-

More than 88% of contracts in the $800 million transaction have terms of less than 40 months; Fitch points to the increased the use of subvention at Toyota dealerships.

By Glen FestSeptember 5 -

Brass No. 7 is Accord's ninth overall securitization of prime mortgages for owner-occupied homes and the second to feature a revolving period.

By Glen FestSeptember 5 -

Collateralized loan obligations denominated in pounds sterling were once a tough sell; two recent deals from Barclays and PGIM indicate that this is changing.

By Glen FestSeptember 4 -

The credit arm of the $24 billion asset H.I.G. Capital is marketing a $458.1 million BSL CLO, its first deal since April 2015.

By Glen FestAugust 31 -

Only 9.6% of €1.08 billion of collateral meets the criteria for responsible lending and borrowing set by the National Institute for Family Finance in the Netherlands, down from 22.9% for the prior deal.

By Glen FestAugust 30 -

The $408.4M Anchorage Capital CLO 2018-10 adds to the $5.2B-asset manager's 2018 tally of three re-issues and a refinancing — not to mention a debut European CLO.

By Glen FestAugust 29 -

The percentage of CCC "buckets" in CLOs increased in the second quarter and they are now at levels similar to 2016, when managers struggled with concentrations of troubled energy-sector assets.

By Glen FestAugust 28 -

The first two transactions were initiated in March, just a few days before skin-in-the-game rules were lifted for this asset class; this time, the CLO manager is not exactly sticking its neck out.

By Glen FestAugust 28 -

S&P says extended term loans and "liberal" collection policies are pushing losses and amortization toward the tail end of some lenders' securitizations — making cross-comparing performance between lenders and an issuer's own outstanding vintage deals more difficult.

By Glen FestAugust 26 -

DFG Investment Advisers, led by former Goldman and HVB Group veterans, will exceed $4.2B in CLO assets under management with the latest deal.

By Glen FestAugust 26 -

Santander has commonly offered multicurrency (dollar and pound-sterling) notes through its Holmes master trust platform.

By Glen FestAugust 23 -

Volkswagen Bank's Driver 15 is its first German auto-loan securitization since March, as Europe's largest auto-finance company furthers a comeback from the 2015 VW diesel-engine scandal.

By Glen FestAugust 23 -

The $502 million Diamond CLO represents the first securitization of small/medium enterprise loans since Blackstone in the second quarter relaunched a direct lending business.

By Glen FestAugust 21 -

SUVs account for 41.3% of receivables backing HAROT 2018-3; that's up from 37.9% of Honda's prior deal and the first time exposure has increased since early 2017.

By Glen FestAugust 18 -

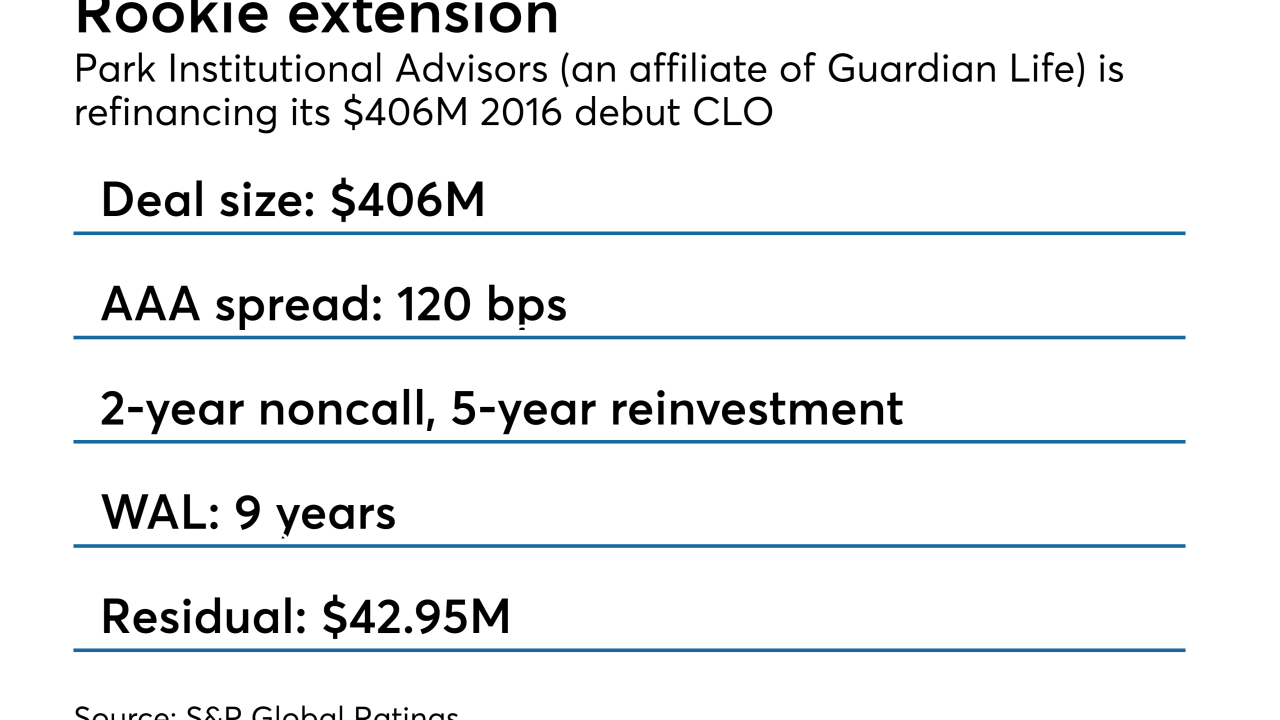

Once refinanced, the $406 million Park Avenue Institutional Advisors CLO 2016-1 will be non-callable for two years and can be actively managed for up to five years.

By Glen FestAugust 17 -

The $449.2 million Carlyle Direct Lending CLO 2015-1R is the 11th deal the global alternative asset manager has refinanced this year.

By Glen FestAugust 16 -

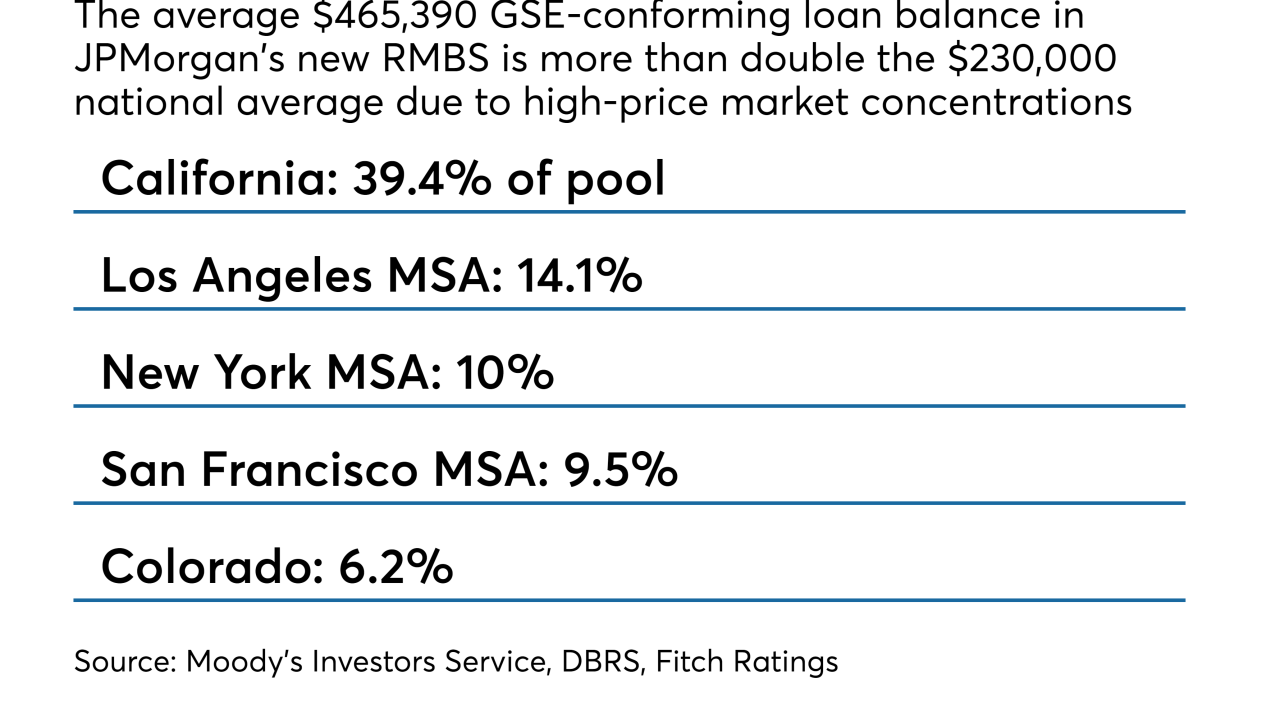

Nearly half the loans were derived outside J.P. Morgan's retail channel, a level not seen in its conforming and prime jumbo securitizations since 2017.

By Glen FestAugust 15 -

Execs at both closed-end funds say expectations for an eventual rise in defaults are driving their strategy to extend reinvestment periods on CLOs in their portfolios.

By Glen FestAugust 15 -

The single-loan securitization is through Morgan Stanley on suburban properties mostly concentrated in the Washington, D.C., area.

By Glen FestAugust 14 -

TPG Capital is including its newly acquired first-lien interest in a Microsoft-leased office campus in Redmond, Wash., in a portfolio of suburban office properties it is financing through a new two-year commercial loan.

By Glen FestAugust 13