-

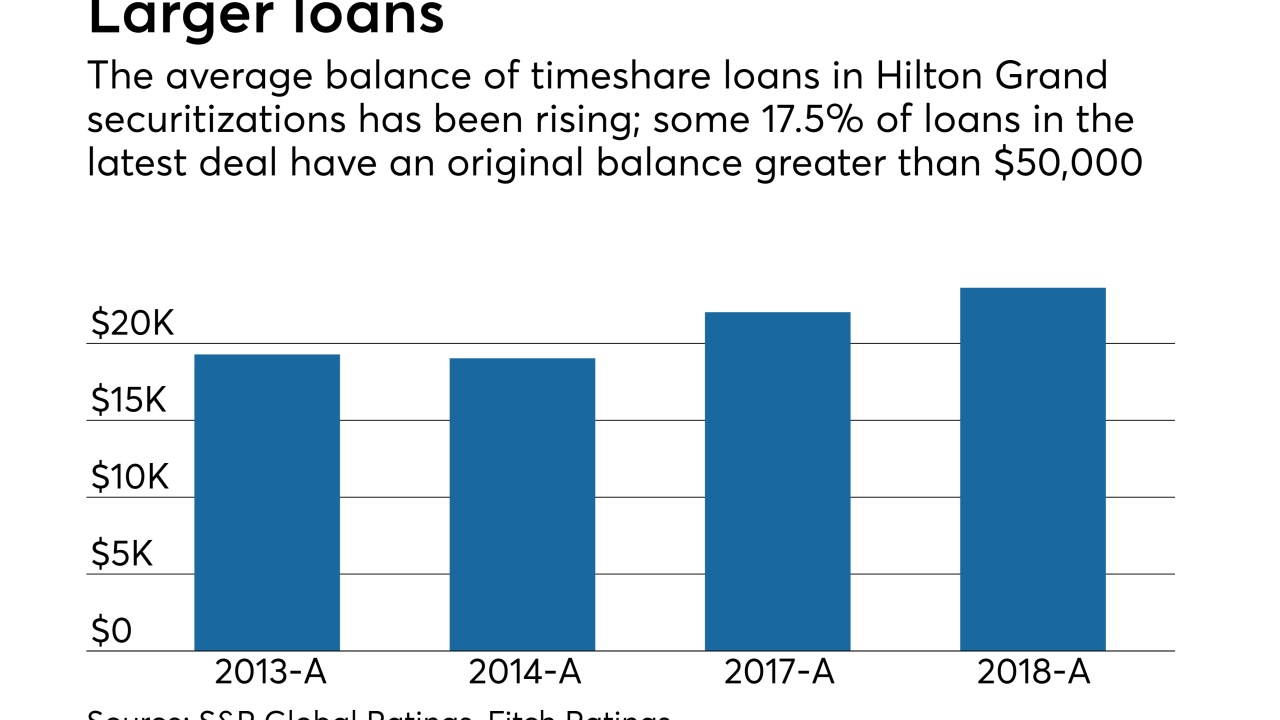

Approximately 81.5% of the borrowers in the latest deal have more than one mortgaged property; those with three or more mortgages (with a maximum of 10) represent 45.5% of the pool and generally show considerable income and liquid reserve.

September 19 -

The sponsor acquired all three, Riverchase Galleria in Hoover, Ala., Columbiana Centre in Columbia, S.C.. and Apache Mall in Rochester, Minn., through its purchase of GGB Nimbus in August.

September 18 -

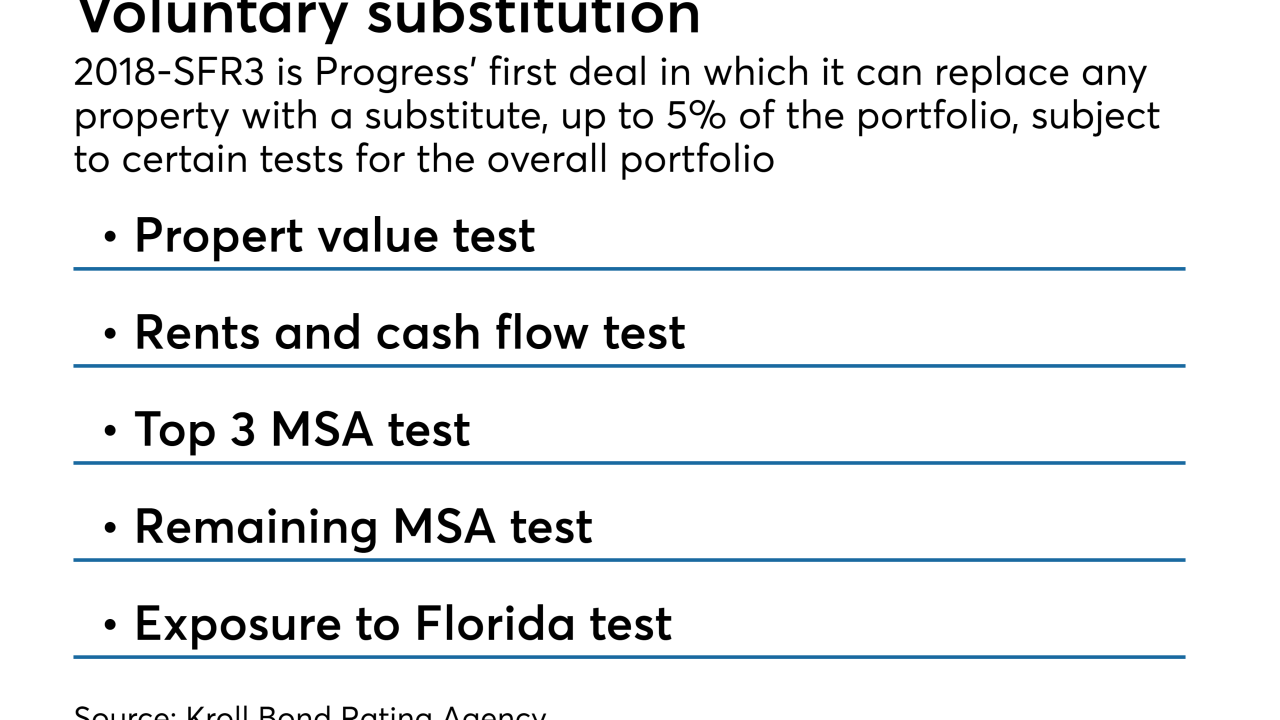

Progress 2018-SFR3 is backed by 3,459 single-family homes, of which 3,418 homes (98.8% by broker price opinion) were previously securitized in 2016. And 1,492 of those properties (44.4%) were first securitized in 2014.

September 18 -

The transaction was launched in early June, just as concerns about a trade war were starting to take a toll on commodities prices.

September 17 -

Apartment buildings account for 78.8% of the $341 million balance of the deal; that's up from 58% of a $304 million deal completed in March.

September 14 -

SoFi’s $577.5 million offering is the sponsor’s 23rd rated term student loan ABS transaction, while Massachusetts’ $164 million offering is only its second deal.

September 14 -

Class A rated dealers, both by number and the percentage of aggregate principal balance of the trust portfolio, have decreased to the lowest level since 2012, according to Moody's.

September 13 -

The $591 million transaction is backed by fewer investment grade obligors than the sponsor's previous deal, and Fitch thinks the overall decrease in credit quality is material.

September 12 -

The credit quality of obligors is up from that of the sponsor's 2017 transaction, which could help offset a decline in performance seen in recent vintages.

September 12 -

The deal, which comes just a year after the commodity trading firm's last securitization, represents 7.85% of assets in a revolving trust; it may be upsized to $500 million.

September 11 -

The $300 million transaction has a six-month prefunding period during with the last $50 million of loans will be acquired; it can be actively managed for three years.

September 10 -

Caliber Home Loans’ next offering of subprime mortgage bonds includes a new product offered to borrowers with a stronger credit profile than its other programs – but also less equity in their homes.

September 10 -

Nearly a third of borrowers, 29.5%, backing the $500 million transaction are making timely payments, up from 27.4% for the prior deal and higher than the lender’s previous two deals.

September 10 -

The GSE recently transferred $166 million portion of risk on $11.1 billion of loans via contracts with seven reinsurers and insurers; it plans to come to market two or three time a year going forward.

September 6 -

The real estate investment trust is securitizing a $225 million mortgage on a portfolio of 10 hotels owned by Taylor Woods and Howard Wu, founders of Urban Commons.

September 6 -

Investor appetite for deeply subordinated debt is increasing even as the industry starts to consolidate; problems at Honor Finance demonstrate the limits of relying on overcollateralization to offset losses.

September 6 -

The sponsor has increased the credit enhancement on the senior support class of notes on offer in order to offset the slightly higher risk to investors.

August 31 -

Widening spreads on ABS have made deposit funding relatively more attractive; the rating agency now expects full-year issuance to be at the low end of its original forecast of $40 billion to $50 billion.

August 30 -

Weilamann was previously managing director and head of U.S. ABS at the credit rating agency; he assumes his new role as Luis Reyna returns to academia.

August 30 -

The initial collateral for Tower Bridge Funding No. 3 consists of 1,737 loans totaling £375.5 million, and there will be a £125 million prefunding account that can be used to acquire additional collateral before the first interest payment date.

August 29