-

The global insurance firm, which operates a three-year-old CLO management affiliate, has now launched private credit unit that will pursue controlling interests in deals managed by others.

By Glen FestFebruary 12 -

The online lender founded by Renaud Laplanche contributed half of the collateral for the $226.9 million transaction. It's also retaining a 5% economic interest in the deal.

By Glen FestFebruary 12 -

The Renaissance and Grand Hyatt Seattle, both sponsored by R.C. Hedreen, account for 14.2% of the assets in the $774.1 million JPMCC 2018-COR4.

By Glen FestFebruary 11 -

GM Financial is front-loading the $1.2 billion deal with early maturities, according to presale reports; Hyundai Capital is also readying a $710 million transaction.

By Glen FestFebruary 8 -

Chrysler vehicles dominate Santander's latest pool, reflecting increased originations that CEO Scott Powell believes will maintain the lender's captive-finance status.

By Glen FestFebruary 7 -

The firm founded by mortgage veteran Michael Vranos looks for leveraged loans it considers "misrated" with strong covenants; many of these loans also amortize relatively quickly.

By Glen FestFebruary 7 -

The 131 basis-point spread for Buckhorn Park CLO is 14 basis points wider than Blackstone's previous deal in November, but in line with peer deals from recent weeks.

By Glen FestFebruary 6 -

The New York and Israel-based investment management startup selected the initial collateral using machine-learning decisions; AI will also be used in determining when to sell consumer loans in the portfolio or buy additional assets.

By Glen FestFebruary 6 -

About half of collateralized loan obligations purchased loans at prices below face value in order to boost the par value of assets, improving overcollateralization.

By Glen FestFebruary 6 -

That's one notch lower than the sponsor's prior deal; the only substantial change is the valuation of securities that are deferring dividend payments.

By Glen FestFebruary 5 -

They join Blackstone/GSO, PGIM, Credit Suisse, Guggenheim Securities and the Carlyle Group in reopening a new-issue market that was dormant in December.

By Glen FestFebruary 2 -

Just 28% of vehicles backing the $400 million Avis Budget Rental Car Funding Series 2019-1 come with repurchase agreements from the manufacturers, including Ford, General Motors and Chrysler.

By Glen FestFebruary 1 -

The three offerings launched Thursday add to the $3.9 billion of prime auto supply already issued this year by General Motors, Ford Motor Co. and CarMax.

By Glen FestJanuary 31 -

Both lenders are boosting originations to borrowers with near-prime loans, though the impact on the overall credit quality of the collateral for their deals is slight.

By Glen FestJanuary 30 -

At least 50% of the U.S. dollar-denominated fund's investments will be in triple-B tranches of U.S. and European CLOs.

By Glen FestJanuary 30 -

Risk retention rules that Japan's Financial Services Agency has proposed for securitizations may not apply to U.S. collateralized loan obligations after all, according to the LSTA.

By Glen FestJanuary 29 -

Guggenheim, Carlyle Group, Credit Suisse and Blackstone have launched four deals totaling €1.74 billion, all with AAA spreads of at least 100 basis points over Euribor.

By Glen FestJanuary 29 -

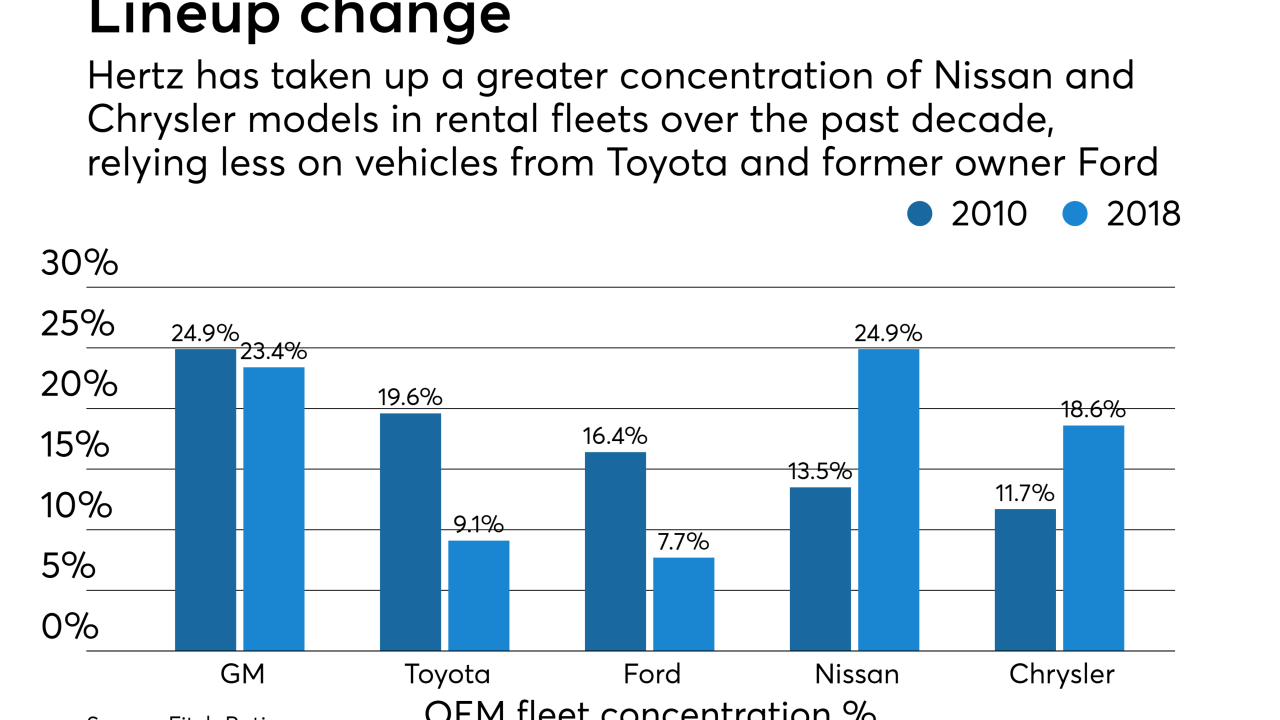

Hertz is issuing the deal following a performance turnaround that includes better returns on the resale value of older cars disposed from its fleet

By Glen FestJanuary 28 -

The rating agency has increased loss expectations for the lender's next securitization, saying trade volatility and tariffs, such as in the soybean sector, might stress some borrowers.

By Glen FestJanuary 25 -

Cadogan Square CLO XIII DAC will be Credit Suisse Asset Management's fourth euro-denominated CLO issued in the past 12 months.

By Glen FestJanuary 24