-

The $300 million transaction has a six-month prefunding period during with the last $50 million of loans will be acquired; it can be actively managed for three years.

September 10 -

Caliber Home Loans’ next offering of subprime mortgage bonds includes a new product offered to borrowers with a stronger credit profile than its other programs – but also less equity in their homes.

September 10 -

Nearly a third of borrowers, 29.5%, backing the $500 million transaction are making timely payments, up from 27.4% for the prior deal and higher than the lender’s previous two deals.

September 10 -

The GSE recently transferred $166 million portion of risk on $11.1 billion of loans via contracts with seven reinsurers and insurers; it plans to come to market two or three time a year going forward.

September 6 -

The real estate investment trust is securitizing a $225 million mortgage on a portfolio of 10 hotels owned by Taylor Woods and Howard Wu, founders of Urban Commons.

September 6 -

Investor appetite for deeply subordinated debt is increasing even as the industry starts to consolidate; problems at Honor Finance demonstrate the limits of relying on overcollateralization to offset losses.

September 6 -

The sponsor has increased the credit enhancement on the senior support class of notes on offer in order to offset the slightly higher risk to investors.

August 31 -

Widening spreads on ABS have made deposit funding relatively more attractive; the rating agency now expects full-year issuance to be at the low end of its original forecast of $40 billion to $50 billion.

August 30 -

Weilamann was previously managing director and head of U.S. ABS at the credit rating agency; he assumes his new role as Luis Reyna returns to academia.

August 30 -

The initial collateral for Tower Bridge Funding No. 3 consists of 1,737 loans totaling £375.5 million, and there will be a £125 million prefunding account that can be used to acquire additional collateral before the first interest payment date.

August 29 -

Cheap funding and marketing muscle could give it an advantage over existing lenders, but this corner of the market may not be big enough to move the needle for the bank.

August 23 -

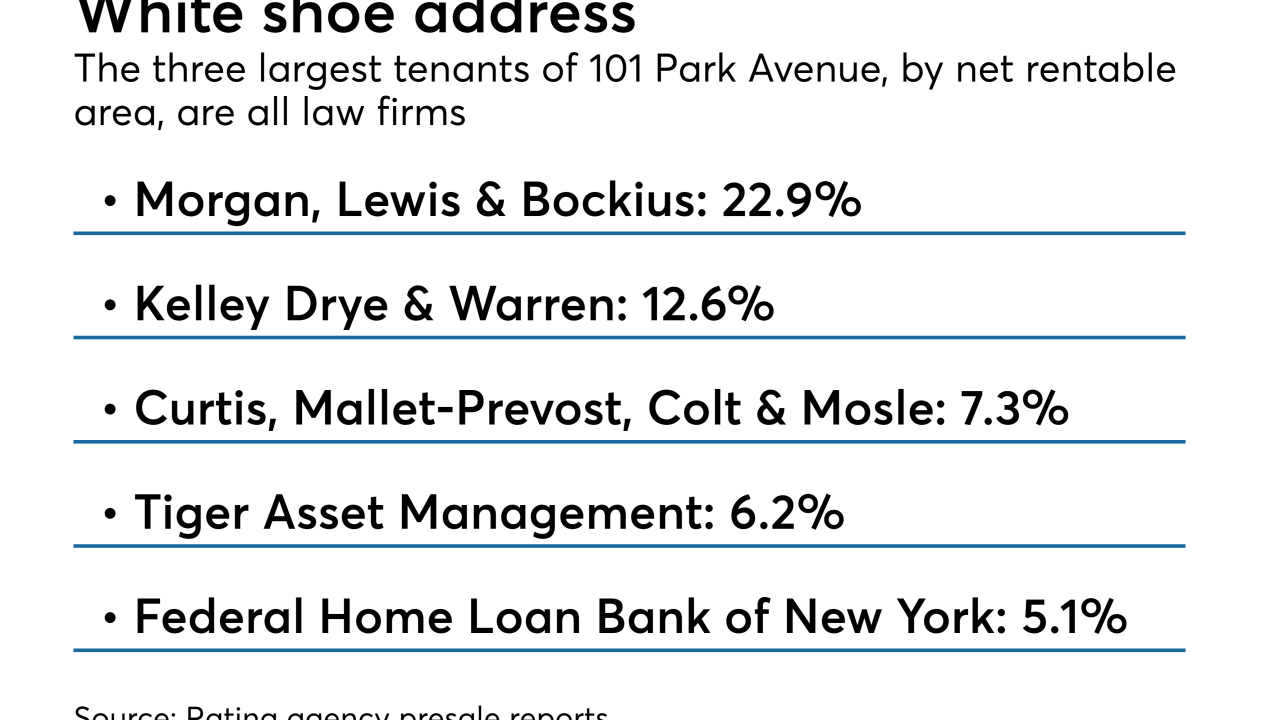

Peter S. Kalikow, a leading New York City real estate investor, is tapping the securitization market for a cash-out refinancing of a 1.3 million-square-foot, 48-story building at 101 Park Ave.

August 22 -

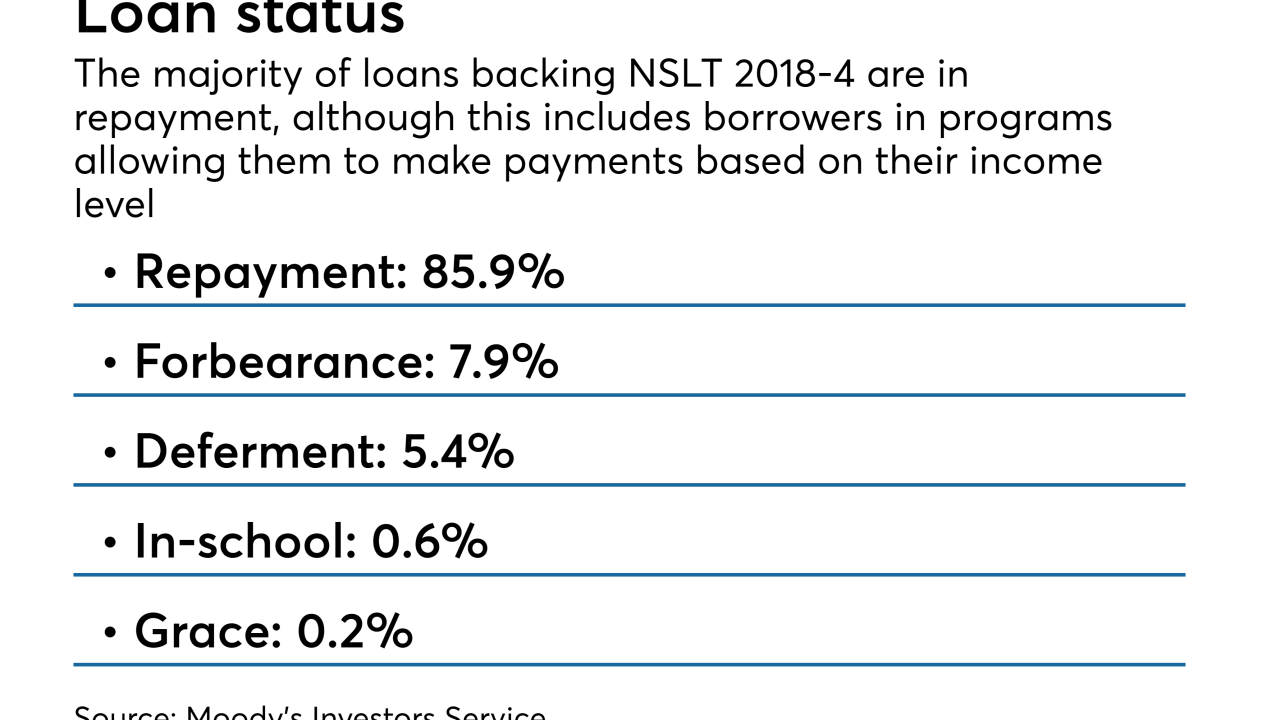

Borrowers who were once delinquent but are now making timely payments account for a quarter of the collateral, more than the student loan servicer's past two deals.

August 22 -

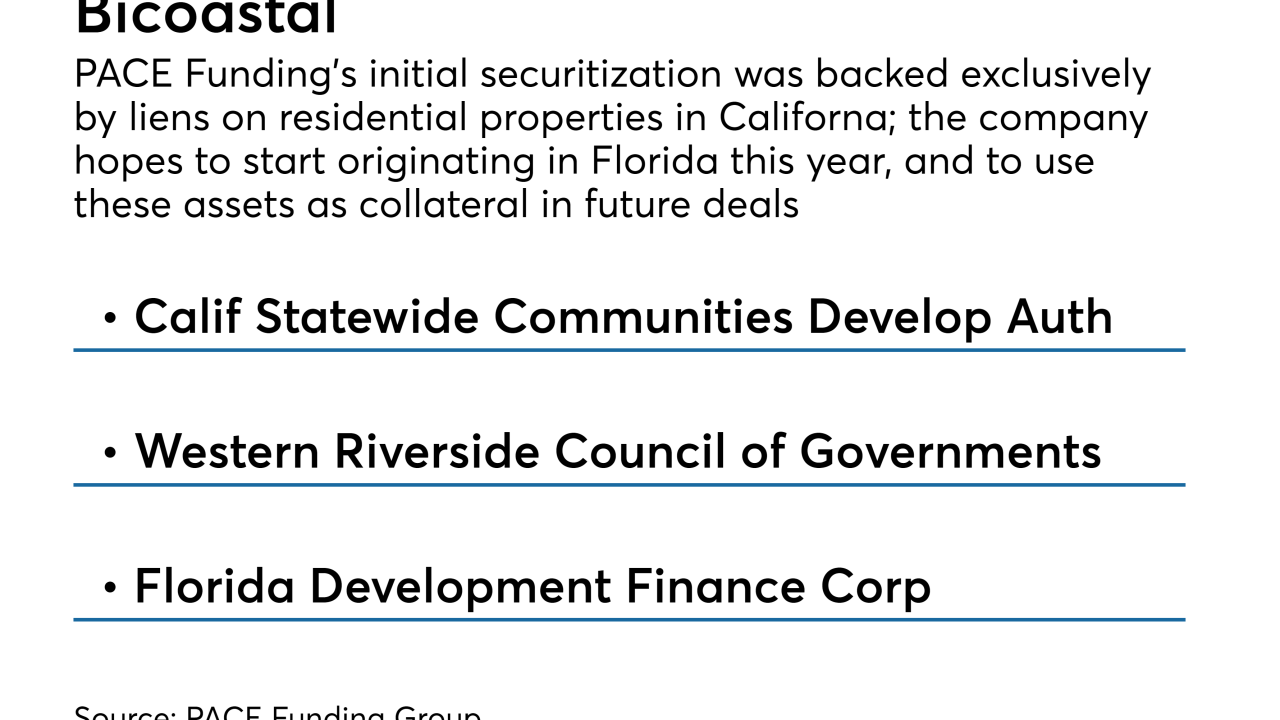

PACE Funding Group, based in Los Gatos, Calif., recently obtained a $55 million line of credit from SunTrust Bank and Rosemawr Management and is gearing up for its second securitization later this year.

August 21 -

The transaction comes with a bigger prefunding account than the sponsor's prior deal, completed in 2015; the collateral is also more geographically diverse.

August 20 -

Similar to the sponsor's prior transaction, however, the collateral includes a large portion of loans underwritten using bank statements to verify borrower income: 49%.

August 17 -

Partly for this reason, Kroll expects losses on the transaction, PMIT 2018-2, to reach just 12.4% over the life of the deal, down from 13.4% for the previous transaction.

August 16 -

CCG Receivables Trust 2018-2 is backed by $257.7 million of loans and leases, 9.9% of them on machine tools, up from 4.93% in the sponsor’s previous deal,

August 16 -

S&P has lowered default expectations for the $300 million of Series 2018-1 transaction, allowing the sponsor to achieve an AAA, up from A on the previous deal; Kroll is not rating the new deal.

August 13 -

Proceeds will be used to repay its $1.29 billion whole business securitization completed in 2014; the new transaction will boost leverage to 5.9X from 5.7x.

August 10