Bancorp Bank is readying its second securitization of the year of mortgages on commercial properties that are being rehabbed or converted to another use.

The collateral for Bancorp Commercial Mortgage 2018-CRE4 Trust consists of 45 floating-rate loans secured by 50 commercial properties totaling $341 million.

The deal is larger than Bancorp’s prior commercial real estate collateralized loan obligation, completed in March, and more heavily concentrated in a single property type, multifamily buildings, which account for 78.8% of the principal balance, according to rating agency presale reports. By comparison, just 58% of the collateral for the $304.3 million Bancorp Commercial Mortgage 2018-CRE3 were multifamily properties.

Both DBRS and Moody’s cite as a strength of the deal the fact that a large share of the loans, 41 totaling 93.6% of the deal balance, were used to acquire properties (as opposed to refinancing), with borrowers making a down payment.

Moody’s also takes comfort from that there are no loans on properties with a sole tenant.

And DBRS notes that none of the loans are secured by student or military housing properties, which tend to experience more turnover and so have more volatility cash flow than traditional multifamily properties.

Offsetting these strengths, both rating agencies agree, is the high level of leverage.

Moody’s puts the loan-to-value ratio at 127.6%. That is above the average of the three prior Bancorp Commercial Mortgage transactions of 124.7%.

DBRS measured the current balance of the mortgages and their in-place cash flow and determined that 44 loans, representing 95.6% of the pool, have debt service coverage ratios below 1.15x, which it says is “a threshold indicative of a higher likelihood of term default.”

Both DBRS and Moody’s expect to assign a triple-A rating to the senior tranche of Class A notes to be issued, which benefits from 49.875% subordination. DBRS also expects to assign an AAA to the Class AS notes, with 43.250% subordination. It is also assigning ratings ranging from AA to B to five subordinate tranches of notes.

Wells Fargo Securities is the placement agent and structuring agent.

Unlike most commercial real estate collateralized loan obligation transactions where the Issuer retains all below-investment-grade certificates, Bancorp will only be retaining the Class C Certificates, representing a 7.5% retained interest.

The risk-retention role will be fulfilled by The Värde Mortage Fund II, an affiliate of Värde Partners, purchasing Class G-RR as a third-party purchaser, which will represent at least 5.0% of the initial principal balance of the certificates. Värde Partners is a large investment firm participating in a range of asset classes, including the commercial real estate sector as a direct lender on transitional properties.

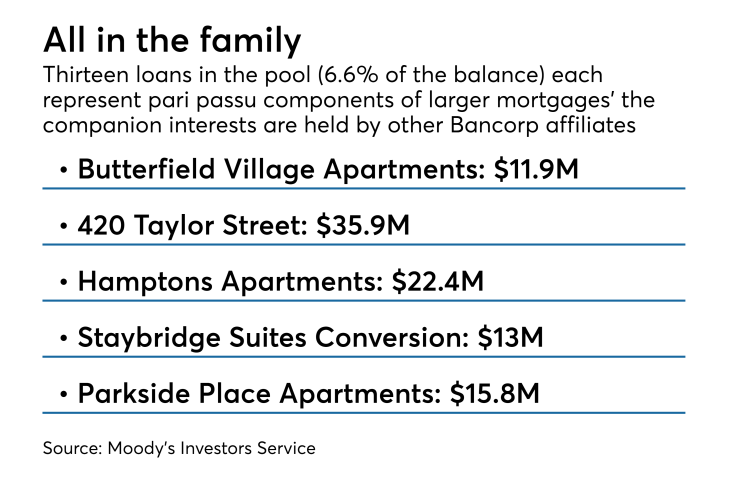

Thirteen loans in the pool (6.6% of the balance) each represent pari passu components of larger first mortgages; the companion participations have been securitized in other deals.

Thirty one of the loans (78.3% of the balance) have a future funding component. These companion participation interests will also rank on a pari passu basis and the loans held in the trust and will held by another affiliate of Bancorp Bank. These future funding companion participation commitments total $53.6 million.