-

The structured credit specialist will more than double its $2.9 billion in assets by acquiring a portfolio of three collateralized loan obligations that Trimaran Advisors runs from KCAP Financial.

By Glen FestNovember 12 -

The Loan Syndications & Trading Association wants to introduce “delayed compensation” for brokers who have to wait too long to take possession from agent banks.

By Glen FestNovember 12 -

VW Credit is also adding more Audi-brand vehicles to VALET 2018-2 compared to its earlier 2018 transaction that renewed a long-dormant ABS shelf.

By Glen FestNovember 9 -

S&P considers the $1.034 billion lease securitization among the "most diversified" in lease-end concentrations, limiting the impact of future declines in residual values as cars come off lease.

By Glen FestNovember 8 -

Proceeds will be used to repay $788 million of bonds backed by franchise fees that were issued in 2016, pay down a revolving credit facility and potentially finance a dividend to Yum! Brands shareholders.

By Glen FestNovember 8 -

Flagship, Santander Consumer USA and AmeriCredit are printing $2.3 billion in new notes backed by subprime auto-loan originations.

By Glen FestNovember 8 -

The 2018-1 series from Tesco's Delamare master trust will issue de-linked notes backed by £3.4B in receivables.

By Glen FestNovember 6 -

According to presale reports, PGIM is marketing a $509.5 million Dryden 61 CLO transaction in the states, while also prepping a €411 million Dryden 66 Euro CLO portfolio.

By Glen FestNovember 6 -

The $612 million Horizon Aircraft Finance 1 carries preliminary single-A ratings from Fitch and Kroll, on par with the $1.2 billion deal the sponsor completed in 2015.

By Glen FestNovember 6 -

Both Kroll and S&P expect losses on collateral in the subprime consumer lender's latest deal to be higher than its 2017 deals; Kroll alone assigned a lower rating to the senior tranche.

By Glen FestNovember 5 -

Marlette sharply reduced the share of sub-700 FICO borrowers, while also tightening a trigger tied to cumulative loss rates to enhance investor protections.

By Glen FestNovember 5 -

While three deals matches 2017's output, the total $2.08B volume of 2018 issuance trails the 2017 level by more than $1B.

By Glen FestNovember 1 -

The firm's risk profile has not altered, executives said on a third-quarter earnings call Wednesday; it remains "appropriately cautious."

By Glen FestNovember 1 -

The deal comes a year after the captive finance company began excluding low-FICO loans from its primary auto loan ABS platform.

By Glen FestOctober 31 -

It's the first time any of the rating agencies has assigned an AAA for any securitization of consumer loans by a marketplace lender.

By Glen FestOctober 31 -

The Urban Institute's conclusion is based on estimates that one-year SOFR rates could be 25 to 50 basis points lower than the current Libor equivalent.

By Glen FestOctober 31 -

The €411 million deal puts it in the small club of UK managers that have completed three or more transactions in 2018.

By Glen FestOctober 31 -

The New York-based firm is adding 4.9 years to the reinvestment period of the $518.6 million Neuberger Berman CLO XVIII.

By Glen FestOctober 30 -

The REIT formerly known as Sutherland Asset Management is pooling loans with an average balance of $583,029 on primarily single-tenant and owner occupied properties.

By Glen FestOctober 29 -

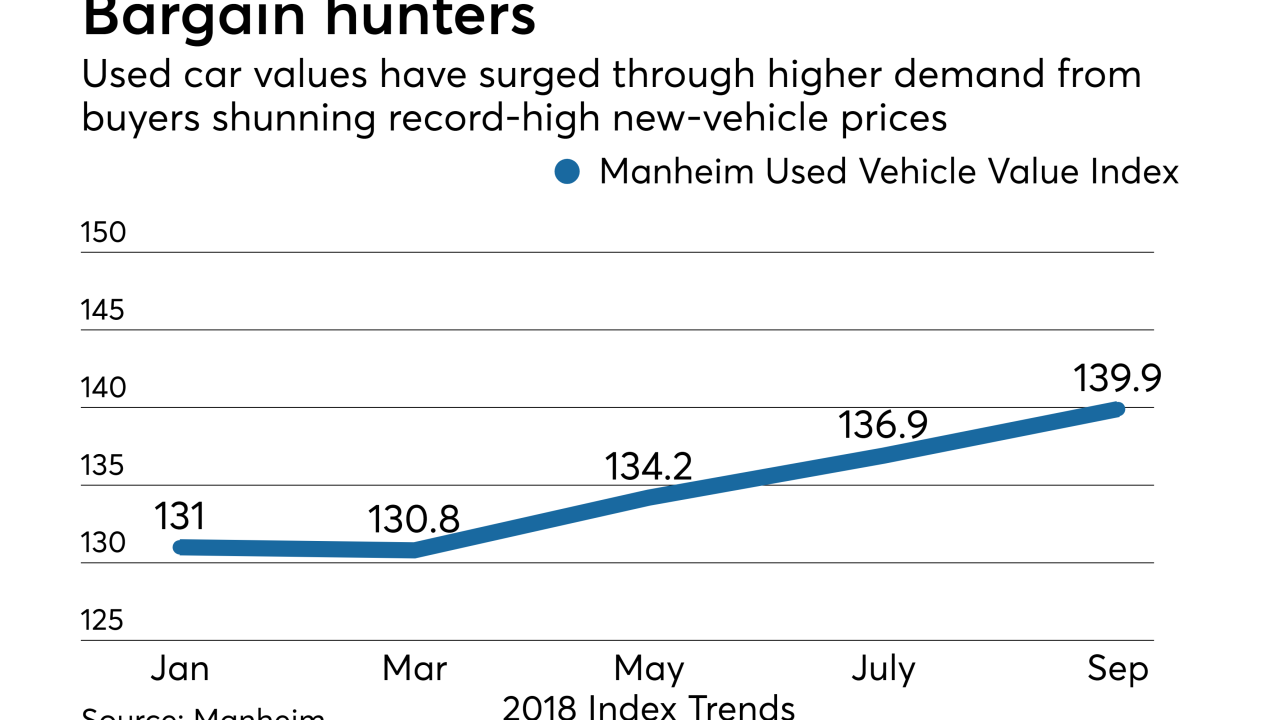

Sales of older vehicles are on the rise and prices are headed back up, so there's more collateral available and it is also performing better.

By Glen FestOctober 29