-

Cheap funding and marketing muscle could give it an advantage over existing lenders, but this corner of the market may not be big enough to move the needle for the bank.

August 23 -

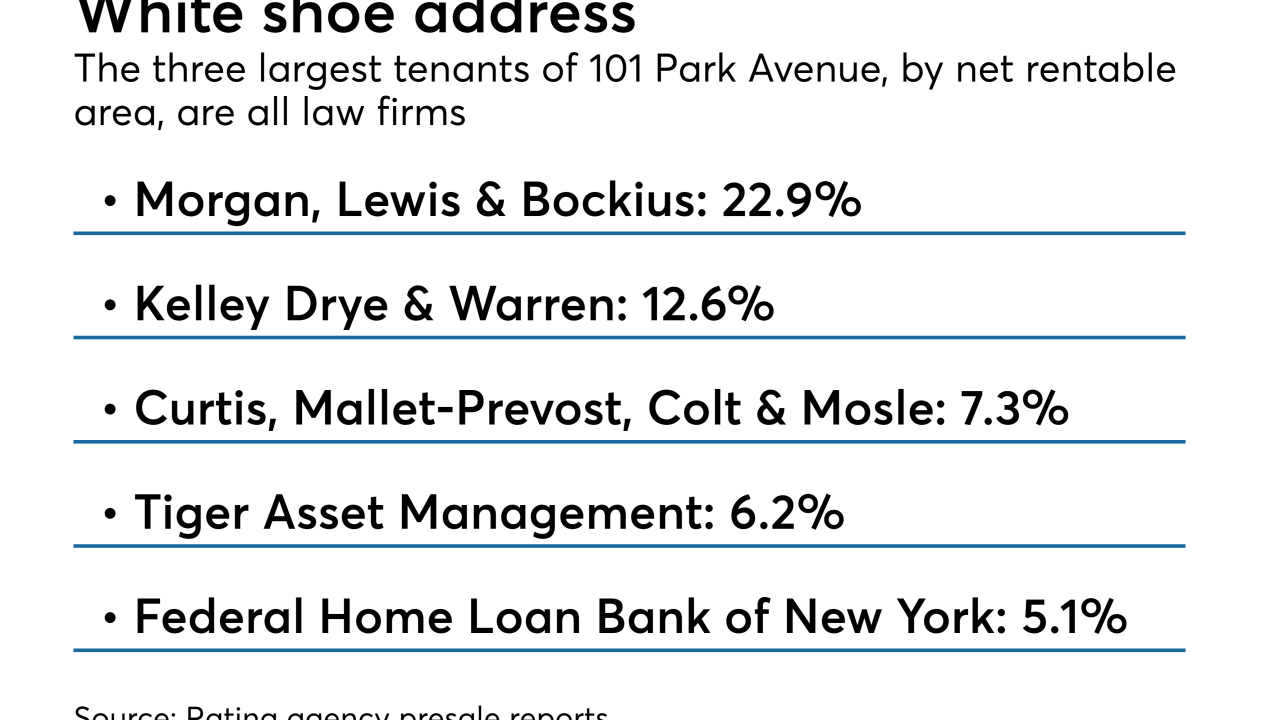

Peter S. Kalikow, a leading New York City real estate investor, is tapping the securitization market for a cash-out refinancing of a 1.3 million-square-foot, 48-story building at 101 Park Ave.

August 22 -

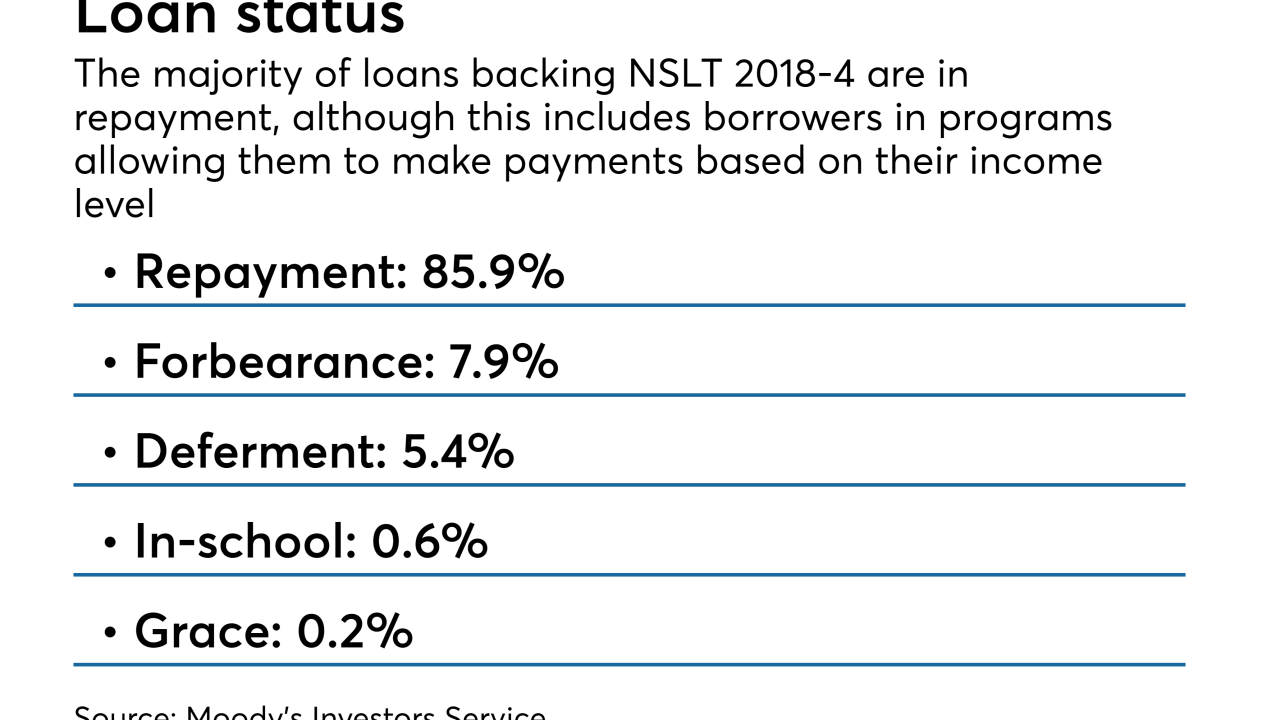

Borrowers who were once delinquent but are now making timely payments account for a quarter of the collateral, more than the student loan servicer's past two deals.

August 22 -

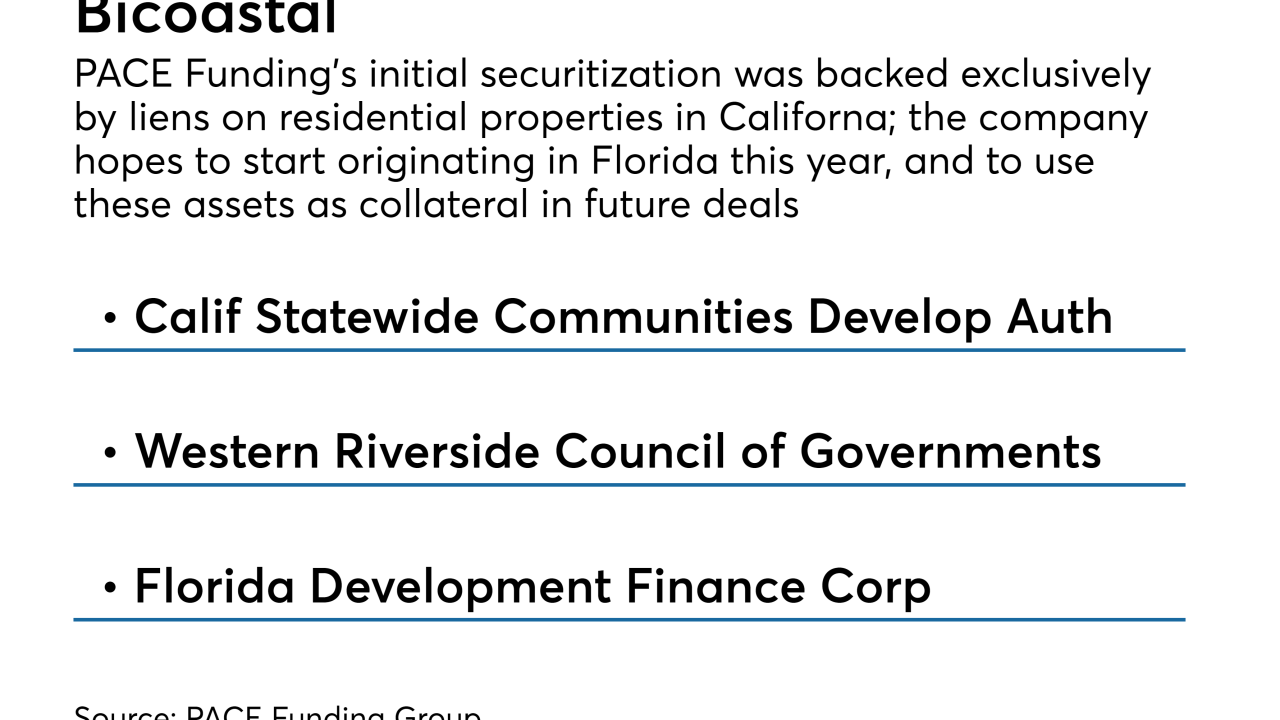

PACE Funding Group, based in Los Gatos, Calif., recently obtained a $55 million line of credit from SunTrust Bank and Rosemawr Management and is gearing up for its second securitization later this year.

August 21 -

The transaction comes with a bigger prefunding account than the sponsor's prior deal, completed in 2015; the collateral is also more geographically diverse.

August 20 -

Similar to the sponsor's prior transaction, however, the collateral includes a large portion of loans underwritten using bank statements to verify borrower income: 49%.

August 17 -

Partly for this reason, Kroll expects losses on the transaction, PMIT 2018-2, to reach just 12.4% over the life of the deal, down from 13.4% for the previous transaction.

August 16 -

CCG Receivables Trust 2018-2 is backed by $257.7 million of loans and leases, 9.9% of them on machine tools, up from 4.93% in the sponsor’s previous deal,

August 16 -

S&P has lowered default expectations for the $300 million of Series 2018-1 transaction, allowing the sponsor to achieve an AAA, up from A on the previous deal; Kroll is not rating the new deal.

August 13 -

Proceeds will be used to repay its $1.29 billion whole business securitization completed in 2014; the new transaction will boost leverage to 5.9X from 5.7x.

August 10 -

The $653 million Bellemeade Re 2018-2 is being rated by both Fitch Ratings and Morningstar Credit Ratings, though Fitch sees more risk to the transaction.

August 10 -

Westlake's $800 million offering features increased exposure to loans sourced through a relationship with Ally Bank; CAC's $398 million deal is notable for having less seasoned collateral.

August 9 -

The initial portfolio for the $373.4 million deal consists of 55 engines and a single airframe, which represents 0.3% of the pool; airframes could rise to 10% during the reinvestment period, however.

August 9 -

Rather than set a new date, the trade group will supplement the agenda at a residential mortgage finance symposium to take place in New York in late October.

August 9 -

AmeriHome GMSR Issuer Trust, consists of $155 million of fixed-rate, five-year notes and $500 million of two-year variable funding notes; it is modeled on deals by PennyMac.

August 8 -

The mortgage servicer plans to add PHH advance receivables to the collateral once the acquisition closes, though these will only account for around 6% of the total pool.

August 8 -

The $423.2 million Master Credit Card Trust 2018-3 consists of three tranches of notes maturing in January 2022, one floating-rate and two fixed-rate.

August 8 -

Though not heavily indebted, the 1.5 million-square-foot Fair Oaks Mall has anchored by department stores that have announced store closures, and has below-average inline sales.

August 7 -

Conn’s has increased the credit enhancement on its latest consumer loan securitization to account for rising losses on its managed portfolio, according to rating agency presale reports.

August 7 -

The company is marketing another $550 million of bonds backed by MSRs; proceeds will be used to repay the remaining $500 million of notes issued last year at wider spreads.

August 6