-

The $653 million Bellemeade Re 2018-2 is being rated by both Fitch Ratings and Morningstar Credit Ratings, though Fitch sees more risk to the transaction.

August 10 -

Westlake's $800 million offering features increased exposure to loans sourced through a relationship with Ally Bank; CAC's $398 million deal is notable for having less seasoned collateral.

August 9 -

The initial portfolio for the $373.4 million deal consists of 55 engines and a single airframe, which represents 0.3% of the pool; airframes could rise to 10% during the reinvestment period, however.

August 9 -

Rather than set a new date, the trade group will supplement the agenda at a residential mortgage finance symposium to take place in New York in late October.

August 9 -

AmeriHome GMSR Issuer Trust, consists of $155 million of fixed-rate, five-year notes and $500 million of two-year variable funding notes; it is modeled on deals by PennyMac.

August 8 -

The mortgage servicer plans to add PHH advance receivables to the collateral once the acquisition closes, though these will only account for around 6% of the total pool.

August 8 -

The $423.2 million Master Credit Card Trust 2018-3 consists of three tranches of notes maturing in January 2022, one floating-rate and two fixed-rate.

August 8 -

Though not heavily indebted, the 1.5 million-square-foot Fair Oaks Mall has anchored by department stores that have announced store closures, and has below-average inline sales.

August 7 -

Conn’s has increased the credit enhancement on its latest consumer loan securitization to account for rising losses on its managed portfolio, according to rating agency presale reports.

August 7 -

The company is marketing another $550 million of bonds backed by MSRs; proceeds will be used to repay the remaining $500 million of notes issued last year at wider spreads.

August 6 -

The eligibility criteria for loans that can be acquired are “more liberal” than recent CRE CLOs rated by Kroll; they are also more liberal than those of Hunt’s initial CRE CLO, completed last year.

August 3 -

A joint venture between an investment vehicle for Michael Dell's family and Lake Avenue Investments obtained a $450 million mortgage on the Four Seasons Hualalai from Goldman Sachs.

August 1 -

Most providers of property assessed clean energy financing shoot for relatively modest credit ratings in the securitization market. But CleanFund wanted to set itself apart.

July 31 -

The bulk of the collateral, 59.6%, was acquired from Impac Mortgage Corp., a lender with a long track record; the remainder, 40.4%, from Sprout Mortgage Corp., a relative newcomer.

July 31 -

As a result of the forward flow agreement, Kroll has increased expected recoveries, allowing Upstart to lower credit enhancement on its next securitization.

July 31 -

A $333 million first mortgage on the Palmer House Hilton, a 24-story building with 1,641 guestrooms in Chicago’s central business district, is being securitized by JPMorgan Chase.

July 27 -

Just 5.1% of the $91 million of liens backing the transaction are vacant, down from 9.2% of the prior deal; this allowed the sponsor to borrower more heavily against the value of hte collateral.

July 26 -

Some collateral attributes, such as non-full documentation and a high percentage of non-QM and HPQM loans, fall slightly outside the credit box seen in other recent prime transactions, according to Fitch.

July 26 -

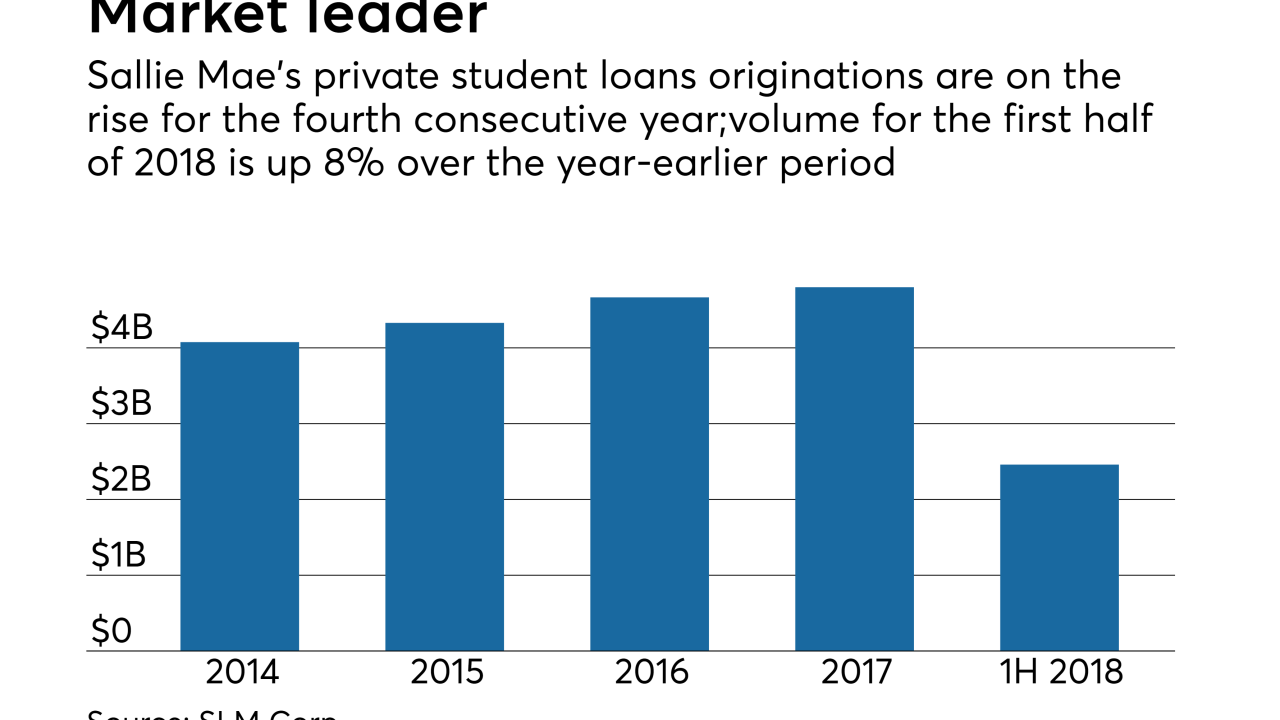

The amount of loans cherry picked by the likes of SoFi and CommonBond fell by 3%, to $221 million; just as well, since Sallie Mae's grad school loans are off to a slow start.

July 25 -

A $100.3 million sliver of the $1.7 billion loan is being used as collateral for a conduit securitization called Benchmark 2018-B5 Mortgage Trust, according to DBRS. It represents 9.9% of the $1.04 billion transaction.

July 25