-

The $320.1 million Homeward Opportunities Fund 1 Trust 2018-2 features fewer loans that rely on alternative ways to document borrower income, but borrowers have higher debt-to-income ratios and lower FICOs.

By Glen FestDecember 13 -

Stricter energy regulations for European residential and commercial buildings, effective in 2020, will likely depress cash flow and property values, though the impact will vary by country, according to Moody's Investors Service.

By Glen FestDecember 12 -

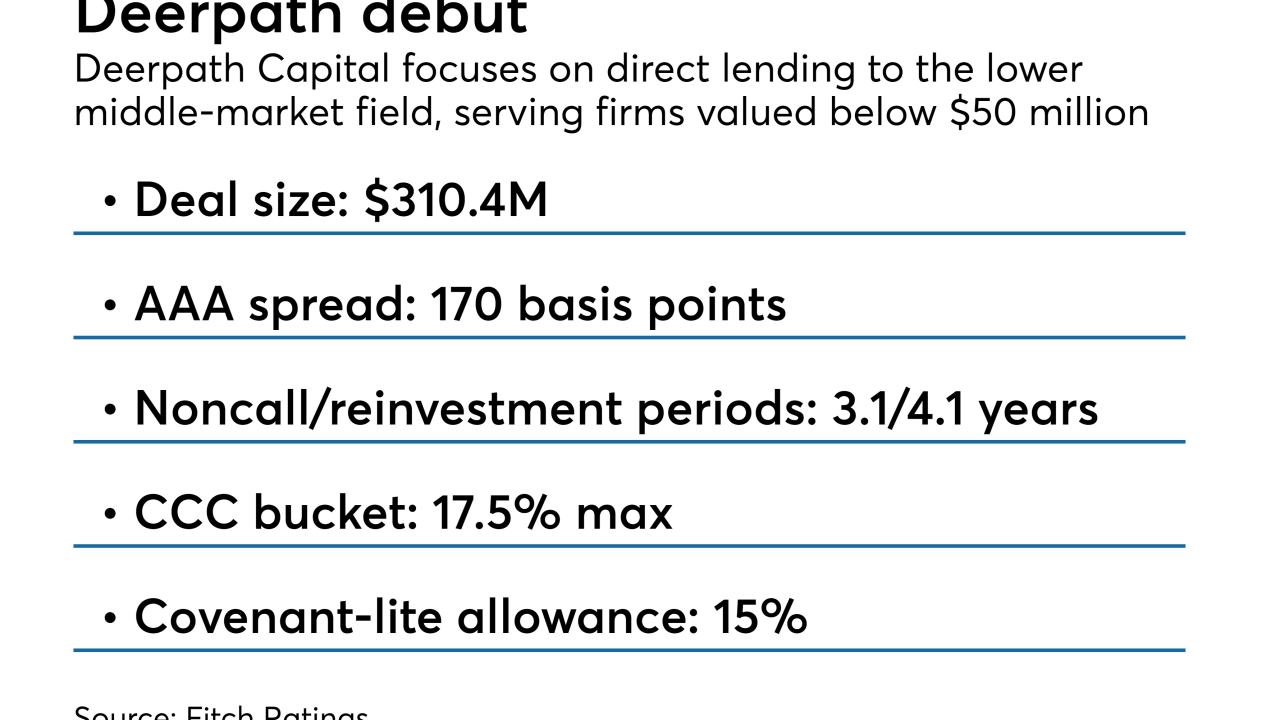

The $308 million Deepath CLO 2018-1 has an unusually large allowance for riskier triple-C loans of up to 17.5% of the portfolio.

By Glen FestDecember 11 -

The transaction has a senior-note tranche with a double-A rating from DBRs, and is being arranged by Banco Santander.

By Glen FestDecember 10 -

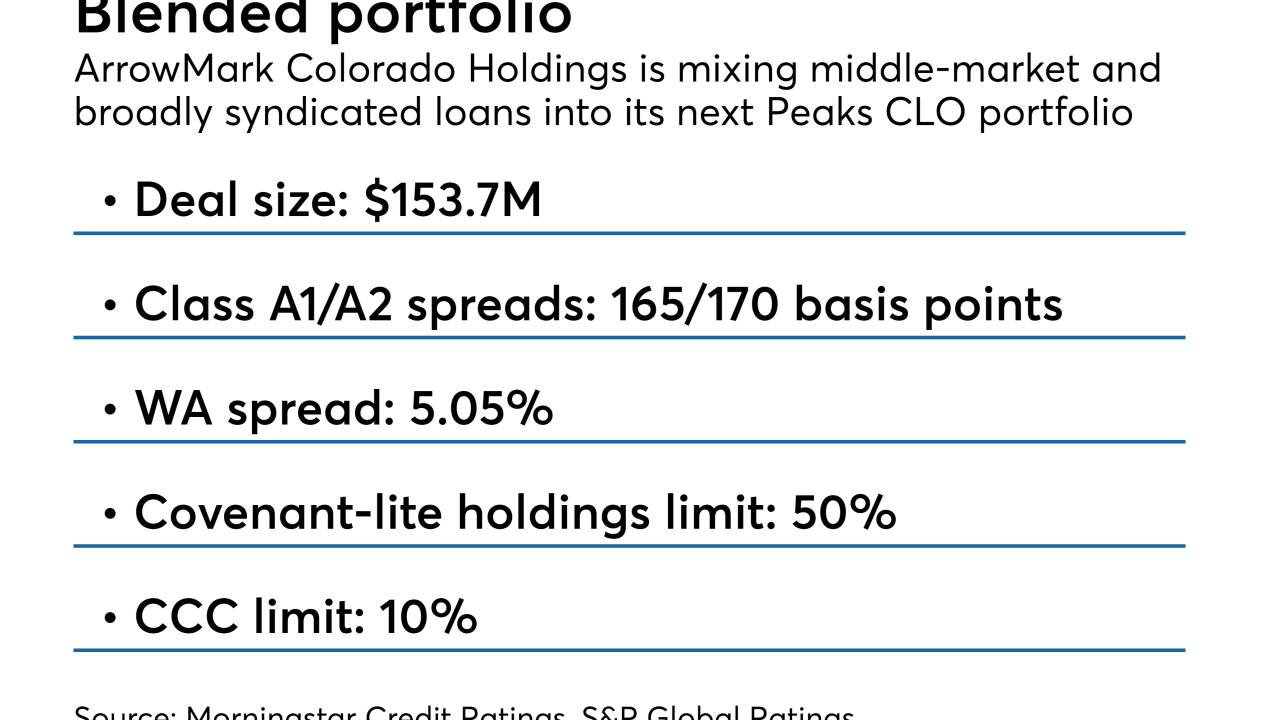

The $153.7 million Peaks CLO 3 also features a high ceiling for triple-C-rated loans and for "current-pay" loans that meet one or more criteria for default.

By Glen FestDecember 10 -

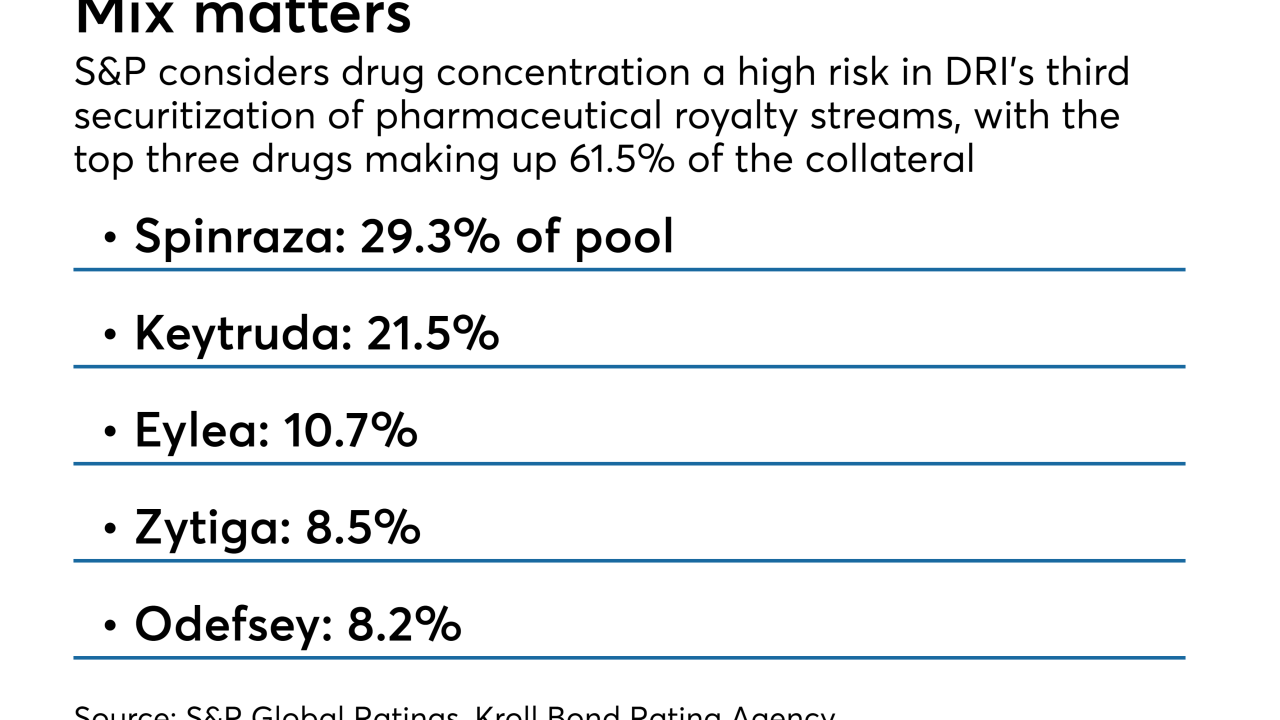

The bonds will be collateralized by payments from 15 royalty streams on 14 patent-protected drugs and technologies and will rank pari passu with securities issued from the same master trust in 2017.

By Glen FestNovember 28 -

A $55 million whole loan for the Dream Inn hotel in Santa Cruz, Calif., is the largest of 44 loans backing the $891.8 million transaction, called BBCMS Mortgage Trust 2018-C2.

By Glen FestNovember 27 -

Both managers are pricing their 3rd CLOs of 2018; the 135 basis point spread on Zais' is among the widest this year for a deal backed by broadly syndicated loans.

By Glen FestNovember 27 -

The transaction, Quarzo S.r.l. – Series 2018, is backed by 104,640 accounts with an average outstanding balance of €8,600 and an average interest rate of 9.1%. The loans have original average terms of 61.9 months, with 4.8 months of seasoning.

By Glen FestNovember 26 -

JPMorgan is securitizing a $180 million, two-year commercial mortgage backed by a leasehold interest on the 24-story building in a single-asset transaction.

By Glen FestNovember 26 -

The pool includes loans for 23 new construction, converted or acquired assets, each in a pre-stabilization phase awaiting refinancing through a permanent agency takeout loan.

By Glen FestNovember 21 -

Guggenheim joins GSO/Blackstone and Bain Capital as longtime CLO managers expanding into the SME space this year.

By Glen FestNovember 21 -

More collateralized loan obligations are failing weighted-average lift tests due to the dearth of available loans whose near-term maturities could provide some relief to portfolios.

By Glen FestNovember 20 -

Commercial aircraft are considered end-of-life after 18 years, but older passenger planes are often converted to freighter cargo. Nearly 4% of the planes in Vx’s collateral pool exceed 30 years of age, according to Kroll.

By Glen FestNovember 20 -

The $345 million COLT 2018-4 Mortgage Loan Trust has a 42% concentration of loans from the lender’s highest credit tier of high net incomes and high-cost housing within a recently launched “elite access” class of borrowers.

By Glen FestNovember 19 -

Kroll assigned an AA+ to the Class A-1 tranche of EJF’s $351 million TruPS transaction, up two notches from AA- on the sponsor's prior transaction.

By Glen FestNovember 16 -

American Honda Finance's fourth auto-loan securitization of the year also features borrowers with higher scores and larger loans.

By Glen FestNovember 16 -

Eagle Point's CEO criticized "hyperbole" about growing risks in leveraged loans and CLOs, noting the benefits that price volatility can present to equity buyers.

By Glen FestNovember 15 -

NIBC's €476.2 million transaction has comparable credit quality to recent deals in the Netherlands; the collateral has a weighted average LTV ratio of under 80% and weighted average seasoning of four years.

By Glen FestNovember 14 -

The conduit's allocation is unrelated to the e-tailer's big "HQ2" announcement this week, but is one of two investment-grade loans included in Citi's new 2018-C6 commercial mortgage pool.

By Glen FestNovember 14