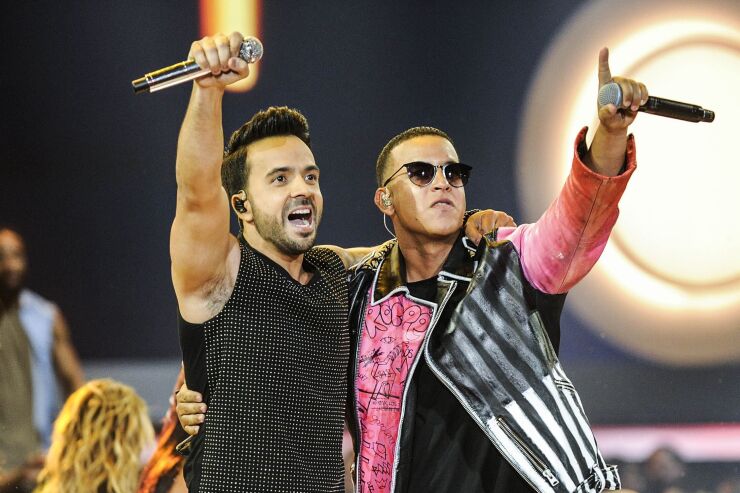

(Bloomberg) -- KKR & Co Inc. is leading a $500 million financing package for HarbourView Equity Partners, a $1.6 billion money manager known for acquiring music rights of famous artists such as Brad Paisley and Luis Fonsi.

Kuvare Asset Management was also part of the financing, which was done by securitizing music royalties, meaning repackaging royalty payments into bonds, the firms said Wednesday in a statement.

"What we're showing is we're able to be a good player institutionally to the broader capital markets," HarborView's founder and Chief Executive Officer Sherrese Clarke Soares said in an interview. "We've been one of the more dominant players in the market place. Our goal is to really build an ecosystem of assets, artist partners, investments in operating companies to drive value."

KKR has been rapidly seeking to expand its asset-based financing business, which has about $48 billion in assets since starting up in 2016. The private lender has also taken advantage of the pullback of regional banks to expand into consumer debt, purchasing bundles of auto loans and others from financial institutions. Meanwhile, HarbourView has been expanding its scope across sports, media and entertainment.

KKR isn't the only private lender involved in financing from music royalties. In late 2022, Apollo Global Management Inc. priced $1.8 billion of bonds backed by music copyrights in Concord Music Royalties' first securitization. Since then, only Kobalt Music Group has come to the public markets with a $266.5 million bond offering backed by music royalties, according to data compiled by Bloomberg News. Concord has done other transactions with Apollo privately following their public debut, Bloomberg reported.

HarbourView has acquired thousands of titles from roughly 80 portfolios of artists, labels and songwriters since starting up in 2021 with $1 billion of capital from investors including Apollo. Separately, HarbourView in December expanded a credit facility with firms including Fifth Third Bank to about $300 million.

The portfolio has included acquisitions from Justin Bieber, Fleetwood Mac, Nelly, Wiz Khalifa. They have also focused on popular regional artists like Eslabon Armado and heavy metal bands such as Hollywood Undead.

Intellectual property around music is "one of many areas where we see opportunity and we are pleased to finance a scaled and high-quality portfolio in this space," Avi Korn and Chris Mellia, co-head of US asset-based finance at KKR, said in the statement. "This transaction is a testament to the scale and versatility of our high-grade asset-based finance strategy, which is a fast growing segment of our private credit business."

--With assistance from Carmen Arroyo.

More stories like this are available on

bloomberg.com