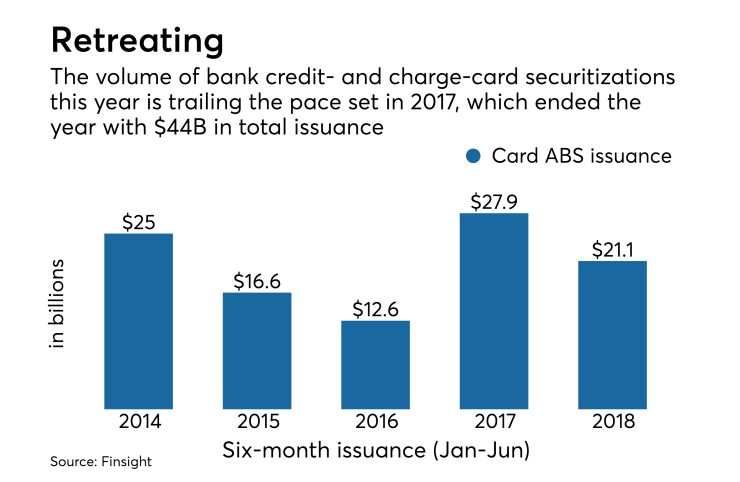

Through Monday, issuance of bank-sponsored credit and charge cards totaled $21.05 billion, some $6.4 billion short of the $27.9 billion volume through the same period a year ago. That narrows the gap from $9 billion at the end of last month, when S&P cited interest-rate hikes that were increasing the cost of funds for issuers.

Although higher rates have increased absolute yield for investors, S&P said spreads have tightened as a result of higher credit costs and expenses, including rewards programs.

The six largest bank issuers’ trusts had a first-quarter yield of 19.3%.

While the higher rates may discouraging banks from tapping the securitization market, borrowers are on a binge, according to Federal Reserve data. The Fed reported a $14 billion increase in nonmortgage household debt to a record high $3.84 trillion in the first quarter, as consumers benefit from wage growth due to GDP growth, low unemployment and tax reform.

Despite the caution, only 10% of lenders indicated they are tightening underwriting, according to the Fed’s latest quarterly senior loan officer opinion survey, issued in April.

But many are raising loss reserves. According to S&P, managed pool reserves grew 14% year over year, outpacing the 6.3% year-over-year growth in managed portfolio receivables through the first quarter.