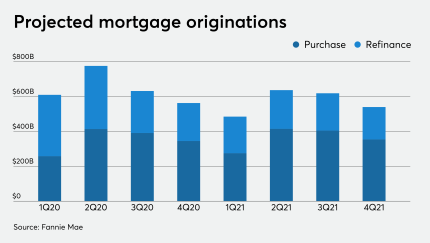

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

-

Sen. Marco Rubio, R-Fla., said that $349 billion will likely not be enough meet loan demand from small businesses seeking a lifeline to help them weather the economic downturn brought on by the coronavirus outbreak.

April 5 -

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

The review for downgrade affects three recent Aaa-rated issues totaling $3.25 billion from Nissan Motor Acceptance Corp.'s dealer inventory ABS platform.

April 3 -

ABS participants saw markets freeze and were bracing for worse when federal aid provide a short-term respite. The question now: How much trust can anyone put in the medium-term and beyond?

April 3 -

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

April 2

-

The agencies will give the industry another month to submit feedback on the so-called covered fund portion of the rule "in light of potential disruptions resulting from the coronavirus.”

April 2 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees or placing a temporary cap on consumer lending rates.

April 1 -

The agency said lenders should avoid reporting delinquent payments to credit bureaus for consumers who have sought payment relief due to the pandemic.

April 1 -

Federal Housing Finance Agency Director Mark Calabria said a virus-induced financial crisis might give rise to more delinquencies and foreclosures than the 2007 subprime mortgage meltdown.

April 1 -

The collapse of dine-in revenues for restaurant chains during the outbreak is placing whole biz deals under the ratings microscope.

April 1 -

After budget cuts and a strategic transition, the interagency body conceived by Dodd-Frank to identify systemic threats has largely been silent as the pandemic roils the economy.

March 31 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31