-

A second bank, M&G Prudential, had joined the deal agent, ING Capital, boosting capacity to $80 million from $40 million.

December 22 -

The Kurban Group, a Lebanese travel conglomerate, recently closed on a rental fleet securitization that, despite its small size, represents some notable "firsts."

December 21 -

At the end of September, the share of loans in MeasureOne’s private student loan database in forbearance was 2.88% of the outstanding balance, up 26.81% on the year.

December 20 -

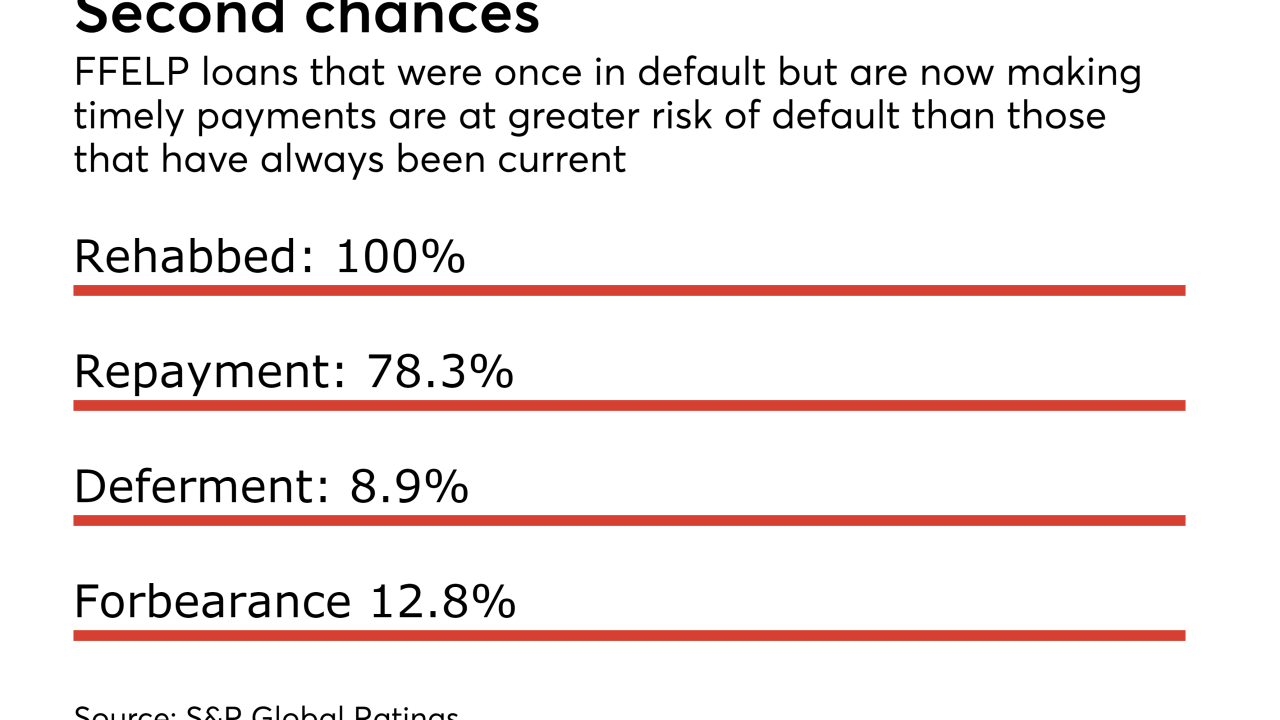

Risks include a high geographic concentration and a not insignificant exposure to loans that have either been rehabbed or are now delinquent.

December 18 -

The two Democratic lawmakers sent a letter Monday to the four largest servicing companies asking them to address borrower complaints.

December 18 -

The 2-million-square-foot office complex in Tempe, Ariz., was acquired by JDM Partners and Transwestern Investment Group in a sale-and-leaseback agreement.

December 18 -

Two proposals, limiting deductibility of interest and like-kind exchanges, would make securitization uneconomical for auto and equipment lessors, according to the industry trade group.

December 15 -

A $300 million, interest-only first mortgage that the REIT obtained from Wells Fargo this month is being used as collateral for a transaction called WFCM 2017-SMP.

December 14 -

The collateral for the $59.9 million transaction from DRB Capital includes life-contingent structured settlement receivables; when the beneficiary dies, the insurer stops making payments.

December 13 -

A lower Manhattan office building that serves as the headquarters of the New York Department of Financial Services is the largest loan in a $891 million CMBS from UBS.

December 13 -

Just over half of the collateral for the $883 million deal is eligible to be purchased by Fannie or Freddie; the bank itself contributed nearly half.

December 12 -

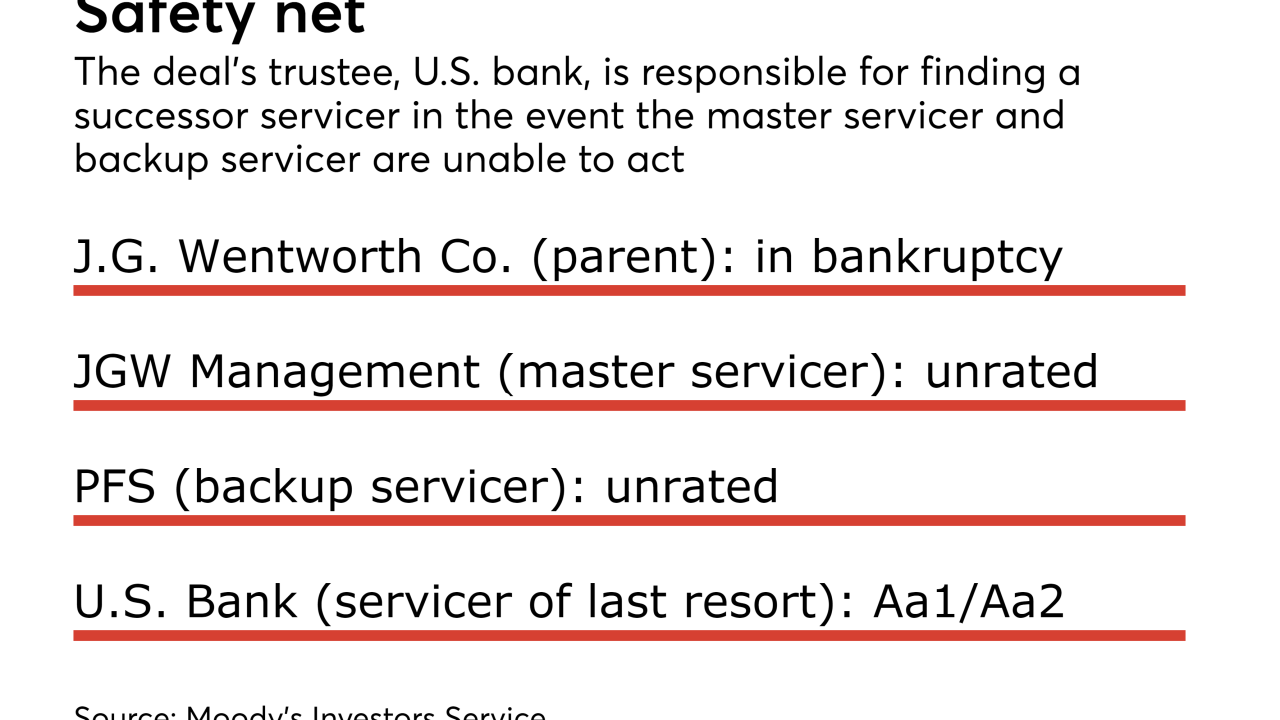

A prepackaged restructuring will not disrupt servicing of the company's assets-backeds because the servicing subsidiary is not part of the filing.

December 11 -

HUD's decision to stop endorsing Property Assessed Clean Energy will have little impact; the widest segment of FHA borrowers "would not qualify anyway."

By Glen FestDecember 11 -

ReliaMax is an unusual kind of marketplace lender that says it can help regional and community banks take advantage of business opportunities in private student lending.

December 11 -

Securitization of nonperforming home equity conversion loans was pioneered by Nationstar; FAC's inaugural deal may be outstanding longer.

December 7 -

Roughly 52% of the properties backing Tricon American Homes 2017-SFR2 were obtained through the May acquisition; 19.4% were previously securitized by Silver Bay.

December 7 -

By comparison, rehabilitated loans accounted for just 19.5% of the collateral for the servicer’s July offering and 10% of its May offering.

December 6 -

The deal, BXMT 2017-FL1 weighs in at $1 billion, making it more than twice as large as most CRE-CLOs issued this year; its size isn't the only unusual feature, however.

December 5 -

The Trepp CMBS delinquency rate is now 5.18%, a decrease of three basis points from the October level; declines were limited to the industrial, multifamily and office subindexes.

December 5 -

The $160 million cell tower deal is the first since T-Mobile and Sprint abandoned merger talks that could have reduced lease renewals.

December 5