-

The .. also named David Williams as head of U.S. global structured credit solutions capital markets; both executives have been with the firm for over a decade.

June 7 -

Fitch Ratings, which has only rated two other CRE CLOs over the past three years, joins Moody's Investors Service and Kroll Bond Rating Agency on the $514.2 million transaction.

June 6 -

Blame the decline in the oil and gas industry; many 2014 vintage deals have exposure to a number of multifamily and hotel properties in North Dakota and Texas, according to Fitch.

June 5 -

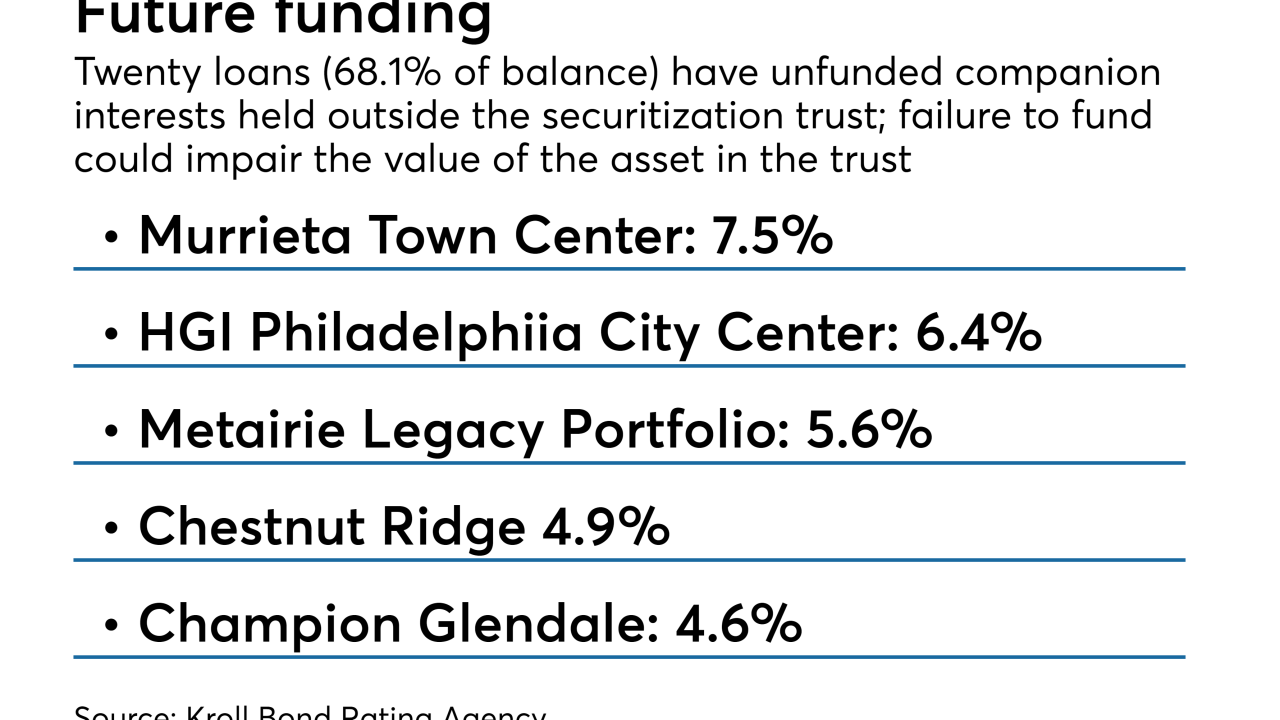

Both Fitch Ratings and Kroll Bond Rating Agency expect to assign a single-A ratings to the senior tranche of notes to be issued; the sponsor’s prior four deals were rated by Kroll alone.

June 4 -

The biggest decline was in the delinquency rates for offices and retail, but late payments on multifamily and industrial CMBS loans increased.

May 31 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

Just 16% of the collateral for the $522 million Nelnet Student Loan Trust 2018-2 consist of “rehabbed” Federal Family Education Loan Program loans.

May 28 -

After a long and ultimately successful battle to exempt managers from risk retention rules, it may be hard to engage participants in the search for a suitable replacement for Libor.

May 24 -

Unlike several recent transactions by other solar panel financiers, which were backed by loans, the $347.5 million Vivint Solar Financing 5 is backed by leases and power purchase agreements.

May 24 -

The as-yet unsized Volta VI is backed by a tariff on all users of electricity in the nation; it is designed to help EDP, the largest utility, recover the costs of supporting renewable electricity.

May 23