Arivo Acceptance, a two-year-old specialty-finance auto lender, is launching its debut securitization of subprime and non-prime loans for new and used cars, trucks and SUVs.

-

Prosper Marketplace Issuance Trust, 2019-4, is counting on a de-leverage transaction structure that will boost its credit enhancement levels over time, as it seeks to sell $138 million in securities backed by unsecured consumer loans.

October 30 -

A lower court “erred” when it sided with Fannie Mae and Freddie Mac’s investors, the Justice Department said in its petition to the high court.

October 30 -

Due to come to the market in November, Juniper Receivables 2019-2 DAC will issue about $2.1 billion in securities backed by retail auto loan contracts.

October 30 -

Pepper Residential Securities Trust No. 25 is relying on rigorous servicing to ensure the performance of its collateral of low-doc, high-loan-to-value loans made to borrowers with unfavorable credit records, according to details from an S&P Global presale report.

October 29 -

Triton Trust No.8 is issuing approximately A$500 million in pass-through securities backed by prime residential mortgages in Australia, with a substantial amount of loans that are made to investors, 40.4%, according to an S&P Global presale report.

October 29

-

Tetragon's announcement reveals the firm will complement its equity strategy by also focusing on the debt-note structure of deals, in hopes of gaining returns on the performance lowest-rated mezzanine and subordinate tranches.

October 29 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

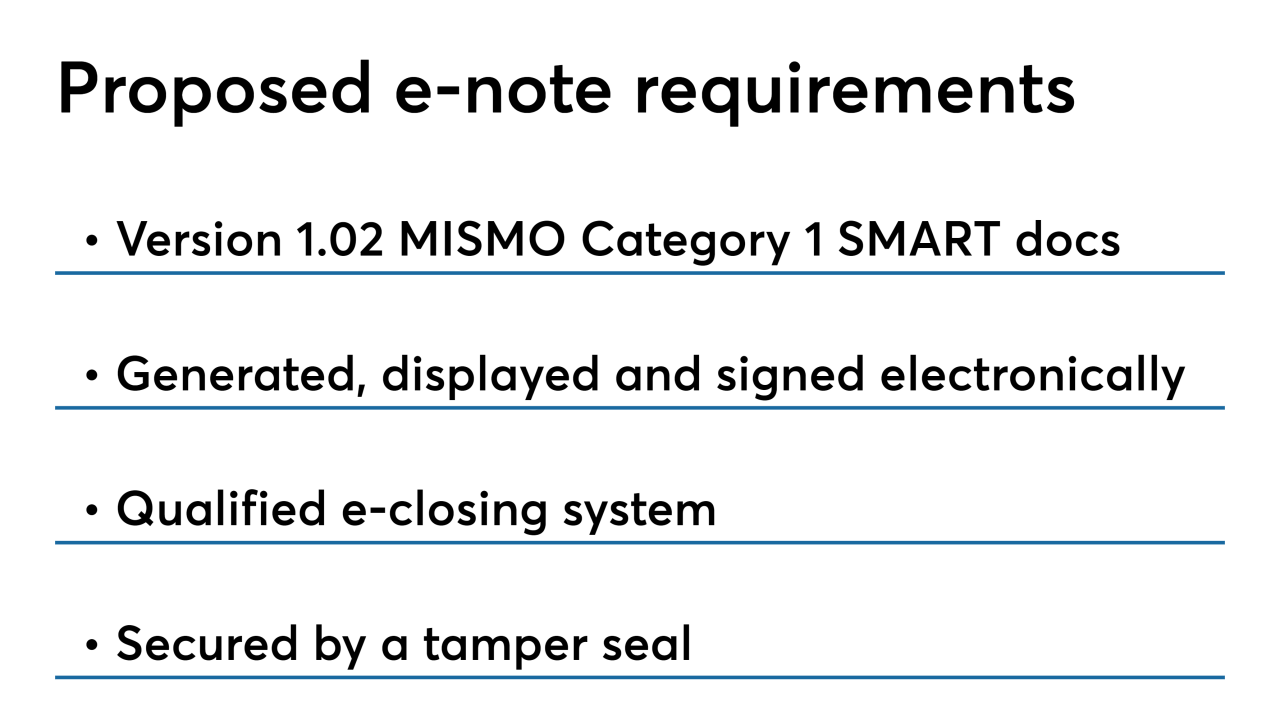

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

Mosaic Solar Loan Trust 2019-2 is bringing to market $208 million in asset-backed securities that are secured by residential solar consumer loans.

October 28 -

Concerns over banks’ level of preparation have led to worries about disruptions in the lending market, and some financial institutions warn that a new interest rate benchmark could cause lenders to pull back on credit.

October 27 -

The loans underlying the $465 million securitization that OBX 2019-EXP3 Trust is launching will provide a test of the market’s willingness to accept concentration risk in a high-quality pool of mortgages.

October 25 -

Subprime auto finance company Global Lending Services brought $300 million in notes to the asset-backed securities market GLS Auto Receivables Issuer Trust 2019-4.

October 25