-

The $226.5 million transaction looks very similar to the previous one; the heaviest concentration of receivables is long-haul trucks (23.3%), followed by trailers (21.2%), heavy equipment (11.9%) and short-haul trucks (9.3%).

October 3 -

Blackstone Real Estate Income Trust obtained a $257 million mortgage from Barclays on 17 hotels with a total of 2,189 rooms across seven states; it still has $177 million of equity in the properties.

October 1 -

Similar to estimates published by Moody's and Morningstar, the data provider reckons that more than half of the loans are securitized by Fannie, Freddie or Ginnie.

October 1 -

The initial collateral for J.G. Wentworth XLII Series 2018-2 is 97.4% structured settlements, up from 96.6% for the prior deal and the highest concentration of any deal over the past five years.

October 1 -

Zephyrus, which is owned by Virgo Investment Group (98%) and Seabury (2%), is marketing $336.6 million of fixed-rate loans with a final maturity of 2038 and a preliminary A rating from Kroll Bond Rating Agency.

September 28 -

Fitch and S&P recently trimmed default expectations for payment plans of customers with various tenures; this allows the carrier to offer less credit enhancement on its next securitization; Moody's is also rating the deal for the first time.

September 27 -

The £571.6 million Elvet Mortgages 2018-1 is the first mortgage bond offering rated by Moody's Investors Service to include loans that were originated using a mobile phone application.

September 27 -

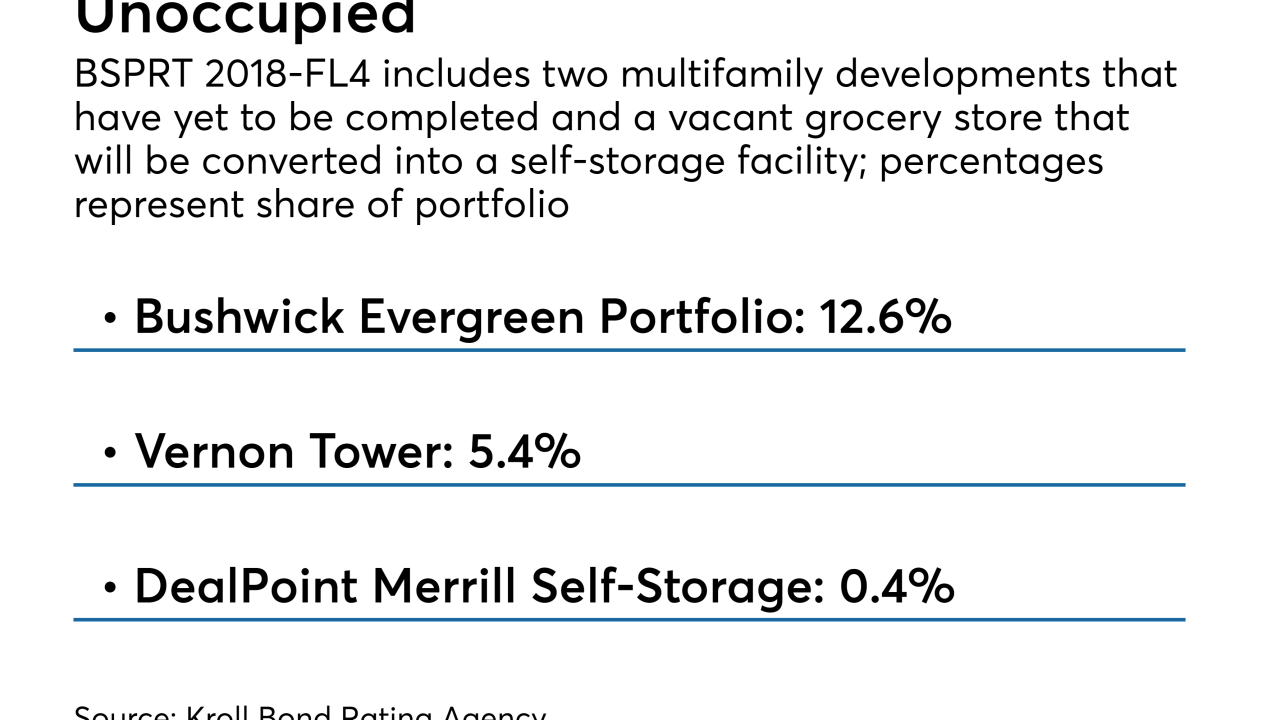

Three of the loans backing the $868.4 million BSPRT 2018-FL4 representing 18.4% of the collateral are either still under construction or have yet to be redeveloped, according to Kroll Bond Rating Agency.

September 24 -

Moody's sees $10.7 billion of securitized commercial mortgages at risk, Morningstar just $1.49 billion; both say loans in Freddie Mac K-deals account for a significant portion of exposure.

September 21 -

A conflict between risk retention rules and prohibitions against self-dealing were limiting options for some lenders to hold skin in the game; a no-action letter issued to Golub Capital creates a "clear path" to compliance.

September 20 -

Approximately 81.5% of the borrowers in the latest deal have more than one mortgaged property; those with three or more mortgages (with a maximum of 10) represent 45.5% of the pool and generally show considerable income and liquid reserve.

September 19 -

The sponsor acquired all three, Riverchase Galleria in Hoover, Ala., Columbiana Centre in Columbia, S.C.. and Apache Mall in Rochester, Minn., through its purchase of GGB Nimbus in August.

September 18 -

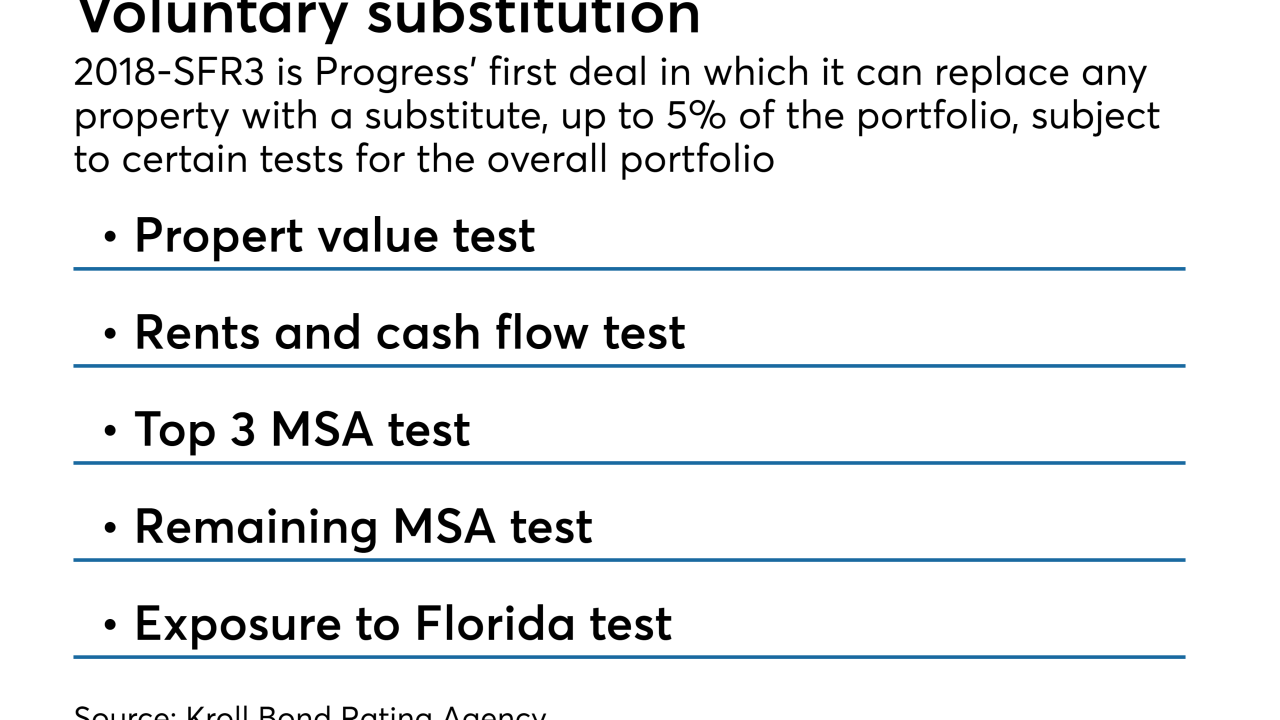

Progress 2018-SFR3 is backed by 3,459 single-family homes, of which 3,418 homes (98.8% by broker price opinion) were previously securitized in 2016. And 1,492 of those properties (44.4%) were first securitized in 2014.

September 18 -

The transaction was launched in early June, just as concerns about a trade war were starting to take a toll on commodities prices.

September 17 -

Apartment buildings account for 78.8% of the $341 million balance of the deal; that's up from 58% of a $304 million deal completed in March.

September 14 -

SoFi’s $577.5 million offering is the sponsor’s 23rd rated term student loan ABS transaction, while Massachusetts’ $164 million offering is only its second deal.

September 14 -

Class A rated dealers, both by number and the percentage of aggregate principal balance of the trust portfolio, have decreased to the lowest level since 2012, according to Moody's.

September 13 -

The $591 million transaction is backed by fewer investment grade obligors than the sponsor's previous deal, and Fitch thinks the overall decrease in credit quality is material.

September 12 -

The credit quality of obligors is up from that of the sponsor's 2017 transaction, which could help offset a decline in performance seen in recent vintages.

September 12 -

The deal, which comes just a year after the commodity trading firm's last securitization, represents 7.85% of assets in a revolving trust; it may be upsized to $500 million.

September 11