-

Lauren Hedvat, Angel Oak's managing director of capital markets, said that the rising non-qualified mortgage volume in the market has expanded the number of third-party origination loan packages for purchase.

June 27 -

The $35 million offering of fixed-rate bonds comes from a new mater trust and will be taxable; previously, the state student loan authority has funded refinance loans with the same tax-free bonds used to fund in-school lending.

June 27 -

Bavarian Sky UK 2 plc is as yet unsized; the collateral will initially consist of 70% new and 30% used primarily BWM and MINI vehicles, 56% of which use diesel fuel, according to Moody's Investors Service.

June 27 -

HPS Loan Management 9-2016 will be backed by a $750 million portfolio of broadly syndicated loans and other assets, up from $500 million originally; Moody's is only rating the two senior tranches of notes to be issued.

June 26 -

La Quinta is spinning off a portfolio of 2014 hotels into a real estate investment trust called CorePoint; the REIT obtained a $1.035 billion mortgage from JPMorgan Chase that is being used as collateral for mortgage bonds.

June 25 -

CoreVest American Finance’s next offering of rental bonds is backed by homes that are older and smaller than any of its previous transactions, according to Kroll Bond Rating Agency.

June 25 -

The bank, which purchases loans from Mosaic, is contributing an unspecified amount of collateral for the $317 million deal; it's also the underwriter and risk retention holder, and appears to be behind the unusual structure.

June 22 -

The $470 million transaction has some features rarely seen now that the market for bridge loan securitization has been rehabilitated, including a "blind ramp" and a "blind reinvestment" period.

June 21 -

Adding to the layering of risks, the majority of the loans (84%) originally paid only interest, and no principal, at the time of origination; however, all 506 loans have passed their initial, fixed-rate period, eliminating some potential for reset shock.

June 20 -

The real estate investment trust, along with co-borrower Stellar Management, obtained a $675 million mortgage from four banks; they are cashing out $113 million of equity in the process.

June 19 -

The rental car giant is issuing approximately $213 million each of notes maturing in July 2021 and July 2023 from its revolving master trust, Hertz Vehicle Financing II LP, according to rating agency presale reports.

June 18 -

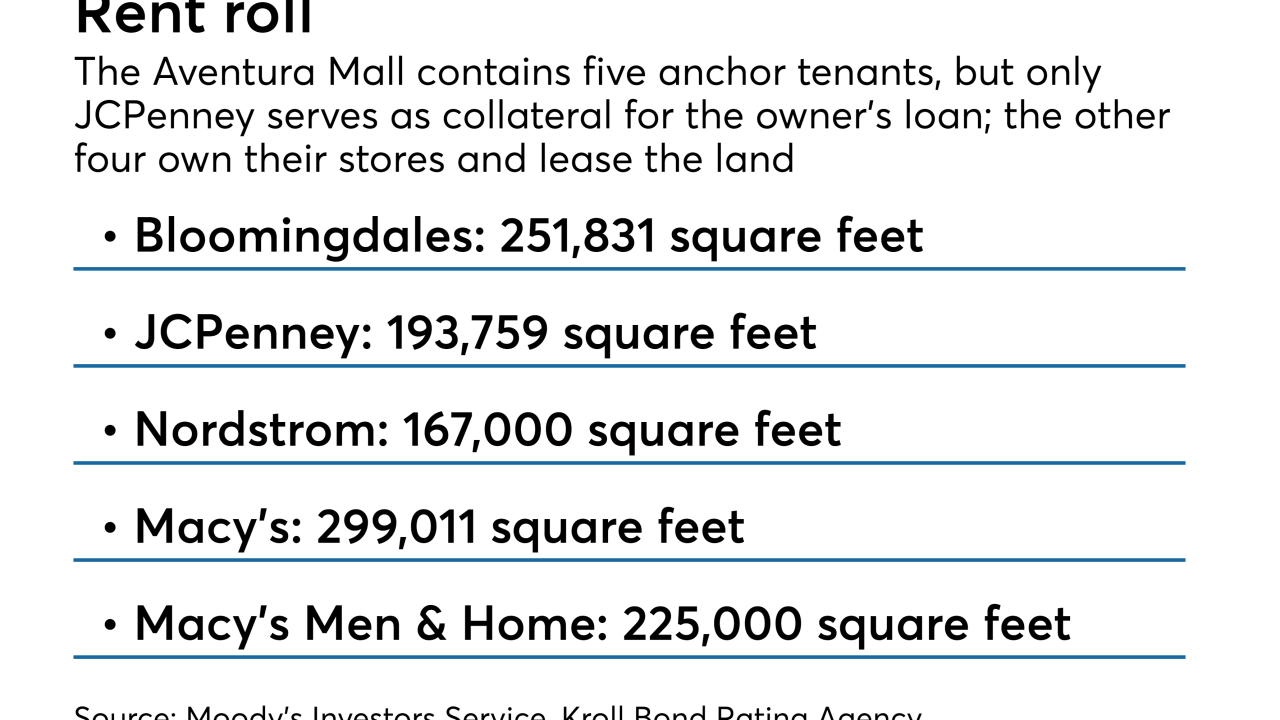

The 10-year, fixed-rate term of the $1.75 billion interest-only loan may raise some eyebrows, though the owners still have "implied equity" of $1.7 billion in the 2.2 million square foot property, per Moody's Investors Service.

June 18 -

Like the sponsor's February transaction, this one is backed by midsize and larger business jets, a volatile asset class; it amortizes more slowly and has looser restrictions on extending the terms of leases and loans.

June 18 -

The borrowers in the pool of collateral have lower FICO scores, and the size of a prefunding account has risen to 25% of the initial balance from 16% for Marriott's prior deal, completed in August 2017.

June 15 -

The $278.3 million RCMF 2018-FL2 also has unusually heavy exposure to apartment buildings, offices and industrial properties that are either vacant or have low occupancy levels, according to Kroll Bond Rating Agency.

June 14 -

QSuper Board, an Australian pension fund, is tapping the commercial mortgage bond market to help finance a portion of a 52-story office building on Manhattan’s Upper West Side.

June 13 -

The Dallas-based money manager has launched a UCITS that invests in both U.S. and European loans, investment-grade CLO securities, and obligations and other kinds of structured products.

June 12 -

IH 2018-SFR1 refinances three earlier transactions (one each from 2013, 2014 and 2015) and is initially sized at $1.1 billion; it may be upsized to $1.3 billion, depending on investor demand.

June 11 -

The El Segundo, Calif. company is selling $100 million of bonds backed by a revolving pool of loans secured by precious metals as well as some of its own inventory of cash and gold, silver, platinum, and palladium.

June 8 -

All five – Plaza West Covina Mall (Calif.), Franklin Park Mall (Ohio), Parkway Plaza (Calif.), Capital Mall (Wash.), and Great Northern Mall (Ohio) – were built in the 1970s and have JCPenney or Sears as a major tenant.

June 7