-

The $650.5 million transaction is also slightly more geographically concentrated in California and New York, and a higher proportion of the loans were originated through correspondent and broker channels.

May 23 -

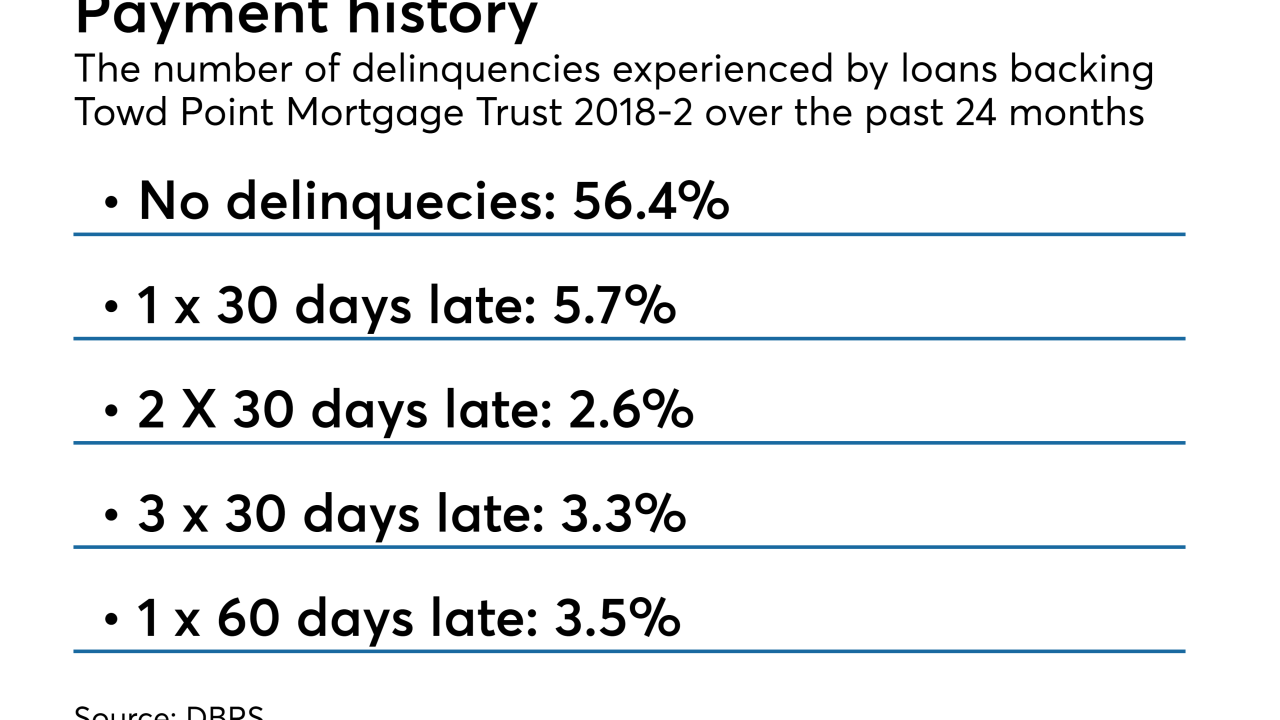

The $1.56 billion Towd Point Mortgage Trust 2018-2 also features higher exposure to loans on investment properties, in some cases loans backed by single-family homes in more than one state.

May 22 -

The online lender was able to lower the credit enhancement (again) on its latest securitization of consumer installment loans, the $221.9 million Avant Loans Funding Trust 2018-A.

May 21 -

The $770 million transaction is also more concentrated in terms of obligors than MassMutual's prior deal, though more of these corporate obligors have investment-grade ratings, resulting in a lower WARF.

May 18 -

Affinity's NREIG unit will become OwnAmeria's preferred insurance provider; landlords who list their portfolios will be able to apply for insurance directly from the trading platform.

May 18 -

Two of the loans, or 10% of the $730 million of collateral, are secured by buildings that derive considerable income from parking, which Kroll Bond Rating Agency warns can fluctuate.

May 16 -

Unlike the sponsor's previous four deals, which were backed at least in part by jumbo loans, all of the collateral for FSMT 2018-3INV is eligible to be purchased by either Fannie Mae or Freddie Mac.

May 15 -

Requiring solar panels for all newly constructed residences is good news for investors who finance these systems, if only because it will help keep developers afloat, according to Moody’s Investors Service.

May 15 -

The Plano, Tex., company was founded by veterans of AIG and GE and has been in business only three years; the $598 million transaction represents roughly a quarter of loans and leases it has funded to date.

May 14 -

The Show Me State accounts for 9.1% of the collateral, up from 3.4% from the sponsor’s prior deal, completed in November; as of April, 12 homeowners in the state had missed a payment.

May 11 -

Collateral for the mortgage bonds does not include what Moody's Investors Service terms the "improvements," a 42-story building, state-of-the-art digital signage or a 452-room luxury hotel.

May 9 -

Despite the entrance of several large players over the past several years, financing to small-time landlords is still inefficient, executives say.

May 8 -

CARDS II Trust, Series 2018-1 will issue two tranches of floating-rate two-year notes and CARDS II Trust, Series 2018-2 will issue two tranches of fixed-rate two-year notes; both are as-yet unsized.

May 4 -

Sprint’s planned merger with T-Mobile should reduce the likelihood of a default on $7 billion of notes backed by leases on its spectrum licenses, according to Moody’s Investors Service.

May 2 -

The overall delinquency rate for securitized U.S. commercial real estate loans is now 4.36%, a decrease of 19 basis points from the March level.

May 2 -

Banyan Street Capital and Balandis Real Estate are tapping the commercial mortgage bond market to help finance the revitalization of a mixed-use development in downtown Atlanta.

May 2 -

Qualifying borrowers have their maximum monthly payment reduced to 15% of the total of the household income, but the maximum dollar amount that can be extended is capped at $4 million.

May 2 -

Harley Marine Service has been expanding rapidly, racking up debt; a $455 million deal backed by its tugboat and barge fleet and contracts will lower funding costs.

May 1 -

Hunton Andrews Kurth LLP (formerly Hunton & Williams and Andrews Kurth Kenyon) has named Robert A. Davis Jr. as special counsel in its tax and ERISA practice.

April 30 -

All of the loans in the £206.6 million deal were funded by institutional investors; the transaction allows these institutions to exit their investments by pooling loans into collateral for bonds.

April 30