-

The average FICO for the pool of lease obligors is at a peak level for GM Financial's shelf, but Fitch expects higher losses on resale values on a pool more heavily dependent on longer-term leases and luxury models.

By Glen FestJune 14 -

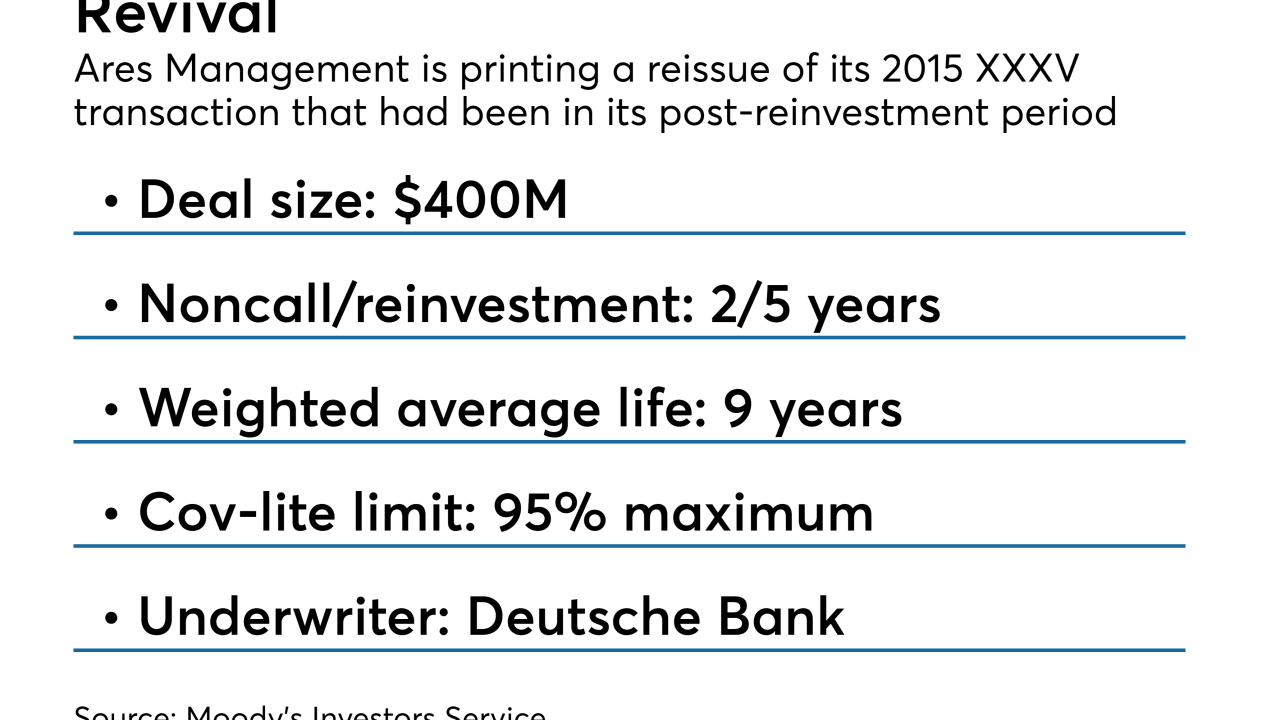

The $71.7 billion-asset manager is replacing notes from a 2015-vintage CLO that had been squeezed on asset quality prior to its October 2017 post-reinvestment period.

By Glen FestJune 12 -

The $482.5 million deal comes to market as demand for railcar leases is picking up as the result of a boost in intermodal traffic that began last year, according to S&P Global Ratings.

By Glen FestJune 11 -

The $52 billion in year-to-date volume in resets of collateralized loan obligations is nearly outpacing new-paper issuance of $53.5 billion, reports LPC.

By Glen FestJune 11 -

The Sunshine State accounts for 10.5% of the $147.3 million transaction, which is also Renew's first under its new chief executive (and former chief financial officer) Kirk Inglis.

By Glen FestJune 11 -

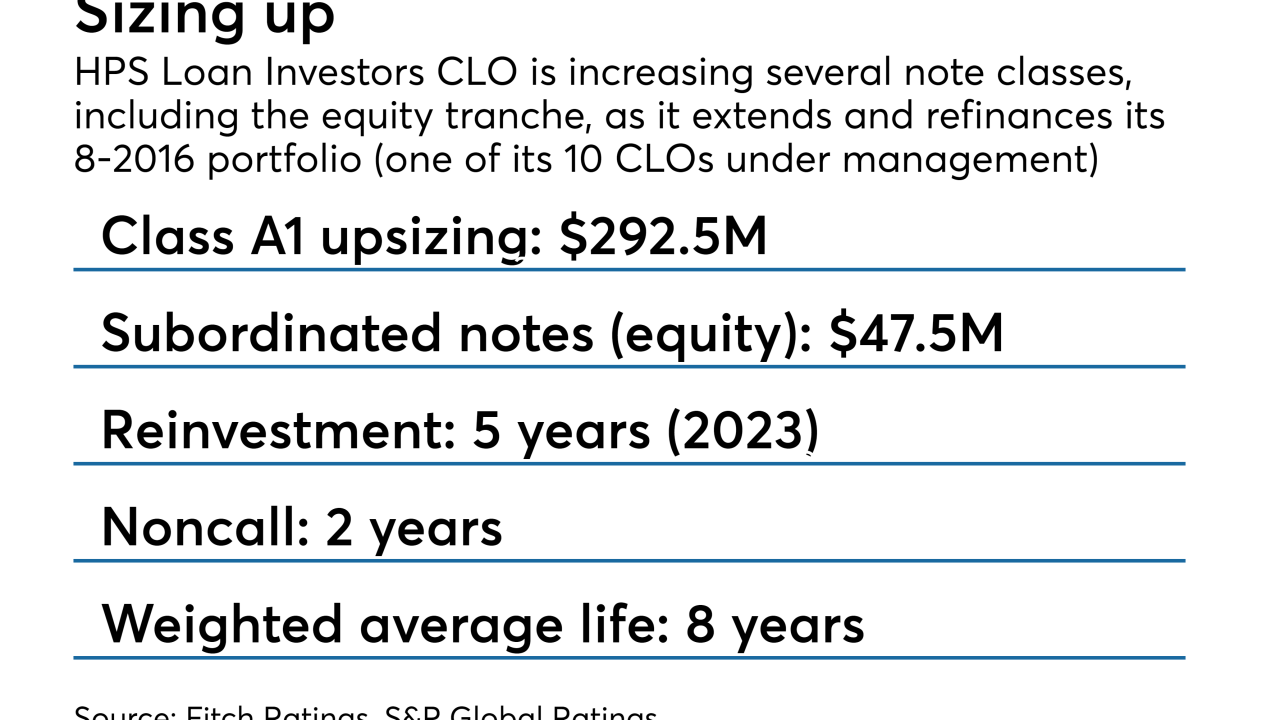

The new notes are not being distributed proportionally across the capital stack, however; instead the refinancing will result in slightly higher subordination for the senior, triple-A-rated Class A notes.

By Glen FestJune 8 -

Global Lending Services returns to double-A status in its new $299.4M transaction, while American Credit Acceptance issued another AAA-rated deal with a substantial prefunding account feature.

By Glen FestJune 7 -

It's the third deal to feature large and public institution clients primarily derived from the Dell EMC storage services subsidiary created by Dell's $67 billion merger with storage giant EMC Corp. two years ago.

By Glen FestJune 7 -

Changes that federal regulators are contemplating to the Volcker Rule could pave the way for CLOs to resume investing in high yield bonds, which they currently cannot do without putting themselves off limits to banks.

By Glen FestJune 6 -

The volume of "true" new-issue CLOs (excluding reissued deals of existing collateralized loan portfolios) have declined for four consecutive months after February's high-water 2018 mark of $14.7 billion. But JPMorgan maintains its $115 billion-$130 billion annualized forecast.

By Glen FestJune 6 -

For the first time, the collateral includes lease contracts from its standalone Genesis luxury sedan line; two models, the G80 (base price $41,000) and G90 (base price $68,000) account for 4% of the total pool balance.

By Glen FestJune 4 -

The $900 million transaction consists of a mix of fixed- and floating-rate bonds backed by receivables from inventory financing payments of primarily BMW, MINI and Rolls-Royce dealers.

By Glen FestJune 1 -

Despite a steep drop in average FICO and increase in extended-term loans, DriveTime is shaving overcollateralization levels thanks in part to improved performance from its outstanding securitization portfolios.

By Glen FestJune 1 -

Blackstone originally included 21 of the 23 properties as collateral for a $2 billion loan issuance and securitization in 2016 to partially fund its $8.8B BioMed Realty buyout.

By Glen FestMay 31 -

The ratings agency cautions that marketplace lenders' efforts to tighten credit standards during a "solid" macroeconomic environment underscore the volatility their portfolios might face in a downturn.

By Glen FestMay 30 -

The investment firm obtained $430 million of financing on its leasehold interests in 355,000 square feet of retail and office space, but it just lost its one office tenant, Amtrak.

By Glen FestMay 29 -

Noria 2018-1 is a €1.6 billion securitization of unsecured personal loans, of which 30% are debt consolidation accounts.

By Glen FestMay 28 -

Default risks in retail and media leveraged loans have also risen to the forefront of CLO manager concerns, which a few years ago were centered on oil and gas exposure.

By Glen FestMay 24 -

Despite concerns about credit quality, the only constraints on new issuance appear to be the supply of loan collateral and the capacity of warehouse facilities and rating agencies.

By Glen FestMay 24 -

Issuance is strong and defaults remain low; yet CLO market participants are concerned about heavy debt loads of the companies they invest in, as well as the lack of investor protections.

By Glen FestMay 23