HPS Investment Partners is refinancing and upsizing a collateralized loan obligation originally issued in 2016, according to Moody’s Investors Service.

HPS Loan Management 9-2016 will be backed by a $750 million portfolio of broadly syndicated loans and other assets, up from $500 million originally.

The CLO will issue six classes of secured notes and one class of securities known as “residual notes” that are entitled to whatever is left over after the secured notes are repaid. Proceeds will be used to redeem in full all of the classes of secured notes issued on the original closing date; the residual notes issued in 2016 will remain outstanding.

BNP Paribas Securities is the underwriter.

Moody’s expects to assign an Aaa rating to the two tranches of Class A notes to be issue, one of which has an assumed coupon of Libor plus 104 basis points and one of which has an assumed coupon of Libor plus 135 basis points.

However, the rating agency will not rate any of the subordinate tranches of notes to be issued in the refinancing, not even those that it rated when the transaction was originally issued.In addition to upsizing and repricing the individual tranches, HPS is making changes to other terms of the deal. The non-call period will be extended by two years, the reinvestment period will be extended by 2.5 years, and the legal maturity date of the notes will be extended by three years.

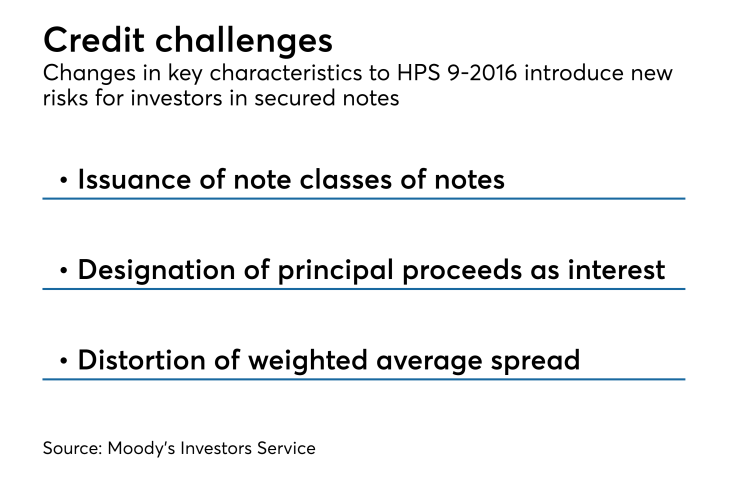

Covenants designed to protect investors in the CLO securities are also being changed. For example, he weighted average life test covenant will extend by one year, giving the manager more flexibility to buyer longer-dated loans later in the life of the transaction.

In addition, the maximum permitted percentage of covenant-lite loans will change; it is now limited to 95% of assets, but only so long as the Class A1 notes are outstanding. And covenant-lite is now defined as “any loan that (a) does not contain any financial covenants or (b) does not require the underlying obligor to comply with a maintenance covenant.”

The collateral quality matrix and modifiers and coverage test levels will also change.

The CLO is now permitted to issue one or more new classes of subordinate notes, which Moody’s noted could make the interest diversion test less effective.

And at a certain point, the manager can designate a certain amount of principal proceeds in the principal collection subaccount to be treated as interest proceeds, which makes it easier to divert these funds to holders of the residual notes.

Not all of the changes give the CLO manager more leeway however; some are more restrictive. The percentage of assets that can pay fixed rates of interest or make semi-annual payments (as opposed to quarterly payments) decreased to 5.0% from 7.5%.

Finally, the CLO will add provisions to that allow interest on the notes to be pegged to an “alternative base rate” instead of Libor. The latter index may not be available after 2021.