-

The rental car giant is issuing approximately $213 million each of notes maturing in July 2021 and July 2023 from its revolving master trust, Hertz Vehicle Financing II LP, according to rating agency presale reports.

June 18 -

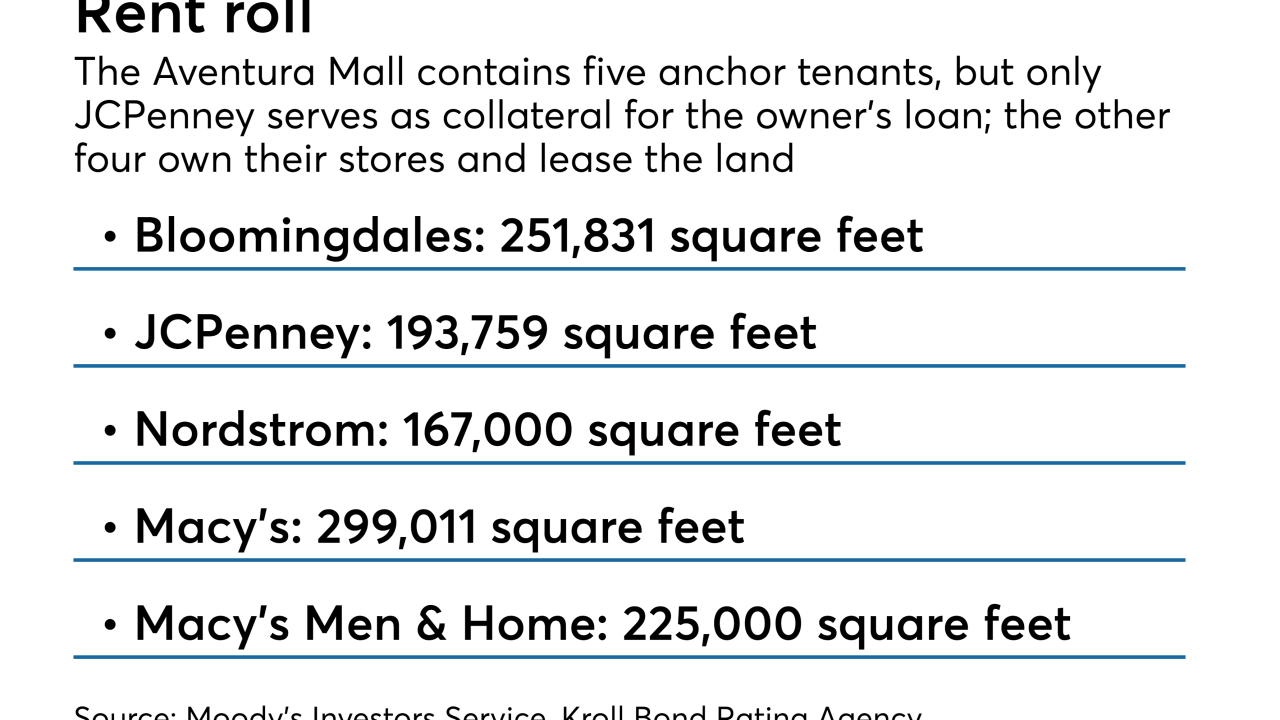

The 10-year, fixed-rate term of the $1.75 billion interest-only loan may raise some eyebrows, though the owners still have "implied equity" of $1.7 billion in the 2.2 million square foot property, per Moody's Investors Service.

June 18 -

Like the sponsor's February transaction, this one is backed by midsize and larger business jets, a volatile asset class; it amortizes more slowly and has looser restrictions on extending the terms of leases and loans.

June 18 -

The borrowers in the pool of collateral have lower FICO scores, and the size of a prefunding account has risen to 25% of the initial balance from 16% for Marriott's prior deal, completed in August 2017.

June 15 -

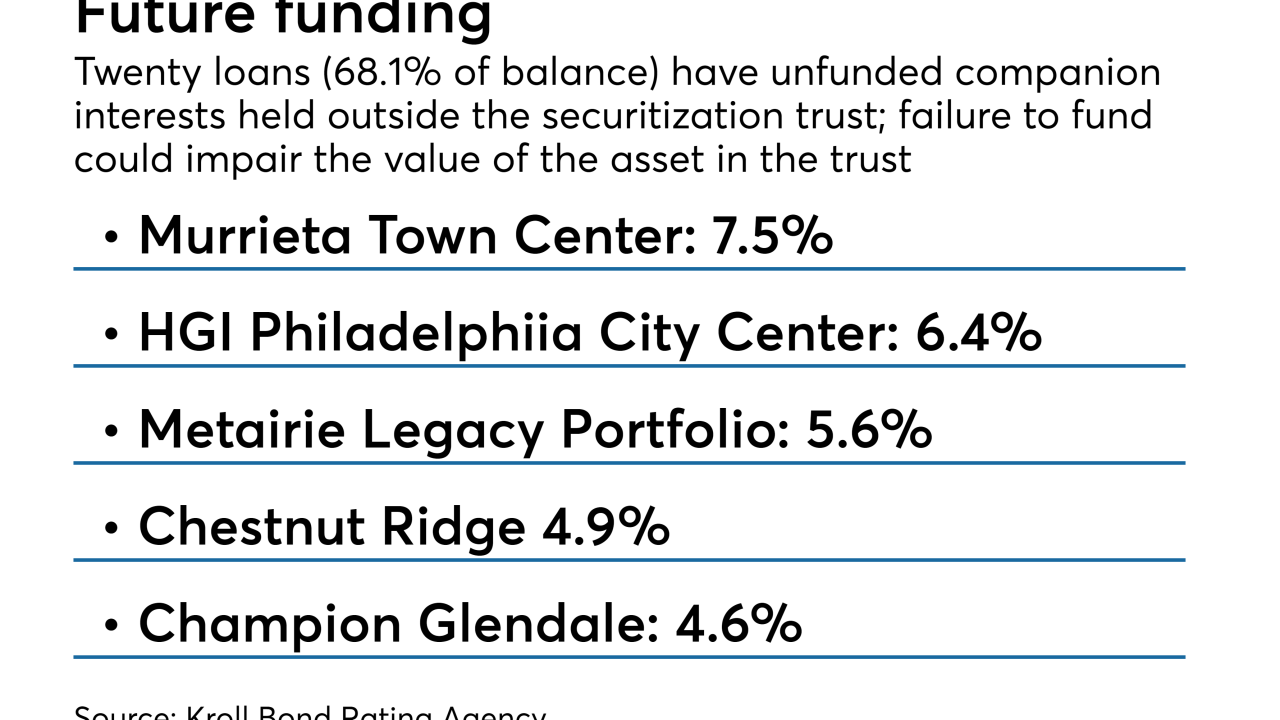

The $278.3 million RCMF 2018-FL2 also has unusually heavy exposure to apartment buildings, offices and industrial properties that are either vacant or have low occupancy levels, according to Kroll Bond Rating Agency.

June 14 -

QSuper Board, an Australian pension fund, is tapping the commercial mortgage bond market to help finance a portion of a 52-story office building on Manhattan’s Upper West Side.

June 13 -

The Dallas-based money manager has launched a UCITS that invests in both U.S. and European loans, investment-grade CLO securities, and obligations and other kinds of structured products.

June 12 -

IH 2018-SFR1 refinances three earlier transactions (one each from 2013, 2014 and 2015) and is initially sized at $1.1 billion; it may be upsized to $1.3 billion, depending on investor demand.

June 11 -

The El Segundo, Calif. company is selling $100 million of bonds backed by a revolving pool of loans secured by precious metals as well as some of its own inventory of cash and gold, silver, platinum, and palladium.

June 8 -

All five – Plaza West Covina Mall (Calif.), Franklin Park Mall (Ohio), Parkway Plaza (Calif.), Capital Mall (Wash.), and Great Northern Mall (Ohio) – were built in the 1970s and have JCPenney or Sears as a major tenant.

June 7 -

The .. also named David Williams as head of U.S. global structured credit solutions capital markets; both executives have been with the firm for over a decade.

June 7 -

Fitch Ratings, which has only rated two other CRE CLOs over the past three years, joins Moody's Investors Service and Kroll Bond Rating Agency on the $514.2 million transaction.

June 6 -

Blame the decline in the oil and gas industry; many 2014 vintage deals have exposure to a number of multifamily and hotel properties in North Dakota and Texas, according to Fitch.

June 5 -

Both Fitch Ratings and Kroll Bond Rating Agency expect to assign a single-A ratings to the senior tranche of notes to be issued; the sponsor’s prior four deals were rated by Kroll alone.

June 4 -

The biggest decline was in the delinquency rates for offices and retail, but late payments on multifamily and industrial CMBS loans increased.

May 31 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

Just 16% of the collateral for the $522 million Nelnet Student Loan Trust 2018-2 consist of “rehabbed” Federal Family Education Loan Program loans.

May 28 -

After a long and ultimately successful battle to exempt managers from risk retention rules, it may be hard to engage participants in the search for a suitable replacement for Libor.

May 24 -

Unlike several recent transactions by other solar panel financiers, which were backed by loans, the $347.5 million Vivint Solar Financing 5 is backed by leases and power purchase agreements.

May 24 -

The as-yet unsized Volta VI is backed by a tariff on all users of electricity in the nation; it is designed to help EDP, the largest utility, recover the costs of supporting renewable electricity.

May 23