Carlyle Aviation Management is issuing a $540M pool secured by the leases and asset values of 29 mid- to end-of-life aircraft.

-

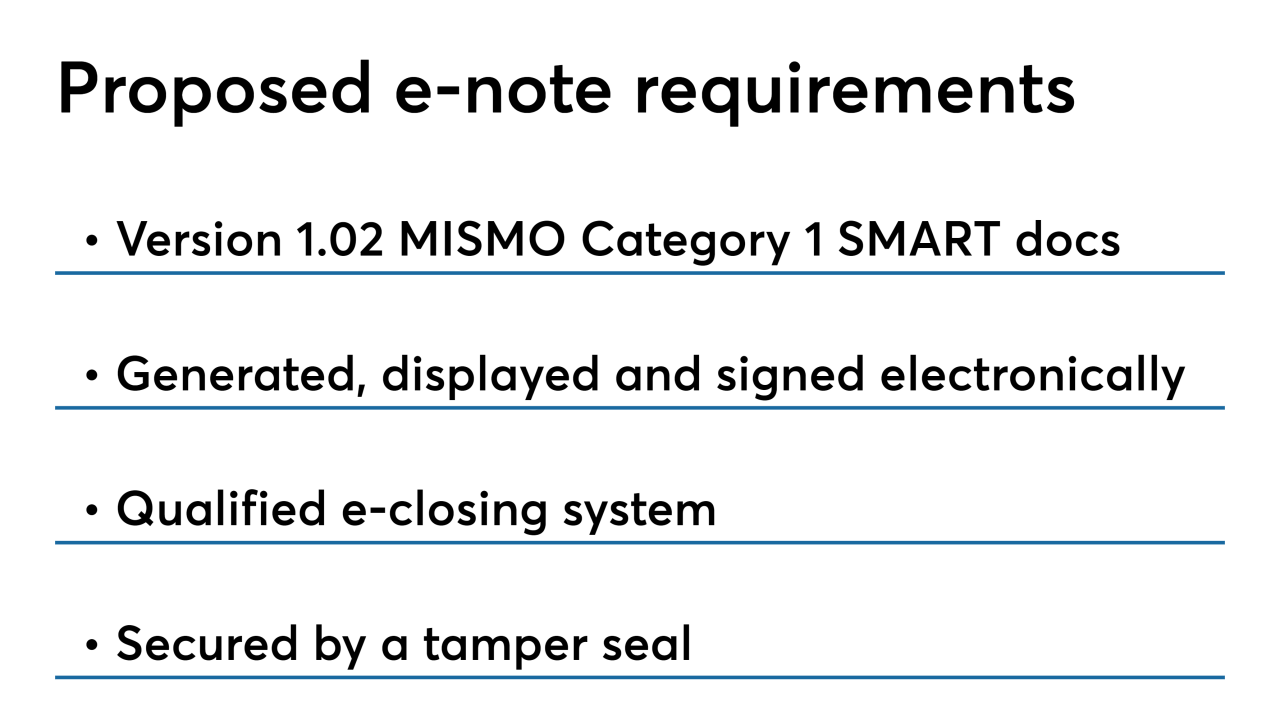

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

Mosaic Solar Loan Trust 2019-2 is bringing to market $208 million in asset-backed securities that are secured by residential solar consumer loans.

October 28 -

Concerns over banks’ level of preparation have led to worries about disruptions in the lending market, and some financial institutions warn that a new interest rate benchmark could cause lenders to pull back on credit.

October 27 -

The loans underlying the $465 million securitization that OBX 2019-EXP3 Trust is launching will provide a test of the market’s willingness to accept concentration risk in a high-quality pool of mortgages.

October 25 -

Subprime auto finance company Global Lending Services brought $300 million in notes to the asset-backed securities market GLS Auto Receivables Issuer Trust 2019-4.

October 25

-

First-lien, prime residential mortgages are securing the Visio 2019-2 Trust, which will raise $202,682,000 from the market, and which has collateral that was funded by the Mortgage Pass-Through Notes, Series 2019.

October 24 -

In a hefty commercial mortgage-backed securities transaction, BANK 2019-BNK22 is preparing to launch a $2.3 billion deal secured by 58 CRE loans on a wide mix of properties, including co-ops, offices and multifamily.

October 24 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

The PSMC 2019-3 Trust is bringing $298.6 million in notes to the market, backed by residential mortgages rounded up by subsidiaries of American International Group.

October 23 -

CommonBond is coming to the securitization market again with another trust that uses the highly selective prefunding period feature to issue notes backed by private, refinanced student loans.

October 23 -

CarMax Auto Owner Trust, 2019-4 is bringing $1.1 billion to the asset-backed securities market with slight decreases in overall credit enhancements. Yet those credit enhancement changes reflect a stronger pool of loans, not increased risk-taking.

October 23 -

The $757.2 million Chase 2019-CL1 will be structured to sell notes that are tied to a reference pool of 979 residential mortgage loans – all of which will remain on JPMorgan’s books rather than being transferred to a trust.

October 22