A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico.

-

The true-up mechanism is charged annually, but can be paid more frequently to ensure notes make timely payment of principal and interest of the 2025 revenue bonds and related financing costs.

January 12 -

Another strong year for aircraft leasing and ABS is expected for 2026, due partly to limited growth prospects from equity capital.

January 12 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

The Senate allowed the nomination of a permanent director of the Consumer Financial Protection Bureau to lapse, giving acting Director Russell Vought more time to lead the agency on a temporary basis.

January 9 -

Sponsored by American Water, the deal funds service contracts on HVAC, plumbing and external water lines.

January 9

-

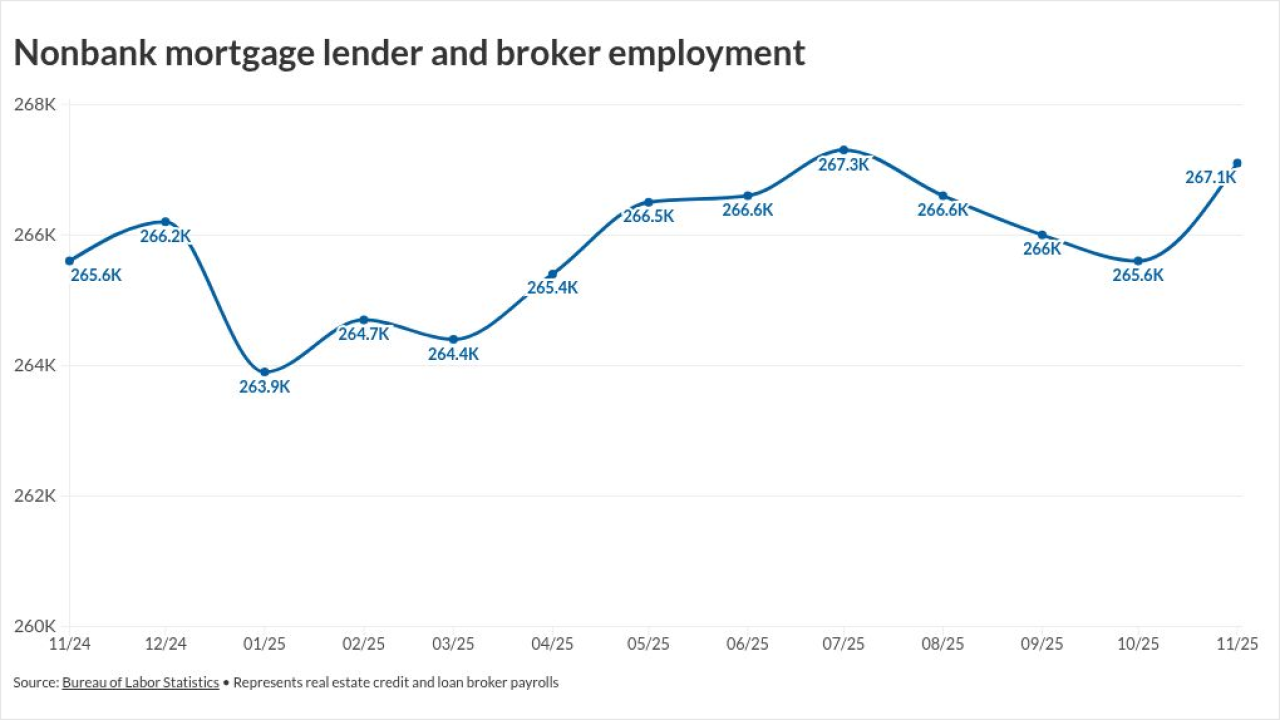

Lenders shouldn't expect the latest jobs numbers to yield major monetary policy moves after the unemployment rate came in mostly flat last month, experts say.

January 9 -

The deal comes to market as President Trump suggested barring institutional buyers from snatching up single-family homes, the type of properties secure the bulk of SEMT 2026-INV1.

January 8 -

ODF II will focus on originating senior and junior commercial rea estate debt investments across major U.S. markets, focused on multifamily properties.

January 8 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

While Westlake's customer accounts usually have credit bureau scores ranging from 500 to 700, the WLAKE 2026-1 collateral pool's non-zero weighted average credit bureau score was 620.

January 7 -

Largely strong credit qualities were offset because by loans on single-family homes in the pool dropping by 0.5%, and that the percentage of loans that received due diligence decreased by 0.4%.

January 7 -

American Banker research highlights growing concerns about an economic downturn, regulatory volatility and open-banking risks.

January 6